The tech rally, driven by euphoria around anything linked to artificial intelligence, also lifted the fortunes of lower-profile executives like Arista Networks Inc’s Jayshree Ullal. A rare non-founder billionaire, the long-time chief executive officer of the networking-equipment company sold nearly US$1 billion as her net worth jumped to over US$6 billion last year.

Nearly all of the top insider sellers, including Ullal and Bezos, used 10b5-1 trading plans, which signal in advance their intention to sell.

Here are the top insider sellers for 2025, according to Washington Service, which tracks insider buying and selling. The data, which track sales disclosed in filings through Dec 30, include board directors who report insider sales on behalf of their firms.

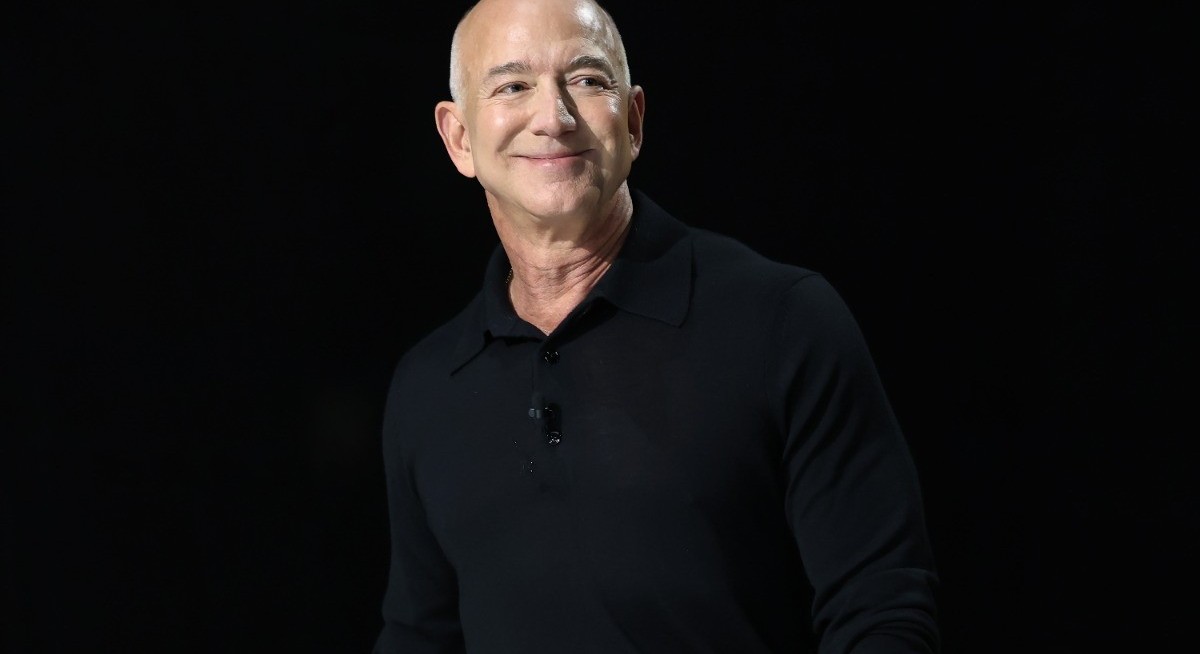

1. Jeff Bezos

See also: Real estate services stocks sink in latest ‘AI scare trade’

Chair, Amazon

Total shares sold: 25,000,000

Total value sold: US$5,654,270,394

See also: Treasuries fall as strong jobs curb Fed-cut bets

Bezos offloaded 25 million shares of Amazon in 2025 under a pre-arranged trading plan that kicked off the same weekend as his Venice nuptials. Over June and July, Bezos sold US$5.7 billion worth of stock, bringing his total sold since 2002 to more than US$50 billion, according to the Bloomberg Billionaires Index. The Amazon chairman has diversified his interests since founding the e-commerce giant and often uses his sale proceeds to fund his space venture, Blue Origin. Amazon didn’t respond to a request for comment.

2. Safra Catz

Former CEO, Oracle Corp

Total shares sold: 12,500,000

Total value sold: US$2,531,343,305

Oracle’s former CEO is always quick to unload any shares she acquires and the pattern continued in 2025. Catz, who uses a 10b5-1 plan, exercised and sold millions of performance-based stock options she received in the first half of the year as Oracle hit new highs. Compared to founder Larry Ellison, whose net worth is primarily made up of Oracle stock, Catz maintains a small position of 1.1 million shares. She stepped down from the CEO role in September after 11 years leading the company, becoming vice chair of the board. Outside of Oracle, Catz recently joined the board of Paramount Skydance Corp, run by Ellison’s son David, and owns a handful of restricted stock units, which aren’t included in her US$3.5 billion fortune, according to Bloomberg’s wealth index. Oracle declined to comment.

To stay ahead of Singapore and the region’s corporate and economic trends, click here for Latest Section

3. Michael Dell

CEO, Dell Technologies Inc

Total shares sold: 16,253,968

Total value sold: US$2,222,753,261

Dell made a splash in December when he and his wife Susan announced they would give US$6.25 billion to launch so-called “Trump Accounts” for 25 million American children. Some of that money could be coming from his stock sales throughout the year. The founder of the eponymous Round Rock, Texas-based computer company often sells large billion-dollar chunks without the use of a 10b5-1 plan. In 2025, he sold over US$2 billion in two different transactions in June and October, increasing his total sold to over US$13 billion, according to the Bloomberg Billionaires Index. Dell still owns around 40% of his company. Dell Technologies representatives didn’t respond to a request for comment.

4. Jensen Huang

CEO, Nvidia Corp

Total shares sold: 6,000,000

Total value sold: US$1,048,586,165

When Huang first filed to unload six million shares of Nvidia, he was expected to net roughly US$865 million. The stock’s relentless march higher, though, ended up tipping the value of his sales over US$1 billion. As Huang sold, Nvidia crossed the threshold of the world’s first US$4 trillion company in July, then the first US$5 trillion company in October. Huang also gave over US$300 million to a donor-advised fund and his foundation, which has struggled to keep pace with Nvidia’s stock growth and will have to double its giving, again, in 2026. Nvidia didn’t respond to a request for comment.

5. Jayshree Ullal

CEO, Arista Networks

Total shares sold: 7,560,143

Total value sold: US$975,839,433

Ullal led Arista Networks to historic highs in 2025 as the networking equipment provider saw its stock soar nearly 50% to a record in October, before it erased some of those gains to end the year up 19%. Ullal’s stock sales also set a record as she unloaded more than US$975 million in the fall. Despite the sales, most of her US$6.1 billion net worth is still tied up in her 2.4% stake in the company, according to the Bloomberg Billionaires Index. Ullal is one of four billionaires tied to Arista Networks, and a rare non-founder CEO who’s among the world’s richest women. A spokesperson for Arista didn’t respond to a request for comment.

6. Mark Zuckerberg

CEO, Meta Platforms Inc

Total shares sold: 1,387,605

Total value sold: US$944,785,836

Meta’s stock finished the year up 13% as the social media company embraced AI. Along the way, Zuckerberg and his wife’s Chan Zuckerberg Initiative, as well as its associated foundation, cashed out nearly US$945 million worth of shares. Zuckerberg had previously said he plans to give away 99% of his stock in his lifetime, and still owns a 13% stake in the company he co-founded. It was a tumultuous year for his philanthropy, which faced layoffs and shifting priorities, and also cut ties with a pro-immigration group he had co-founded. Meta didn’t respond to a request for comment.

7. Max de Groen (on behalf of Bain Capital)

Director, Nutanix Inc

Total shares sold: 10,980,467

Total value sold: US$830,759,670

The Nutanix board director represents Bain Capital, which sold two-thirds of its stake in the cloud-computing company in the past year. Last summer, the Boston-based investment firm converted a note and received 16.9 million shares, which de Groen said in June 2024 that the firm had no intention of selling. Bain sold nearly 11 million of the shares across two transactions in March and June, which are reported under de Groen’s name. Despite reaching a high in May, Nutanix saw a double-digit decline in November after it cut its 2026 revenue forecast. Bain Capital declined to comment.

8. Frank Slootman

Chair, Snowflake Inc

Total shares sold: 3,437,162

Total value sold: US$757,721,569

Slootman parlayed his tenure atop three tech companies into a 10-figure fortune, surpassing other non-founder chief executives like Apple Inc.’s Tim Cook and Microsoft Corp’s Satya Nadella. Since retiring as CEO of the cloud computing company in 2024, Slootman has been exercising stock options and selling shares under a 10b5-1 plan. He remains chairman of the Montana-based company, which didn’t respond to a request for comment on his sales.

9. Nikesh Arora

CEO, Palo Alto Networks Inc

Total shares sold: 4,000,000

Total value sold: US$738,421,375

Arora, a former SoftBank Group Corp executive, scored a huge pay package to come run cyber security firm Palo Alto Networks in 2018. Since then, the billionaire has been exercising and selling some of his stock options on a monthly cadence under a 10b5-1 plan, adding up to nearly US$740 million for the year. Earlier in 2025, Arora and a consortium of tech investors bought an English cricket team. Palo Alto Networks didn’t respond to a request for comment.

10. Baiju Bhatt

Director, Robinhood Markets Inc

Total shares sold: 7,697,404

Total value sold: US$724,926,811

Robinhood’s co-founder briefly made the list of the world’s 500 richest people in 2025 after the Menlo Park, California-based trading platform’s stock quadrupled through early October. It’s since given up some of those gains, but not before Bhatt cashed out nearly US$725 million. The former co-CEO sold 7.7 million shares throughout the year, including several million not included under his pre-existing trading plan. He’s now worth US$6.7 billion, down from a high of US$8.9 billion in October. Bhatt didn’t respond to a request for comment.

Uploaded by Magessan Varatharaja