(Feb 5): The Trump administration hosted 55 countries at a critical minerals summit on Wednesday, pitching price floors and a flood of US private equity in a bid to reduce dependence on China and ensure US manufacturers have stable access to key resources.

The European Union (EU), Japan and Mexico each agreed with the US to set up new policies including price floors to help solve critical mineral supply-chain vulnerabilities, according to statements from the US Trade Representative’s (USTR) office.

Each also pledged to work towards a binding multilateral agreement on trade in critical minerals. The event marked efforts to reduce reliance on Chinese supplies of critical minerals, which have been at the centre of a protracted trade war between the world’s two largest economies.

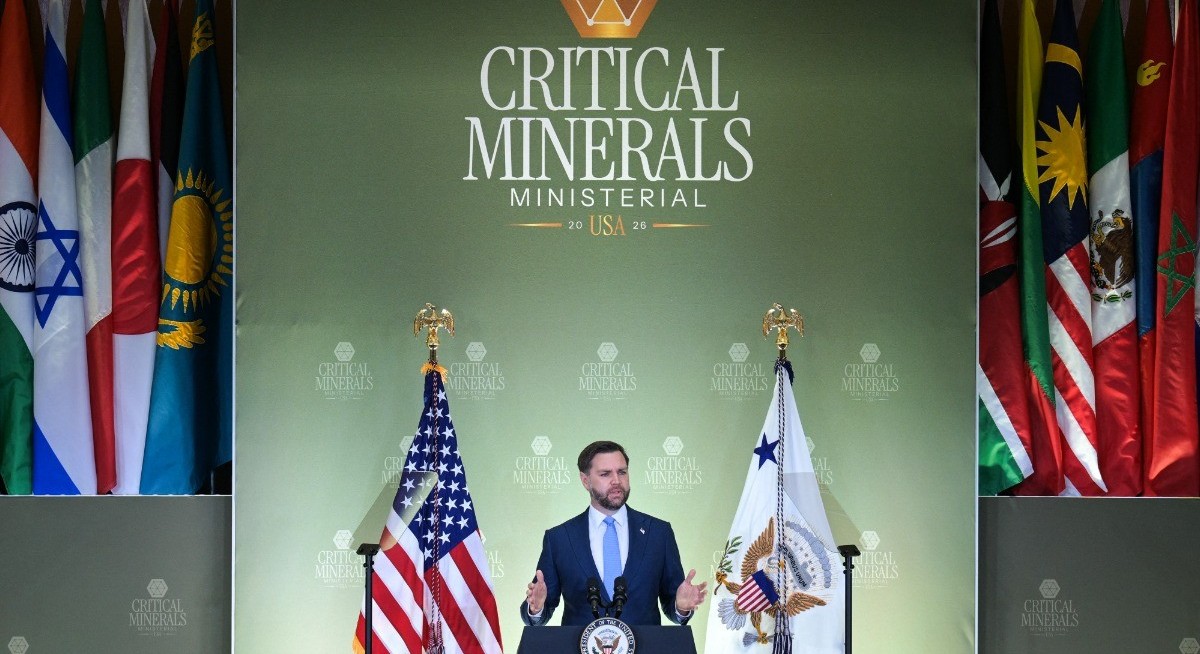

“Today, the international market for critical minerals is failing,” Vice President JD Vance said on Wednesday in remarks to open the summit. “Consistent investment is nearly impossible, and it will stay that way so long as prices are erratic and unpredictable.”

Vance called on the audience of foreign officials to help create stable investment conditions. He pitched a “preferential trade centre for critical minerals protected from external disruptions”, and made it clear the US is seeking coordinated agreement on price floors.

Price floors have long been discussed among critical minerals industry players as a way to shield non-Chinese companies from the Asian nation flooding markets and depressing Western firms’ profits.

See also: Silver plummets more than 16%, erasing a two-day recovery

For months, the US and its trading partners have worked towards some sort of cooperation to wean their global supply chains off China. The public statements on Wednesday by key US partners, as well as the open discussion of price floors, suggest they are getting closer to a solution.

Trade talks

The US and EU have committed to concluding a memorandum of understanding within the next 30 days intended to bolster critical minerals supply-chain security.

See also: EU to offer US critical minerals partnership to check China, Bloomberg reports

The US-Mexico arrangement will also include identifying specific critical minerals of interest and exploring price floors for metals imports, according to the USTR. Their agreement comes before a joint review this year of the US-Mexico-Canada free-trade agreement, which could see significant revisions under Trump’s second term.

Vance highlighted the administration’s US$100 billion ($127.36 billion) lending authority for critical minerals.

His comments built on President Donald Trump’s Monday announcement of plans for a nearly US$12 billion critical minerals stockpile, in his latest effort to aid US manufacturers. What the administration has called Project Vault is meant to “ensure that American businesses and workers are never harmed by any shortages”, Trump said at the White House.

The stockpile is set to be financed through US$1.67 billion in private capital and a record US$10 billion loan from the Export-Import Bank (Ex-Im), whose chief executive officer cast the new setup as a “uniquely American” mechanism that relies on a government-led push for private funding.

“We are crowding in, most importantly, US private equity participation,” Ex-Im CEO John Jovanovic said in a Bloomberg Television interview on Wednesday. The bank has “an assurance of repayment, we have a fantastic basket of credit risk to look to, and we have physical inventory upon which we will earn interest”, he added.

While ending US reliance on China has long been a goal for Washington, it became more urgent last year after Beijing announced export restrictions on so-called rare earths. Trump and Xi Jinping agreed to a trade truce in October that delayed the implementation of the Chinese measures by a year.

Trump spoke with Xi by phone on Wednesday, with the US president saying in in a social media post the two leaders had a “long and thorough call” that included trade. Trump said he looks forward to his April visit to China.

To stay ahead of Singapore and the region’s corporate and economic trends, click here for Latest Section

US officials on Wednesday avoided singling out China by name during the summit, with Secretary of State Marco Rubio noting that critical minerals supply “is heavily concentrated in the hands of one country.”

“That lends itself to — at the worst-case scenario — being used as a tool of leverage and geopolitics, but it also lends itself to any sort of disruptions, like a pandemic,” Rubio said in a press conference.

Rubio also announced the creation of 'Forge', a successor group to the Biden administration-era Minerals Security Partnership. It will be chaired by South Korea through June, according to a State Department fact sheet.

‘Small groups’

Asked about the Washington summit and the US proposals, China’s Foreign Ministry spokesman Lin Jian signalled Beijing’s opposition.

“All parties have the responsibility to play a constructive role in maintaining the stability of global critical mineral, industrial and supply chains,” Lin told reporters at a regular press briefing in Beijing. “At the same time, we also oppose any country forming small groups to disrupt international economic and trade order.”

China is home to more than 90% of global rare earths and permanent magnets refining capacity, compared with just 4% for second-place Malaysia, according to the Paris-based International Energy Agency. The rapid expansion of artificial intelligence is fuelling demand for critical minerals used in data centres and high-performance chips.

“Everything is geographically concentrated in China, which really isn’t a value judgement — it’s an objective fact,” said Under Secretary of State for Economic Affairs Jacob Helberg, speaking with reporters on Tuesday to preview the summit. “And so, ultimately, countries want to diversify and de-risk the supply chain, which inherently means de-risking single points of failure.”

The summit and initiative build on years of efforts by prior administrations, including the US Energy Resource Governance Initiative in Trump’s first term and the Biden administration’s Minerals Security Partnership.

Rubio hosted talks on Wednesday and the summit was attended mainly by foreign ministers and other diplomats, but Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer have also been involved in the discussions.

Uploaded by Tham Yek Lee