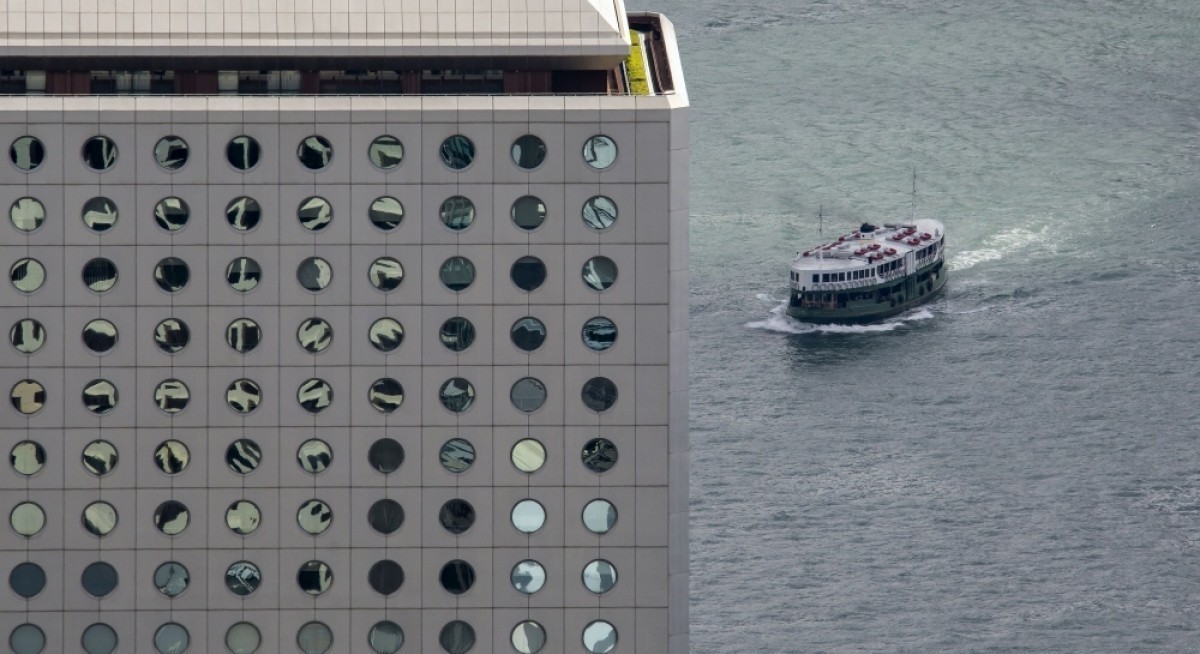

Assets to be part of this fund include One Raffles Link, 33.3% interest in MBFC Towers 1 and 2, and One Raffles Quay, amounting to US$3 billion.

"We are positive about this development, as Hongkong Land demonstrates its ability to generate a recurring stream of fee income through its fund management business," says Chan in her Dec 12 note.

The company, which has reiterated its target of increasing overall AUM to US$100 billion by 2035, is in advanced talks to raise funds from third-party capital partners, which will be deployed into mature commercial assets in Singapore's key business districts.

According to Chan, Hongkong Land has also indicated it will explore other opportunities, including a potential fund in China. "We believe the timing of this initiative will depend on the execution of the Singapore Central Private Real Estate Fund, which could influence the appetite of third-party capital partners," she adds.

See also: PhillipCapital, UOB Kay Hian raise respective target prices for BRC Asia following 1QFY2026 earnings

The company will likely give further updates when it launches the fund, including the fund's portfolio composition and investment strategy.

"Additional guidance on share buybacks is also anticipated once capital recycling of the Singapore portfolio is completed following fund formation," she adds.

Just before Hongkong Land announced the fund, news broke that it is selling its 33.3% interest in MBFC Tower 3 to Keppel REIT at a 2% premium to its end-June total attributable carrying value.

See also: Citi ups target prices on all three banks; prefers Singapore banks over SGX for EQDP play

Net proceeds of US$0.7 billion from the sale, after accounting for asset-level debt and liabilities, will be used to reduce debts and lower interest expenses.

Chan expects the transaction to be initially earnings neutral, as fee income and lower finance costs are offset by reduced profit from the Singapore joint venture assets.

However, she has raised her 2027-29 net income forecasts by 1%, with higher fee income anticipated from further AUM growth.

Her higher fair value of US$7.40 is to reflect the premium from the sale of the sake in MBFC3 and also earnings accretion over the long-term.

The shares, while deemed fairly valued, will enjoy support from the ongoing US$150 million buyback programme.

Hongkong Land shares as at 11 am, changed hands at US$7.14, down 0.42%. It is up 61.17% year to date.