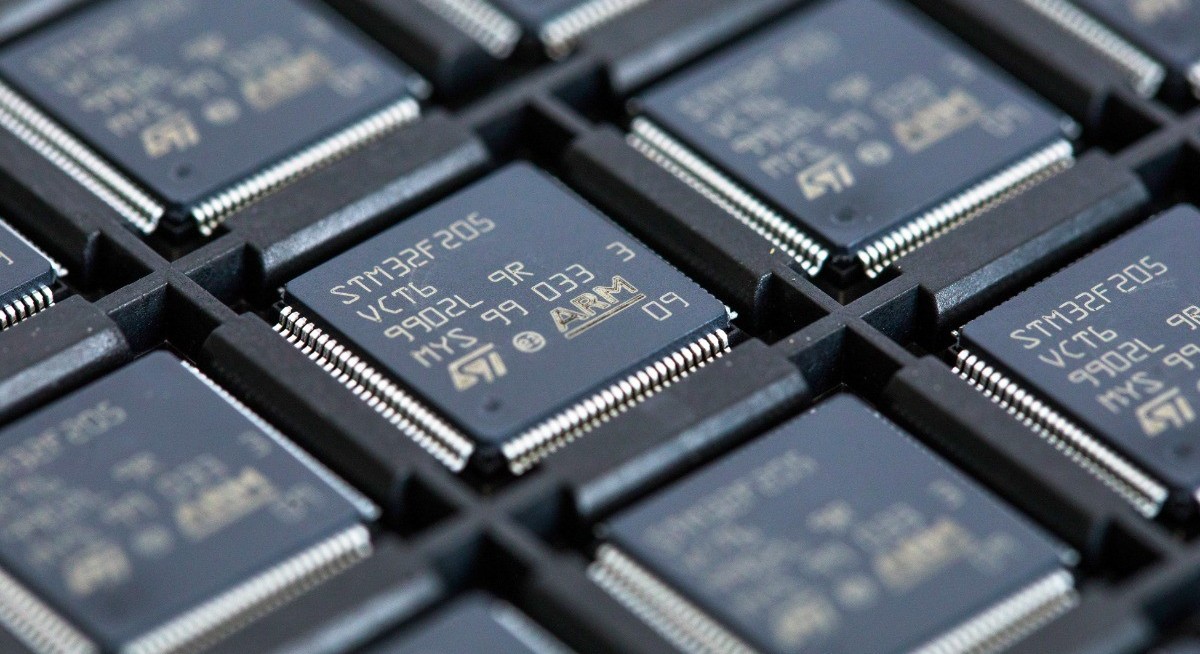

(Jan 29): STMicroelectronics NV, a chip supplier for Tesla Inc and Apple Inc, forecast first-quarter revenue that beat analysts’ estimates after demand from consumer electronics customers showed signs of recovery at the end of last year.

First-quarter revenue is expected to be US$3.04 billion, the Franco-Italian chipmaker said in a statement on Thursday. That compares to the average analyst estimate of US$2.92 billion, according to data compiled by Bloomberg.

STMicro supplies analogue chips to automakers and industrial companies, which have been grappling with tariff threats after US President Donald Trump started a trade war last year. That uncertainty has threatened to prolong a demand slump after customers amassed an oversupply of chips following shortages during the Covid-19 pandemic.

Operating income fell to US$125 million in the fourth quarter and included a US$141 million charge related to restructuring costs. Analysts had forecast US$241.5 million, according to the Bloomberg survey. Sales in the period grew to US$3.33 billion.

Chief executive officer Jean-Marc Chery announced a cost-cutting programme in October 2024 to save the company between US$300 million and US$360 million annually through 2027. The company also plans to cut as many as 2,800 jobs on a voluntary basis globally through 2027, it said in April.

Chipmakers, which feed into supply chains all over the world, are increasingly caught in the middle of geopolitical factions. STMicro has a heavy reliance on US customers, and gets about a fifth of its revenue from American customers Apple and Tesla, according to data compiled by Bloomberg.

See also: SK Hynix’s profit surges on relentless appetite for AI memory

But it doesn’t have a manufacturing base in the US, meaning customers may have to pay extra to import its products. At the same time, the Chinese government is ramping up its push for independence in critical technologies and is investing heavily to boost domestic production of analogue chips, which may push market prices down.

The automotive business came in below expectations in the fourth quarter, Chery said in the statement. Tesla reported a 3.1% decline in sales in the quarter compared to a year earlier.

Last week, chipmaker Intel Corp shares plunged after chief executive officer Lip-Bu Tan gave a lacklustre forecast and warned that the company was struggling with manufacturing problems. STMicro competitor Texas Instruments Inc gave a robust forecast for the first quarter on Tuesday in a sign that chip demand was picking up.

Uploaded by Evelyn Chan