Gold, which traded below US$2,000 just two years ago, has outpaced gains in equities so far this century, reflecting investor demand for safe-haven assets amid inflation concerns and geopolitical unrest. It continued its torrid advance on Tuesday, climbing 0.8% to US$4,142.94 an ounce, extending its gain this year to 58%.

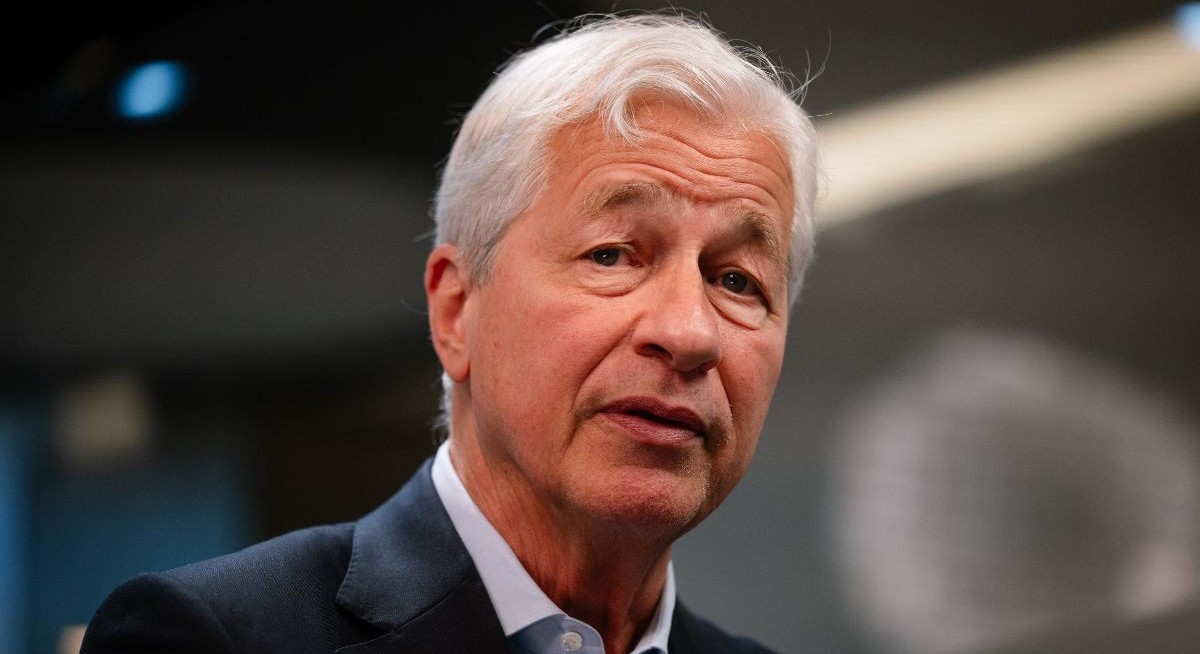

“Asset prices are kind of high,” Dimon said, and “in the back of my mind, that cuts across almost everything at this point.”

Last week, billionaire Citadel founder Ken Griffin said investors were starting to view gold as safer than the dollar, calling the development “really concerning.”