As a result, the STI should be able to hold above breakout-turned-support level, and eventually head towards a target of 3,600.

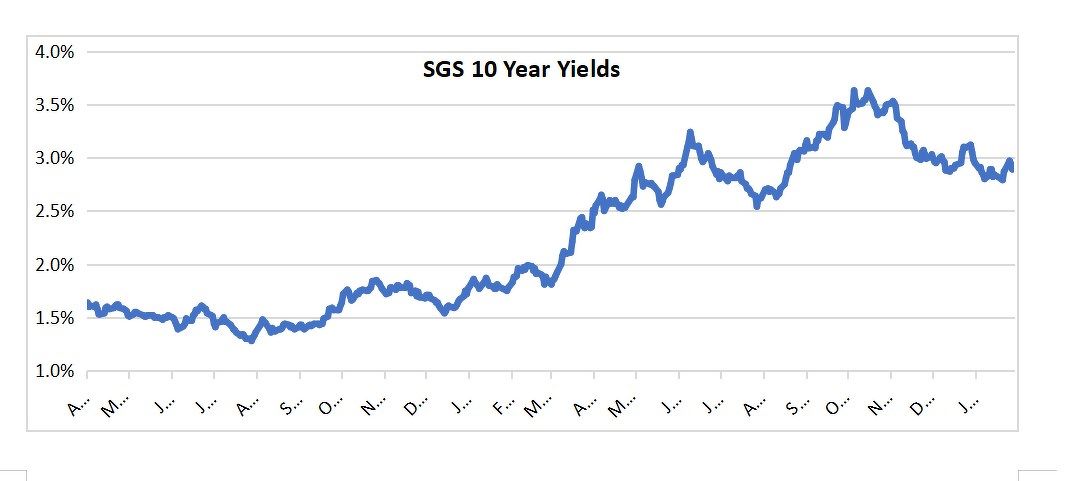

Risk-free rates as represented by the yield on 10-year Singapore Government Securities (SGS) may have peaked. A tentative downtrend has developed, wth the yield breaking below 3%. Support is at 2.79%, a recent trough from which prices rebounded. A move below 2.79% could materialise.

That would likely be the phase where the STI readies itself for the next leg of its upclimb

See also: Singapore assets remain a safe haven as volatility engulfs bitcoin and gold

Risk-free rates as represented by the yield on 10-year Singapore Government Securities (SGS) may have peaked. A tentative downtrend has developed, wth the yield breaking below 3%. Support is at 2.79%, a recent trough from which prices rebounded. A move below 2.79% could materialise. That would likely be the phase where the STI readies itself for the next leg of its upclimb

That would likely be the phase where the STI readies itself for the next leg of its upclimb