Medium-term indicators are largely positive, with quarterly momentum attempting to turn up from its equilibrium line, the moving averages are positively place, and directional movement indicators are intact. However, short-term stochastics and 21-dday RSI are at the top end of their range, and could stymie the STI’s rally in the short term. Support is at 3,350. The STI’s annual and 24-month momentum indicators continue to rise.

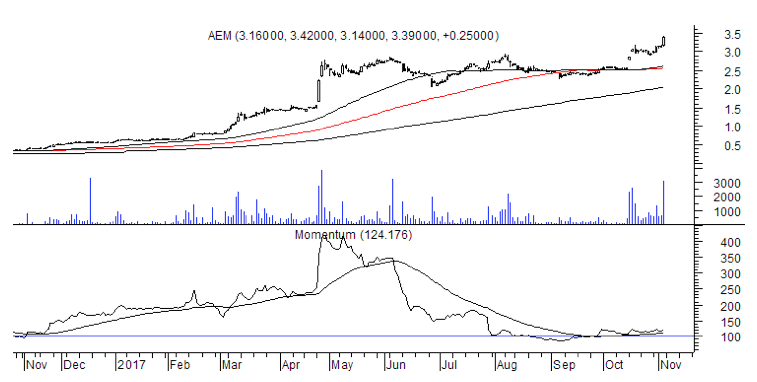

AEM Holdings could rise to $4.20 Although prices are at an all-time high at $3.39, medium-term indicators are poised for a recovery. Quarterly momentum has just turned up at its equilibrium line. The moving averages are positively placed as are the DIs.

ADX is rising and remains at modest levels. These indicators should support further gains. The breakout level is at $3.20, and the upside from this breakout is at $4.20. Support is at $3.20.

AEM Holdings could rise to $4.20

Although prices are at an all-time high at $3.39, medium-term indicators are poised for a recovery. Quarterly momentum has just turned up at its equilibrium line. The moving averages are positively placed as are the DIs. ADX is rising and remains at modest levels. These indicators should support further gains. The breakout level is at $3.20, and the upside from this breakout is at $4.20. Support is at $3.20.

ADX is rising and remains at modest levels. These indicators should support further gains. The breakout level is at $3.20, and the upside from this breakout is at $4.20. Support is at $3.20.