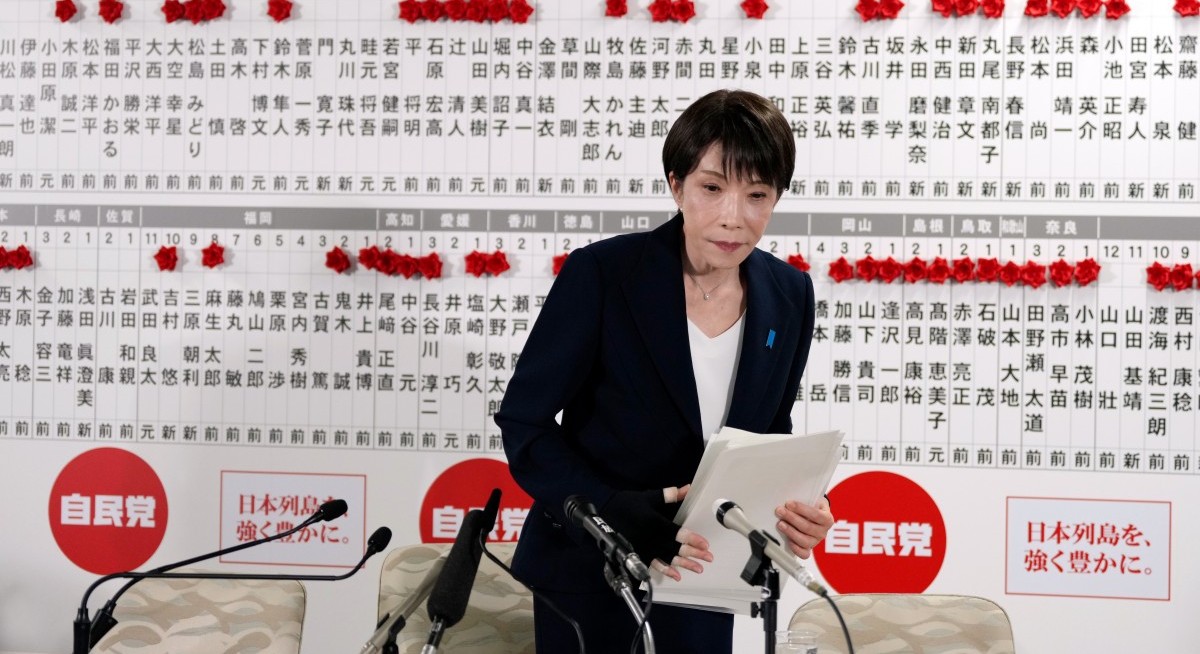

(Feb 9) : The yen fluctuated Monday as Japan’s Prime Minister Sanae Takaichi secured a historic election triumph, while Asian stocks looked set to open the week higher after Wall Street’s Friday rally.

The yen was little changed following earlier weakness after the nation’s ruling Liberal Democratic Party gained a two-thirds super majority in the 465-seat lower house by itself, according to public broadcaster NHK. The result cleared the way for more fiscal stimulus under Takaichi, adding pressure to Japanese bonds while potentially lifting stocks.

Equity-index futures for Asia indicated gains for benchmarks in Australia, Hong Kong and Japan. US stocks jumped on Friday, with the S&P 500 closing about 2% higher amid dip buying from investors and as data showed consumer sentiment increased. The dollar edged lower with Treasuries on Friday.

Japan’s election outcome reinforced expectations for looser fiscal policy and sustained pressure on the yen, with investors bracing for so-called Takaichi trades to dominate markets on Monday. The result also helped set a constructive tone for global assets at the start of the week, extending a risk-on move fueled by resilient US data and Wall Street’s rebound.

Traders were taking advantage of the selloff earlier last week, picking up some cheap stocks to extend the rotational trade into cyclicals and away from tech, said Tony Sycamore, an analyst at IG in Sydney. The Wall Street tailwind and Takaichi trade means “at least for the very very short term, we’re going to see a good risk-on session across Asian equity markets,” he added.

The LDP’s haul gives the party a higher proportion of representatives in the lower house than any other party in post-war elections in Japan and will drive concerns of more debt fueled stimulus. Many investors see an election victory for Takaichi as allowing her to add to Japan’s already heavy debt load.

See also: Ford falls behind China’s BYD in global sales for the first time

The prevailing view is that Takaichi favors monetary and fiscal policy stimulus and “she has won a strong mandate to follow through with this policy agenda,” said Jason Wong, a strategist at the Bank of New Zealand in Wellington. That “reinforces the outlook for a soft yen and pressure on long-term JGBs.”

Friday’s rally pushed the S&P 500 back to breakeven for the week. Still, US stocks are facing more selling this week from trend-following algorithmic funds, according to Goldman Sachs Group Inc.’s trading desk.

“The inability to transfer risk quickly lends itself to a choppier intraday tape and delays stabilization in overall price action,” Goldman’s trading desk team including Gail Hafif and Lee Coppersmith wrote in a note to clients Friday.

See also: Yen carry trade Is a ‘ticking time bomb,’ warns BCA Research

Elsewhere, the Thai baht was little changed in early trading after results from Sunday’s election show the ruling Bhumjaithai party on track to win the most seats and in pole position to form a coalition. The outcome may lift the currency and stock markets as the potential for policy continuity is a relief for those who feared further political dysfunction.

“Overall policy continuity is a scenario that may ultimately result in stability,” said Brendan McKenna, a strategist at Wells Fargo in New York. “Markets are usually comfortable with clarity and the ruling party winning offers a bit more clarity.”

Back in the US, Treasury investors will prepare for a flurry of economic reports that are expected to offer clues for when the Federal Reserve intends to resume interest-rate cuts.

With markets attuned to the policy outlook, attention will focus on a busy US data calendar this week, highlighted by January payrolls on Wednesday and inflation figures two days later. The unusual clustering follows last month’s partial government shutdown, which delayed several key economic releases.

Traders see less than a 20% chance that the Fed will reduce rates next month, after policymakers decided to hold the benchmark at a range of 3.5% to 3.75% in January.

In commodities, iron ore will be watched after Australia’s major ports were shuttered and bulk carriers forced out to sea at the weekend as a tropical cyclone approached the country’s western coast. The area off Australia’s Pilbara region also includes a number of oil and gas operations.

uploaded by Isabelle Francis