(Jan 28): SK Hynix Inc reported its strongest quarterly results to date, underscoring the depth of an artificial intelligence wave that’s triggered an unprecedented surge in memory demand.

Operating profit more than doubled to 19.2 trillion won in the December quarter, beating the 16.7 trillion won average of analysts' estimates. Revenue climbed to 32.8 trillion won.

Once defined by sharp boom-and-bust cycles, the memory business is now delivering consistent profits that would have been improbable just a few years ago, lifting valuations across the sector. Shares in SK Hynix, the leading supplier of high-bandwidth memory or HBM for Nvidia Corp’s AI accelerators, have roughly tripled since the start of September. Samsung Electronics Co, which is trying to catch up with its smaller rival in the market, is slated to report full quarterly results on Thursday (Jan 29).

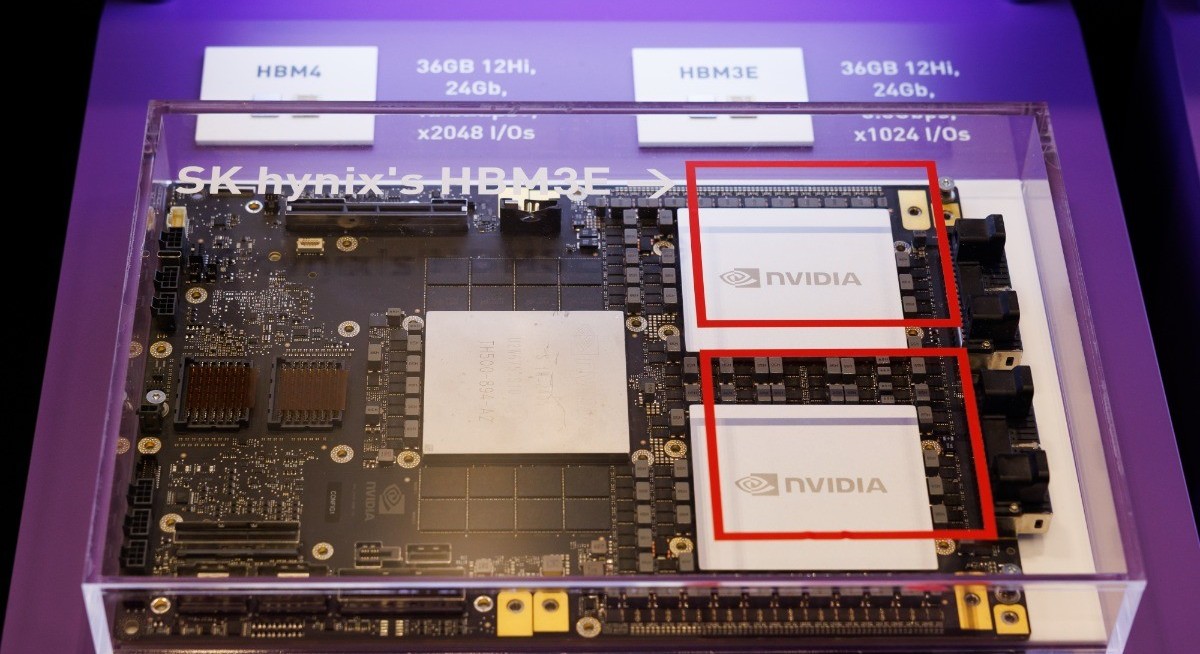

The strong performance reflects the extent of demand for HBM3E, the current cutting-edge version used by Nvidia and major cloud operators. SK Hynix is now the exclusive supplier of HBM3E for Microsoft Corp’s custom AI accelerator, the Maia 200, according to a South Korean media report. Both Korean chipmakers are vying for certification to sell next-gen HBM4 to the world’s most valuable company.

This pivot toward premium AI silicon is cannibalising the production of conventional memory. The resulting supply shortfall in both DRAM and NAND is handing manufacturers like SK Hynix immense pricing power.

See also: STMicro sales outlook beats estimates on chip recovery

The current memory shortage will likely extend, partly because of strong demand for next-generation HBM memory that consumes more wafer capacity as well as tight supply, said Richard Clode, a portfolio manager on the global technology team at Janus Henderson.

“There are no easy wins and levers from a supply perspective to meet this new demand driver,” he said. Compared to consumer electronics companies, “hyperscalers and AI customers are looking at what they are willing to pay for memory through a very different lens”.

The average selling price of DRAM is expected to climb 120% while that of NAND is estimated to climb 90% this year, Citigroup analysts Peter Lee, Jayden Oh and Josh Yang wrote in a report, lifting their price targets for SK Hynix by 56% and for Samsung by 20%.

Uploaded by Arion Yeow