He added that he views the current stance of policy as only “slightly restrictive, which I think is the right place to be.”

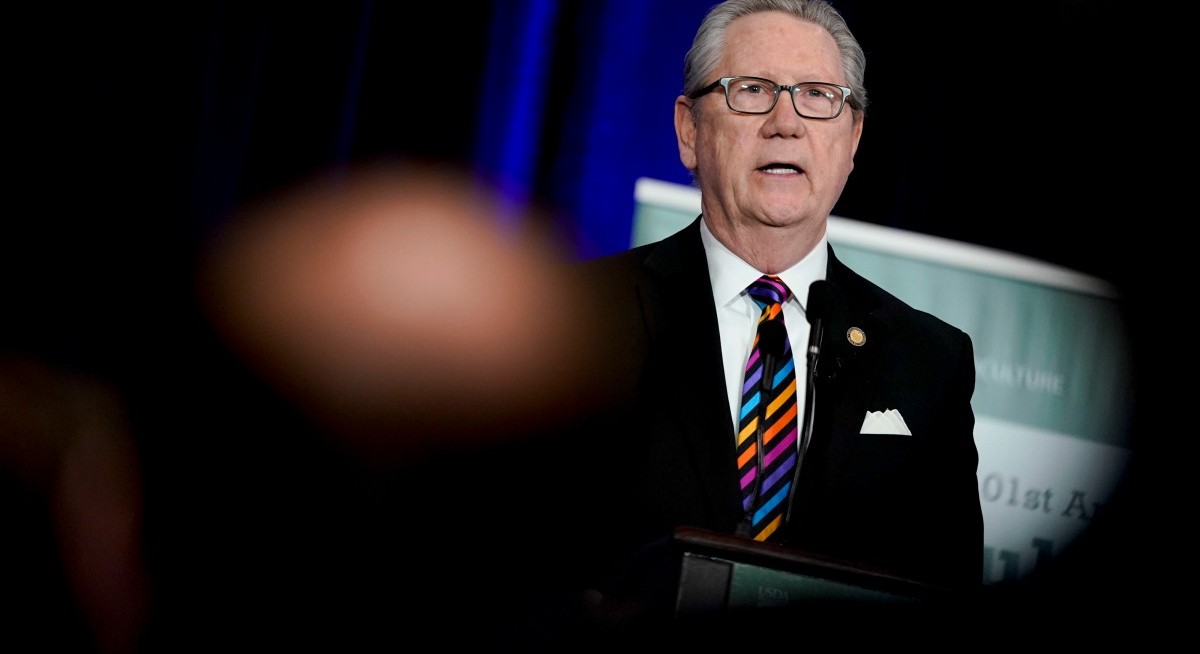

Schmid, who votes on monetary policy this year, joined most of his colleagues in opting for a quarter percentage point reduction in interest rates last week in a bid to support the labour market. That was the first rate cut since December. Fed officials had held rates steady this year to assess how new policies, including tariffs, would impact the economy.

The Kansas City US Fed chief said that while a cooling in the labor market this year would probably help curtail price pressures, recent data showed an increased risk of a more sustained or abrupt slowdown.

“I will continue to take a data-dependent approach to any further adjustments in the policy rate,” Schmid said. “I will be watching the incoming inflation and labor market data closely as I continue to assess the balance of risks to the Fed’s dual mandate.”

See also: US core CPI rises as expected in January on services costs

In a speech that focused largely on the US Fed’s role in supervising and regulating banks, Schmid emphasised the importance of central bank independence in that sphere.

“We often discuss how crucial the US Fed’s insulation from political interests and its regional structure are to effective monetary policy,” Schmid said. “However, the US Federal Reserve system’s independence and the regional reserve banks’ close connections to local economies are just as central to sound supervision and regulation.”

Supervisors and regulators that are independent from political considerations can make decisions that focus on financial stability in the long term, Schmid said, adding that it also allows for agility when responding to instability and fosters public trust in the banking system.

See also: Investors pour another US$4 bil into US high-grade bond funds

Schmid lamented the support by some for removing these functions from the US Fed altogether, or putting those divisions of the central bank under more direct control of the president. Some White House officials have voiced support for this, including Governor Stephen Miran, the US Ded’s newest policymaker whom President Donald Trump appointed last month to fill a vacant seat.

“I think this view is misguided and could lead to unintended consequences that are often not sufficiently considered,” he said.