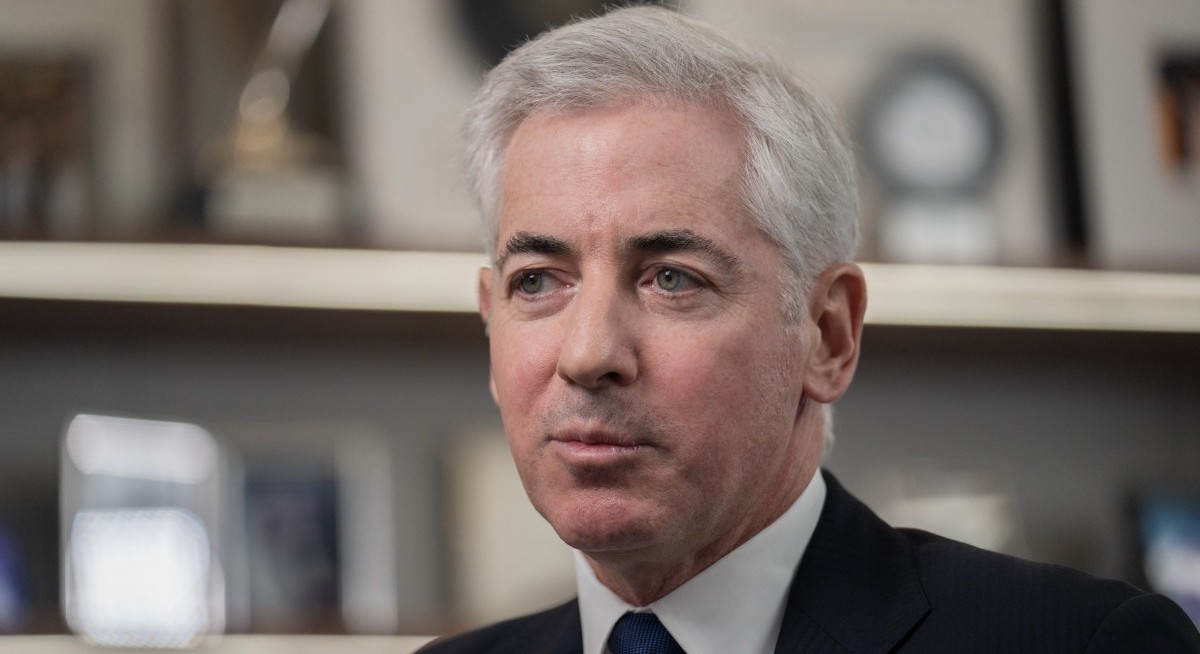

Bill Ackman says it is a “fiction” that the US can go back to inflation levels of 2%. Instead, the hedge fund manager expects the Federal Reserve to aim for an inflation target of between 2.5% to 3%.

"I think the Fed will abandon the goal of 2%," Ackman told UBS Group’s global co-head of wealth management, Iqbal Khan, during a dialogue session at the bank’s annual Asia Wealth Forum on Jan 12.

In December 2025, the Federal Reserve cut interest rates to between 3.5% to 3.75%, down by 25 basis points.

“People are expecting a couple more cuts from the Fed. I’m a little less of a believer there,” Ackman says. "There are so many powerful economic forces that are going to drive the economy and drive the markets that it's hard to envision a world in which that at least some part [is] inflationary."

"Now of course, AI itself is a major productivity tool, a major cost reduction tool, so there's some countervailing effects. I don’t think we are heading back to meaningful low rates," he adds.

Ackman’s view sets him apart from most analysts, who expect more rate cuts to take place this year.

See also: Option traders see payrolls cementing two or three cuts in 2026

In their 2026 market outlook, US asset manager Capital Group says it expects the Federal Reserve to cut interest rates to 3%, in line with the market consensus. “A dovish Fed is likely to continue with rate cuts responding to labour market weakness,” the group adds.