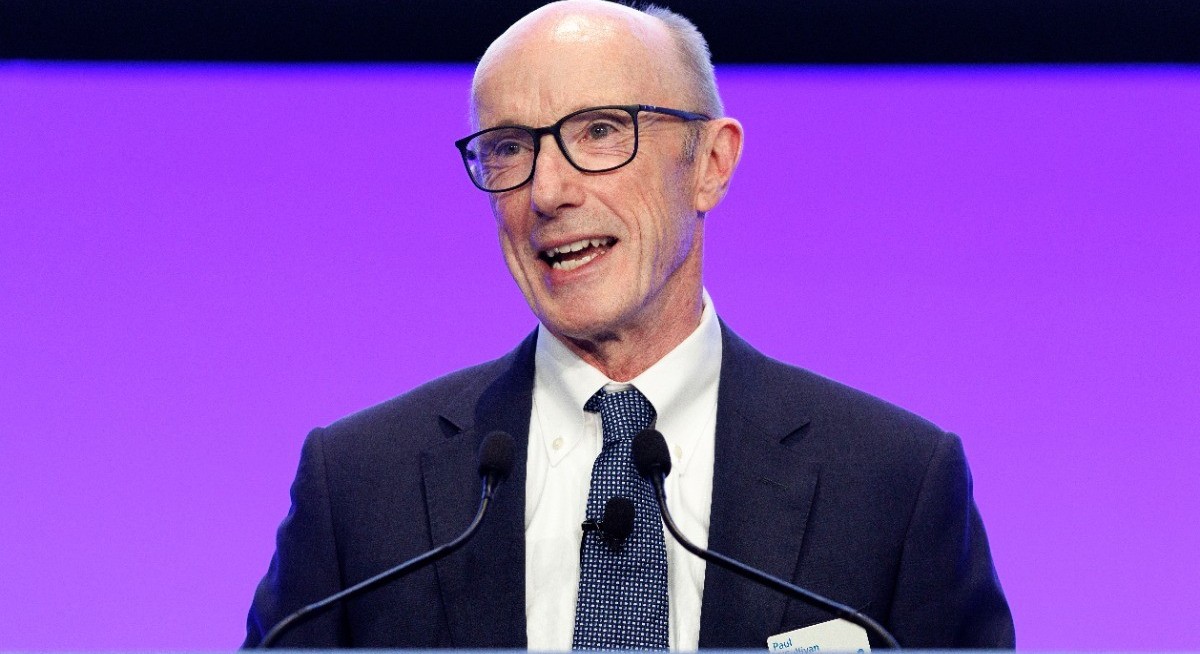

Fielding questions during the meeting over more than four hours in Sydney from disgruntled shareholders, O’Sullivan said the board had driven change and acted with “strong diligence”, being “proactive throughout”.

Despite ANZ’s second remuneration strike in two years triggering a board-spill vote, shareholders voted that down. Some 95% of holders supported O’Sullivan’s re-election as chair for another term.

The pay vote highlights how some ANZ investors want more action from the Melbourne-based lender to address a series of incidents that triggered fines and additional capital requirements. Chief executive officer Nuno Matos, in his first seven months in the role, has overhauled key management and introduced several measures aimed at strengthening risk and compliance.

Current and former senior executives, including ex-CEO Shayne Elliott, were docked more than A$30 million in compensation over a years-long run of problems. Matos last month apologised in parliament, saying cultural change and governance improvements will take time.

See also: Dubai’s financial hub posts record growth on hedge fund boom

The board’s response this year “has been appropriate and proportionate given the challenges faced”, O’Sullivan said.

“I would also point out that outcomes regarding unvested equity for some of our former executives have been, and will continue to be, made as those decisions fall due,” he said. “I want to be really clear the board can — and will — make future adjustments where appropriate.”

He pushed back on suggestions board members should take fee cuts due to failures, saying “it’s a very dangerous game to put boards on variable pay”.

See also: Collins Chin appointed global CFO of Bank of Singapore

O’Sullivan said his priorities during his final term include supporting Matos on delivering the transformation plan, to ensure the board has the right mix of capabilities and to make sure the board provides a smooth transition to the next chair. He indicated he didn’t intend to stay for the entire three years of the term.

MST Financial analyst Brian Johnson had said investors are concerned that ANZ’s board has faced no financial consequences despite being ultimately responsible for management performance.

“The quantum of remuneration cuts to the executive committee clearly shows ANZ management were deemed to have failed and by implication, we think that means the ANZ board failed as well,” he wrote in a report last month.

Glass Lewis has said O’Sullivan’s re-election would provide stability and support an orderly handover to his successor.

The Australian Shareholders’ Association, which represents millions of retail investors, has criticised ANZ’s board for what it describes as skill gaps that need addressing, and has argued that O’Sullivan should not be re-elected.

Uploaded by Felyx Teoh