(Jan 26): Nvidia Corp, the dominant maker of artificial intelligence (AI) chips, invested an additional US$2 billion ($2.54 billion) in CoreWeave Inc to help speed up an effort to add more than five gigawatts of AI computing capacity by 2030.

Nvidia purchased CoreWeave Class A common stock at US$87.20 a share, the companies said on Monday. As part of the collaboration, CoreWeave will be among the first to deploy forthcoming Nvidia products, including storage systems and a new central processing unit, or CPU. Nvidia, already a CoreWeave investor, previously agreed to buy more than US$6 billion in services from the firm through 2032.

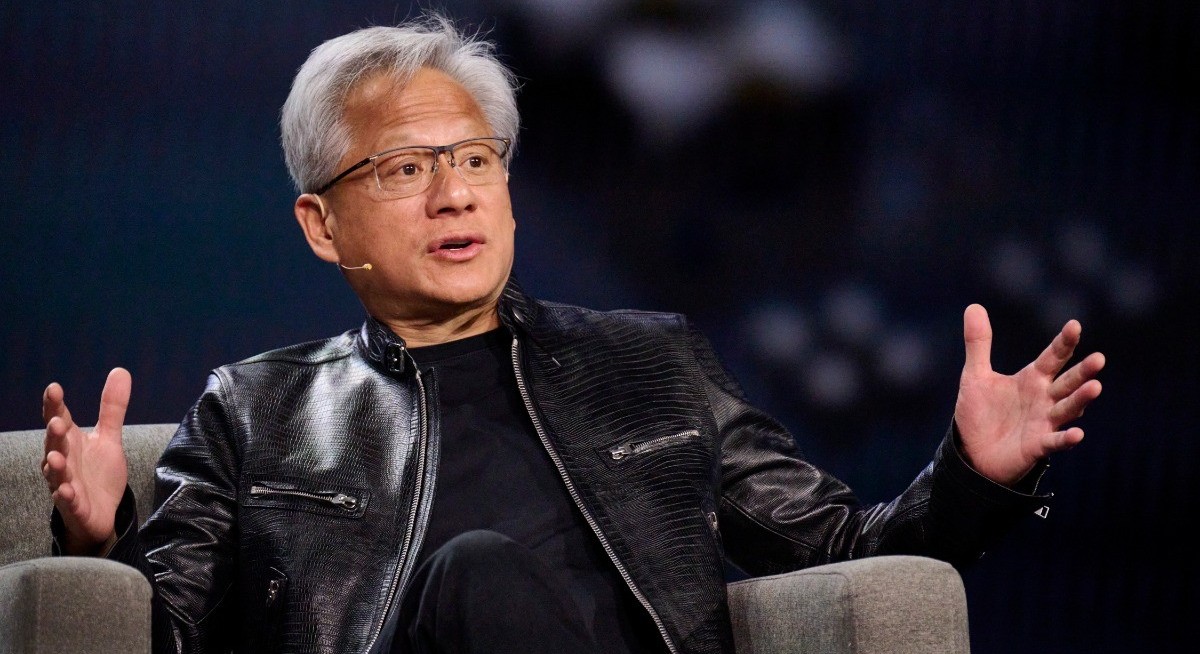

“The investment is confidence in their growth and confidence in CoreWeave’s management and confidence in their business model,” Nvidia chief executive officer Jensen Huang said in an interview. But the partnership itself is more focused on aligning the two companies’ engineering work and getting computing capacity online, he said.

The deal is just the latest example of Nvidia using its enormous resources to propel the broader AI industry. The world’s most valuable company has pledged tens of billions of dollars towards AI companies, bankrolling the deployment of new infrastructure built with its products.

CoreWeave shares rose as much as 17% in trading on Monday, while Nvidia’s stock inched up by less than 1%.

The announcement also puts a spotlight on a new business avenue for Nvidia. The CPU, which carries the Vera brand, marks the first time the company has offered such a chip on a stand-alone basis.

See also: Nvidia-led boom set to turn chips into trillion-dollar industry

That means Nvidia will be challenging processors from Intel Corp and Advanced Micro Devices Inc (AMD) inside data centres. The Vera product also could offer an alternative to in-house components that cloud providers use, such as Amazon.com Inc.’s Graviton. Previous Nvidia CPUs have been only available as part of systems combined with other chips.

“Vera is completely revolutionary,” Huang said of the CPU. He declined to name other customers for it besides CoreWeave but said, “There are going to be many.”

Intel shares fell as much as 4.4%, while AMD’s slipped as much as 2.7%.

See also: TikTok hit by EU ultimatum over addictive design dangers

Nvidia already leads the market for graphics processing units, or GPUs, the powerful chips used to develop and run AI models. With a CPU, often described as the brains of a computer, it’s taking aim at more of the computing industry.

CoreWeave, which went public last year in one of the biggest stock offerings of 2025 and is now worth more than US$50 billion, is known as a neocloud — a specialised cloud-computing provider used by AI services. The Nvidia investment will shore up CoreWeave’s finances and help allay concern about its costly spending spree on data centres.

Under their agreement, Nvidia will assist CoreWeave with the purchase of land and power for data centres. It also will market CoreWeave’s AI software and architecture designs to cloud partners and large business customers.

CoreWeave has ambitious plans. Five gigawatts is equivalent to the output of five large nuclear reactors. A single gigawatt of electricity is enough to power roughly 750,000 US homes at any moment.

The Nvidia funds represent about 2% of what CoreWeave plans to spend to bring new infrastructure online, CEO Mike Intrator said in an interview.

“This year, we are going to deliver an enormous amount of infrastructure, and that’s just going to accelerate over the next three years,” he said.

Before Monday’s accord, Nvidia was the fourth-largest holder of CoreWeave shares, according to data compiled by Bloomberg. The Santa Clara, California-based chip giant owned about 6% of the data centre operator.

To stay ahead of Singapore and the region’s corporate and economic trends, click here for Latest Section

Nvidia has said that it’s spending money to help remove barriers to AI adoption. But the massive investments have intertwined many of the biggest AI companies, sparking concerns about circular deals, arrangements where a business invests in an entity that also serves as a customer. Besides CoreWeave, Nvidia has invested in OpenAI, Anthropic PBC, Elon Musk’s xAI and others.

In response to the circular-deal concerns, Nvidia’s CEO said the investments represent a fraction of the total infrastructure spending those businesses will have to make.

Large customers such as Microsoft Corp and Alphabet Inc continue to pour money into new equipment because it helps their existing business, he said. New companies — described by Huang as “AI-native” — were born in a wave of venture investments. Those firms, in areas such as automated coding, healthcare and video editing, need access to their own computing resources, he said.

“These are generational companies — the investments that we make is confidence in them,” Huang said. “But it’s a small percentage of the amount of money that they ultimately have to go raise, and so the idea that it is circular is — it’s ridiculous.”

CoreWeave has worked to diversify its customer base away from Microsoft, which accounted for two-thirds of sales in the most recently reported quarter. The push has included agreements with OpenAI and Facebook owner Meta Platforms Inc.

CoreWeave is losing money, with its capital spending far outstripping revenue. And the company’s use of debt financing for its data centre build-out had spooked some investors. In December, CoreWeave’s shares fell after it unveiled plans to raise US$2 billion by issuing debt that can be exchanged for shares.

That move also contributed to broader concerns about an AI bubble — something Huang and his peers have downplayed. Nvidia’s CEO has argued that new technology is being adopted so fast that investments are already paying off. The only obstacle is the shortage of computing capacity, he’s said.

Nvidia’s own growth run has shown little signs of fading. After predicting about half a trillion dollars of revenue from data centre chips by the end of 2026, Nvidia said this month that its forecast has only grown more bullish.

In the interview, Huang repeated the assertion that total demand remains “enormous”.

Uploaded by Tham Yek Lee