The rebound is set to continue as stochastics is still rising, as is 21-day RSI. The DIs are positively placed and ADX has turned up from a low level. Quarterly momentum stayed intact and has resumed its uptrend. Annual momentum continues to struggle, but the STI can continue to move higher for the next 2-3 weeks on short and medium term momentum. During this time, the index should be able to head past the target of 3,550 towards the natural resistance level of 3,600. Support should be raised to 3,440.

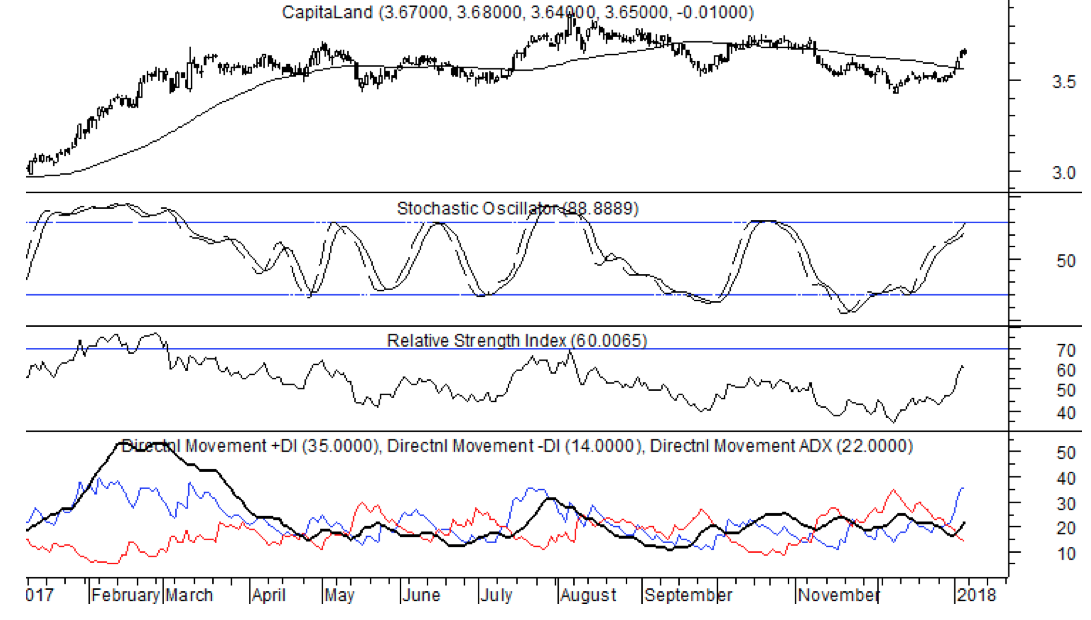

CapitaLand ($3.65) poised for breakout

This counter had underperformed in 4Q2017 but this is set to change this year. Prices have broken above the 50-, 100-, and 200-day moving averages simultaneously. Quarterly momentum appears poised to break above its equilibrium line just as its own moving average is turning up. These are positive signals.

CapitaLand and short term indicators Short term stochastics is rising. The 21-day RSI surged upwards, and ADX which had been flat at a low level has turned up just as the DIs turned positive.

CapitaLand and short term indicators

Short term stochastics is rising. The 21-day RSI surged upwards, and ADX which had been flat at a low level has turned up just as the DIs turned positive.

The breakout indicates a target of $3.86 but prices could move higher than this level as the rally finds its legs. Support is at $3.60.