Bitcoin was caught in the souring sentiment, falling more than 2% on Wednesday, before retracing some of this week’s losses early on Thursday. US futures were fractionally higher after Micron Technology Inc, the largest US maker of computer memory chips, gave an upbeat forecast late on Wednesday.

The sell-off in tech is a further sign investors are further questioning whether companies at the vanguard of the artificial intelligence (AI) boom can keep justifying expensive valuations and ambitious spending. Concerns over the cost and viability of data centre expansion, such as Oracle Corp’s financing plans in Michigan, were fuelling broader unease about the sector’s outlook.

“Investors still see limited disclosure of AI-driven revenues, profits, or cash flows,” said Frank Thormann, a fund manager at Schroders Investment Management. “The result is a growing concern that AI may not be delivering returns commensurate with the enthusiasm.”

See also: How China uses a ‘national team’ to influence trading

Oracle shares fell more than 5% in US trading after the Financial Times reported Blue Owl Capital Inc wouldn’t back a US$10 billion ($12.9 billion) deal for a data centre in Michigan. The tech-heavy Nasdaq 100 is now down more than 5% from its recent peak.

Tech selling combined with comments from a US Federal Reserve official supporting the case for interest-rate cuts to bid up two- and five-year Treasuries, popular havens. The benchmark 10-year yield dropped one basis point to 4.14% on Thursday. Bloomberg’s dollar index was little changed.

Oil advanced for a second day as the US imposed a blockade on sanctioned tankers from Venezuela this week, with President Donald Trump accusing Caracas of taking US “energy rights”. West Texas Intermediate rose 1.7% on Thursday, approaching US$57 a barrel, while Brent traded above US$60.

See also: Stock sell-off extends in Asia as tech, silver rout worsens

Gold steadied near a record high, as investors tracked mounting tensions in Venezuela and waited for US inflation data due later on Thursday. bullion has jumped nearly two-thirds this year and is on track for its best annual performance since 1979.

The recent volatility that has spread across a number of asset classes suggests traders may be in for a busy holiday season, when thin liquidity can exacerbate market moves.

A clearer narrative has emerged in recent weeks: the mega-cap technology stocks that have powered this bull run may be losing their ability to carry the market on their own, according to Fawad Razaqzada at Forex.com.

“Confidence in the sector is being challenged, particularly over whether stretched valuations and heavy spending on AI can still be justified,” he said.

In Asia, the yen edged higher with the Bank of Japan expected to raise interest rates on Friday to the highest level in three decades.

New Zealand’s economy rebounded more than economists had forecast in the third quarter, with falling interest rates helping drive output after a second-quarter contraction.

China Vanke Co, once the nation’s biggest homebuilder, lurched closer towards what would be one of the country’s largest-ever debt restructurings.

To stay ahead of Singapore and the region’s corporate and economic trends, click here for Latest Section

Corporate highlights:

- Woodside Energy Ltd said its chief executive officer Meg O’Neill has resigned to become the CEO of BP plc.

- Ford Motor Co cancelled a KRW9.6 trillion (US$6.5 billion or $8.4 billion) battery agreement with LG Energy Solution Ltd after the US automaker rolled back its electric vehicle ambitions.

- Sumitomo Mitsui Financial Group Inc’s chief executive said he expects to achieve a key profit milestone ahead of time and make the most of the bank’s alliance with Jefferies Financial Group Inc.

- Amazon.com Inc is reorganising teams working on AI projects, putting a top leader from the company’s cloud division in charge of a new unit.

Some of the main moves in markets:

Stocks

- S&P 500 futures had risen 0.1% as of 11.10am Tokyo time on Thursday

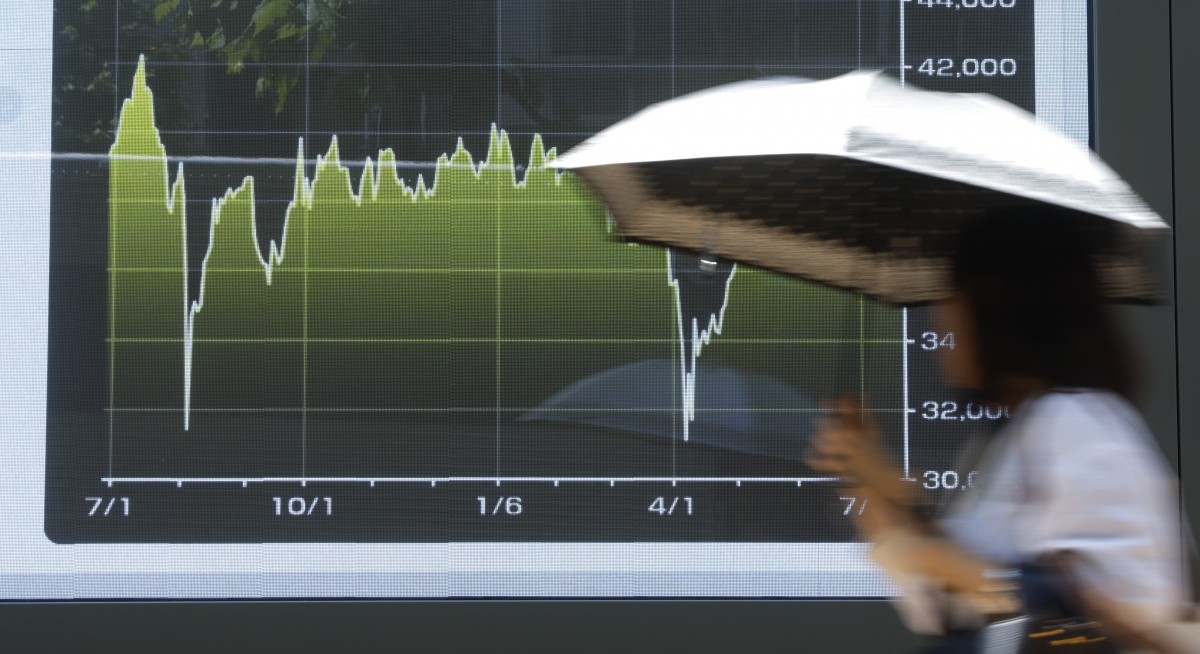

- Nikkei 225 futures (OSE) fell 1.6%

- Japan’s Topix fell 0.5%

- Australia’s S&P/ASX 200 fell 0.3%

- Hong Kong’s Hang Seng fell 0.3%

- The Shanghai Composite was little changed

- Euro Stoxx 50 futures fell 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at US$1.1739

- The Japanese yen was little changed at 155.73 per dollar

- The offshore yuan was little changed at 7.0387 per dollar

Cryptocurrencies

- Bitcoin rose 0.3% to US$86,187.6

- Ether rose 0.3% to US$2,828.21

Bonds

- The yield on 10-year Treasuries declined one basis point to 4.14%

- Japan’s 10-year yield was little changed at 1.980%

- Australia’s 10-year yield was little changed at 4.74%

Commodities

- West Texas Intermediate crude rose 1.6% to US$56.86 a barrel

- Spot gold fell 0.2% to US$4,331.63 an ounce

Uploaded by Tham Yek Lee