The new funds for Intel come after the US government agreed in August to take a roughly 10% stake in and President Donald Trump took on the role of pitchman. Japan’s SoftBank Group Corp, which has committed to invest tens of billions into US chipmaking and cloud infrastructure, made a surprise US$2 billion investment last month and Intel is also raising cash by selling assets to investors. Its current operations, hit by market share losses, cannot shoulder the burden of intensive spending associated with trying to build leading-edge semiconductors.

Intel’s stock surged by as much as 28% after markets opened in New York. On paper, the value of the US government’s stake has jumped by more than 55%, or US$4.9 billion, and is now worth about US$14 billion.

The tie-up between the two Santa Clara, California-based rivals underlines how the balance of power in the computer industry has shifted. Intel is getting a financial shot in the arm and access to market-leading technology from a company that it once relegated to a niche role on the industry’s fringes.

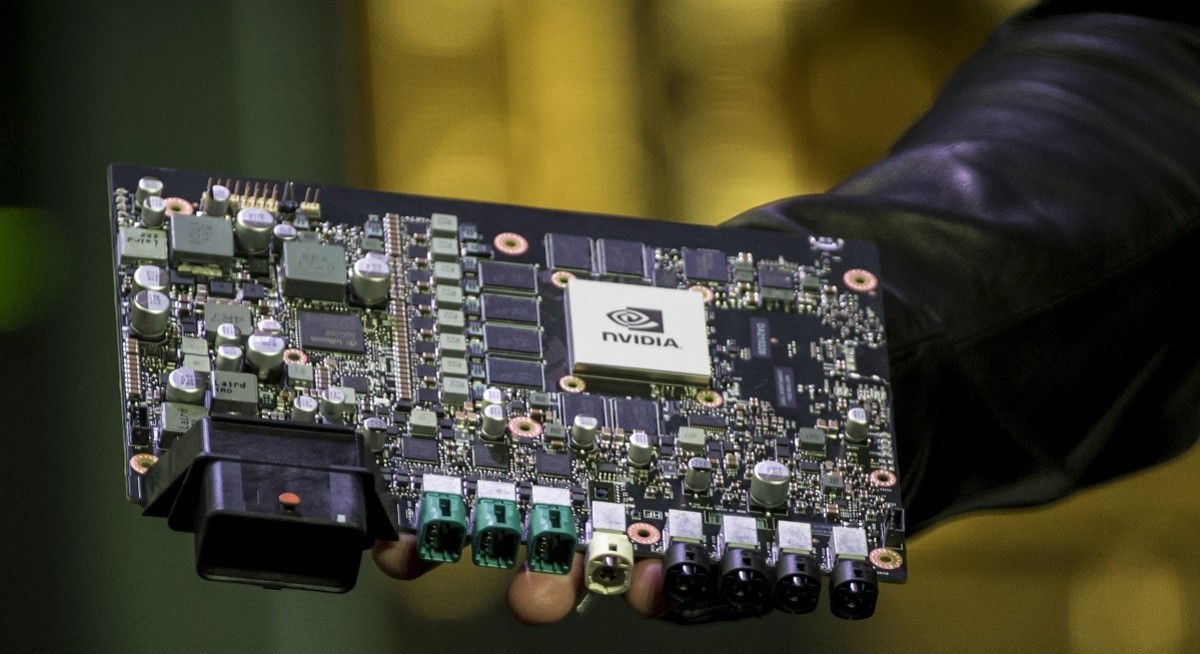

“This historic collaboration tightly couples Nvidia’s AI and accelerated computing stack with Intel’s CPUs and the vast x86 ecosystem — a fusion of two world-class platforms,” Nvidia Chief Executive Officer Jensen Huang said in a statement. “Together, we will expand our ecosystems and lay the foundation for the next era of computing.”

See also: STMicro sales outlook beats estimates on chip recovery

Intel will offer PC chips that combine general-purpose processing with powerful graphics components from Nvidia, better helping it compete with Advanced Micro Devices Inc, which has been seizing market share in desktops and laptops. AMD’s stock fell as much as 5.9% on the news of Nvidia’s investment in Intel. Meanwhile, ASML Holding, the Dutch chipmaking equipment maker that counts Intel as a major customer, rose as much as 8.2% in Amsterdam.

AMD is also Nvidia’s closest competitor in graphics chips. The AI leader continues to evaluate whether to outsource production of its chips to Intel, but has no current plans to do so.

AMD said the announcement hasn’t changed its belief it can keep taking business away from Intel.

See also: SK Hynix’s profit surges on relentless appetite for AI memory

“We’re confident in our ability to continue driving innovation and market share growth and reinforcing AI as the company’s top strategic priority,” the company said in an emailed statement. “Overall, AMD continues to consistently execute our x86 leadership roadmap, delivering high-performance products that power everything from PCs to data centres.”

In data centres, where Nvidia’s artificial intelligence accelerators dominate and have pushed Intel and others to minor roles, Intel will provide its rival with processors for integration into some products. As Nvidia increasingly combines its AI chips into larger computing clusters, processors are required to handle the general tasks that its graphics semiconductors are not ideally suited to.

“We appreciate the confidence Jensen and the Nvidia team have placed in us with their investment and look forward to the work ahead as we innovate for customers,” Intel CEO Lip-Bu Tan said in the statement. “Intel’s x86 architecture has been foundational to modern computing for decades – and we are innovating across our portfolio to enable the workloads of the future.”

Nvidia currently designs its own processors – which work alongside the accelerator components – using technology from Arm Holdings Plc. Company representatives said its plans for in-house processors have not changed.

At Wednesday’s close, Intel had a market value of US$116 billion, meaning Nvidia is taking a less than 5% stake. Nvidia has a market capitalisation of more than US$4 trillion.

Nvidia’s power to determine the future of the industry, and now Intel’s pragmatic attempt to work alongside it, is based on Nvidia’s utter dominance of AI computing. The company saw the need for new types of chips and software ahead of the debut of services such as ChatGPT from OpenAI and had them ready before any of its rivals. When the world’s biggest companies rushed to build data centres to make sure they could compete in the new era of computing, they turned to Nvidia’s chips.

To stay ahead of Singapore and the region’s corporate and economic trends, click here for Latest Section

Nvidia Has Stolen Intel's Data Centre Dominance | Once a niche player, Nvidia is now the world's biggest chipmaker

As recently as 2022, Intel had more than twice as much revenue as Nvidia. The company that gave Silicon Valley its name dominated computing from laptops to data centres with its microprocessors. But it was slow to field the type of accelerator chip that Nvidia offers and has failed to garner meaningful market share in that area.

This year, Nvidia is on course for sales of about US$200 billion, according to Wall Street estimates. At some point next year, it’ll be pulling in more revenue per quarter than Intel gets in a year. Its data centre unit alone is bigger than any other chip company’s sales.

Intel’s failure to anticipate and exploit spending on AI-specific computing compounded the problems it was suffering from a loss of manufacturing leadership. For decades, Intel plants had the best manufacturing technology making its products better, even if others produced comparable designs.

Now it’s forced to turn to Taiwan Semiconductor Manufacturing Co to produce its best chips. TSMC’s rapid improvements in technology have enabled many companies – from Apple Inc. to Nvidia – to turn good designs into industry-leading products.

Under new leader Tan, brought in earlier this year to replace the ousted Pat Gelsinger, Intel has said it will pursue a more open approach, seeking out partnerships and opening its plants to rivals.