(Jan 29): Copper surged by the most in more than 16 years as metals extended a dramatic start to the year fuelled by a wave of intense speculative trading in China.

Chinese investors are piling into metals as they ride a powerful wave of momentum that has lifted everything from tin to silver to record highs. The surge in copper took place at a time of day when Chinese traders dominate flows, with prices on the London Metal Exchange (LME) rising more than 5% in less than an hour starting at 2.30am London time.

“This is all driven by speculative funds,” said Yan Weijun, head of nonferrous metals research at Chinese trader Xiamen C&D Inc. “It’s likely all Chinese money given the surge is in Asian hours.”

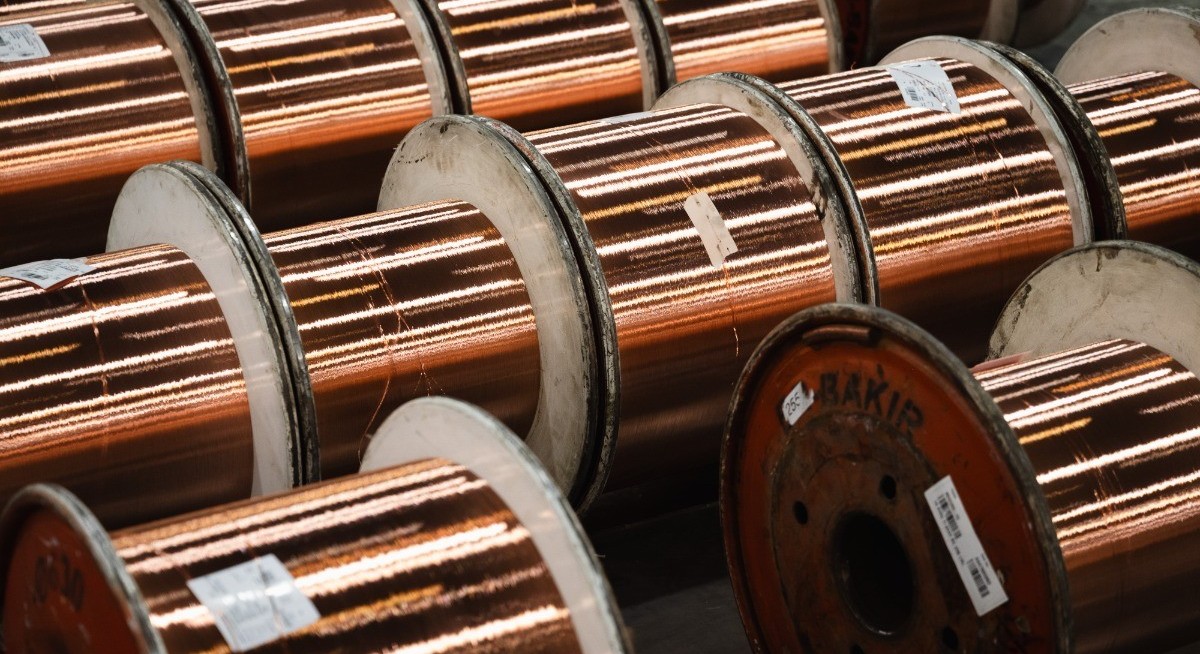

Prices gained as much as 10.1% to trade above US$14,400 a tonne for the first time ever. The industrial metal, which is used in almost every electrical application, has risen about 25% since the start of December.

Copper has long been a favourite of investors who see the energy transition and the growth of data centres driving demand. Still, the recent surge in prices has come in spite of indications of weak demand in China itself, which accounts for about half of physical consumption of the metal, and a widening contango on the LME, an indication of ample supplies.

See also: No silver lining in meltdown

The speculative frenzy has driven a surge in volumes on the Shanghai Futures Exchange (SHFE), China’s top commodities trading platform. January was already the busiest month on record for the SHFE’s six base metals as of last week, and copper racked up its second-biggest daily trading volumes ever on Thursday.

It’s been an eye-watering few weeks for commodities, which have been aided by a sinking US dollar, rising demand for real, physical assets, and elevated geopolitical tensions as the Trump administration follows a more assertive foreign policy. Most recently, speculation that the next Federal Reserve chief will be more dovish than Jerome Powell has aided the rally.

“Commodities are taking turns to rally,” said Eric Liu, deputy general manager of ASK Resources Co. “Copper has been hovering around US$13,000 and funds have been brewing over the metal for some time.”

See also: US pitches mineral price floors, investments to tackle China

Copper was up 9.3% at US$14,301.50 a tonne on the LME. Its intraday move was the biggest since 2009 — when China was rolling out massive stimulus measures in the aftermath of the great financial crisis. SHFE futures reached 112,000 yuan a tonne as the exchange reopened for evening trading, following a 5.8% increase to 109,110 yuan at the close on Thursday. Other metals rallied, with aluminium rising 1.8% and zinc advancing 5% in London.

Fed chair Powell talked up a “clear improvement” in the US economic outlook as the bank kept borrowing costs on hold on Wednesday. His tenure ends in June, after which President Donald Trump may be better positioned to step up his campaign for lower rates.

“Under the cycle in which the US maintains interest-rate cuts, the expectation for upward movement in copper prices has not changed,” said Chi Kai, chief investment officer at Shanghai Cosine Capital Management Partnership. “As for how high prices can rise, there is no clear expectation as long as the US continues to push artificial intelligence (AI), chips and power construction.”

Investors have been flocking in particular to metals needed in major growth markets. Tesla Inc’s plan to spend US$20 billion this year shifting resources to robotics and AI has underscored investment prospects. Copper, aluminium and tin would all be beneficiaries.

But the rally has been broad based, with iron ore futures in Singapore gaining as much as 2.5%.

The advance in metals came after a gauge of the US currency sank to its lowest level in more than four years, with Trump signalling he was unconcerned by the weakness. That slide makes commodities more attractive for many buyers.

There are plenty of voices warning that the spectacular gains in metals have run ahead of real-world demand. There’s likely a “technical adjustment” coming as physical buyers in China balk at higher prices, Goldman Sachs Group Inc co-head of China equities Trina Chen told Bloomberg TV on Wednesday.

Uploaded by Felyx Teoh