(Jan 28): Hong Kong’s Exchange Fund reported a record investment gain of HK$331 billion in 2025, helped by rising global markets.

The fund delivered an investment gain of 8%, according to the Hong Kong Monetary Authority. Hong Kong stock holdings and overseas equities posted a HK$108 billion increase. It earned HK$142 billion from bonds, HK$38 billion from foreign exchange and HK$42.4 billion on other investments.

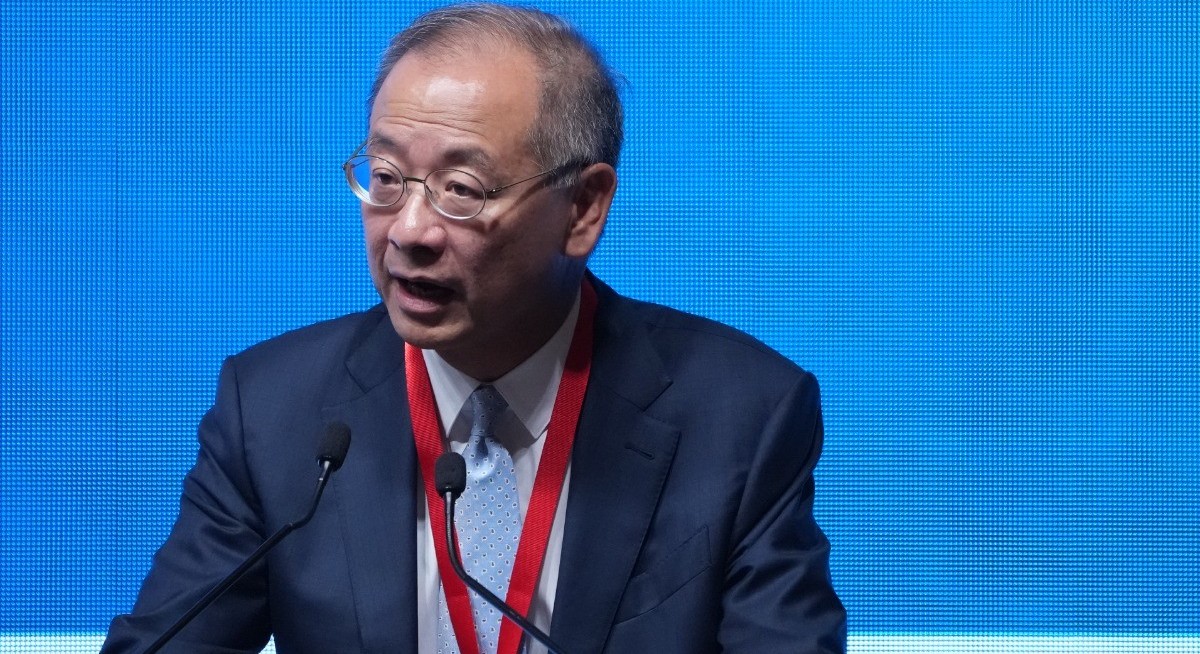

HKMA chief executive Eddie Yue said there’s no guarantee the performance will be sustained this year. “Looking ahead to 2026, factors such as global economic conditions, monetary policies of major central banks, developments in artificial intelligence and geopolitical conflicts could affect the performance of financial markets,” he said.

The HK$4.1 trillion fund serves as the last line of defence for the regime that pegs the local currency to the US dollar. In recent years, the fund has been diversifying away from US dollar-denominated assets and reduced the duration of Treasury holdings to guard against increased volatility.

The US dollar this week slid to the lowest level in almost four years against a basket of major currencies as investors recalibrated their US holdings amid rising geopolitical risks. A drop in the US currency will also weaken the Hong Kong dollar, impacting the price of imports as well as the active cross-border consumption with neighbouring China.

Uploaded by Arion Yeow