If the valuation of liabilities rises, the net asset value (which is assets less liabilities, and equivalent to shareholders’ equity) of the insurer is likely to fall. As a result, low interest rates drive down NAV and capital, affecting the solvency ratio and the capital adequacy ratio of insurers.

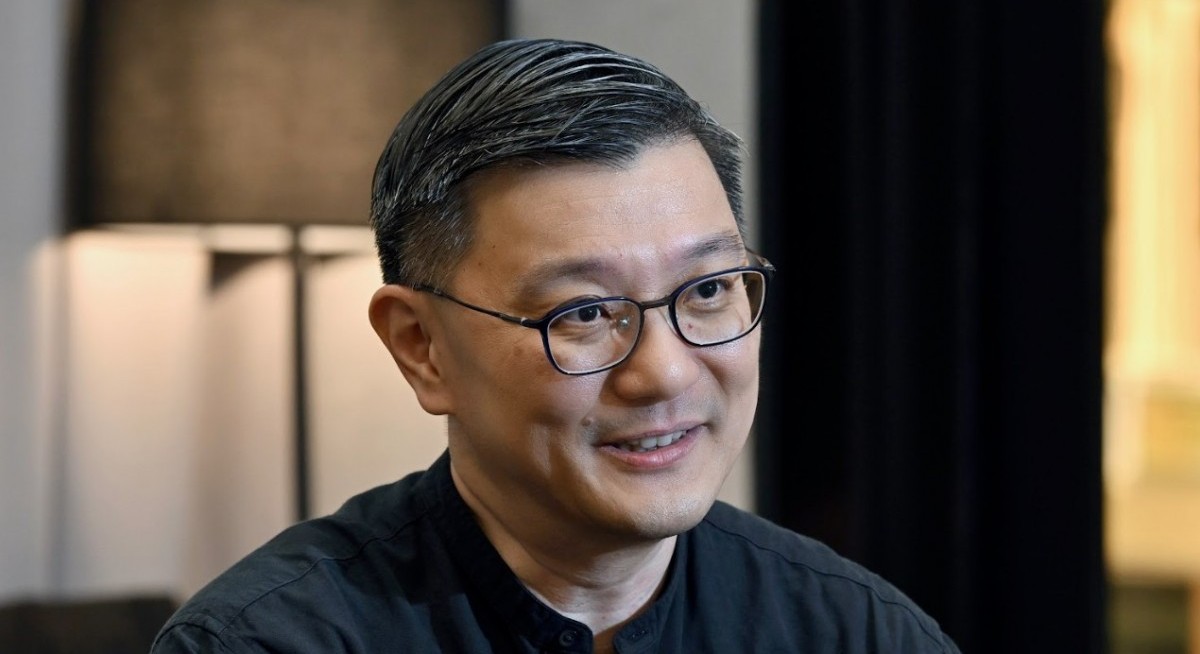

He then recounts the drama of implementing RBC 2, the risk-based capital framework. Long in the pipeline since 2014, it was scheduled for implementation in 2020, which turned out to be a Covid-19 year. “RBC 2 was effective March 31, 2020. We had a ‘circuit breaker’ in April. We had to close our 1Q2020 financials at the same time as transitioning to RBC 2. Then we all had to work from home. It was a challenge for the actuarial and finance folks, but we managed to pull through,” says Tan.

For him, the role of a CFO in an insurance company goes beyond crisis management. He sees it as allocating assets, capital and budgets with intent. “You need to let the money flow where you want to see growth, and you need to tighten the money where you want to restrict growth,” he adds. “Taking risk is easy, but knowing which asset class to take risk in and in which sector is critical, and the CFO of an insurance company would need to be involved.”

The other side of the coin

See also: City Developments set to end year on a strong note

The general public’s association with life insurance is often initially through buying an insurance product. There has been much angst about investment-linked products being appropriate or inappropriate for some purchasers (see cover story “Is insurance a good fit in your portfolio?”), with a view that insurance agents tend to push products because of their commissions.

Insurance companies used to (under the previous international reporting standard or IFRS 4) report a loss in year one of an insurance product. This is the New Business Strain (NBS), which refers to the temporary financial dip an insurer experiences when writing new policies, as upfront costs (commissions, marketing, setting reserves) often exceed initial premiums, creating a short-term drain on capital and profitability until future premiums cover these expenses. NBS is less of a problem in the latest IFRS, IFRS 17.

What is less obvious is that a lot of thought and effort go into manufacturing an insurance product (see sidebar on Universal Life). After a product idea is generated, what the public sees is the marketing campaign, with insurance agents canvassing the product to their customers. What we do not see are: the actuaries who design, price and manage the risk associated with a new product (ensuring it is both competitive for customers and financially sound for the insurer); regulatory approvals for the product; reinsurance to limit liability on specific risk, to stabilise loss experience and to protect against catastrophes; the list goes on.

See also: ‘An enabler of growth, efficiency and optimisation’, besides financial stewardship: Yiong of CityDev

“We structure products to meet customers’ needs, and that can range from investment savings type products all the way down to insurance protection,” Tan says. Medical, home, motor or travel insurance may not be as asset-intensive where the insurer has to rely on investment returns to manufacture a product compared to life products.

“For [general insurance], the key capability that we need is more underwriting the risk, whether the customer or properties or vehicles that we insure are risky or not, price it accordingly and manage the claims around those,” Tan adds.

He continues: “Whole life products or savings type products, where we are giving customers a long-term return commitment, those are the ones where we need to make sure that we choose the right investments that can match the liabilities and provide the returns that are needed. The risk spectrum can range from medical claims to motor claims risk to investment-related risk. And when it comes to investment, it depends on what you invest in. You have interest rate risk, you have currency risk, credit risk and equity risk.”

Navigating interest rate volatility

The role of interest rates is significant. A change in interest rates can impact an insurance company’s net asset value almost immediately.

The capital framework, which is the RBC framework, or the accounting framework IFRS 17, both require GEH to value its obligations or liabilities to the customers using a discounted cash flow approach. Discount rates are dependent on interest rates, which is why interest rates are very critical to a life insurer’s business.

“When interest rates go up and down, the value of the liabilities will go up and down. But similarly, the assets that we invest in will go up and down as well. So it depends on how well we match the two,” Tan notes.

To stay ahead of Singapore and the region’s corporate and economic trends, click here for Latest Section

A life insurance product is a commitment from the insurance company to its customers of a set of future cash flows, similar to a bond or other fixed income instrument, whether whole life, annuity or retirement product. For the insurance company, it is almost equivalent to issuing a bond.

However, the movement on the liability tends to be greater than that of the (matching) asset. “A 1% drop in interest rate will have a greater impact on our liabilities than on our assets, and hence our liabilities will rise more,” adds Tan.

When rates rise, GEH’s long-dated bonds of 15 to 20 years drop less and can be reinvested at a higher rate. “Interest rates drive the valuation of what we commit to the customers, and both the RBC framework and the IFRS framework value this commitment using discounted cash flows based on the interest rate yield curve.”

Prior to the implementation of IFRS 17, GEH’s net profit was volatile because interest rate movements affected the securities portfolio, and the mark-to-market differences had to pass through the P&L (profit and loss). With IFRS 17, interest rate movements impact the contractual service margin (CSM) balance (more of this later). “It allows the profit to be more reflective when it is earned,” adds Tan.

Similarly, in year one of the move to IFRS 17, GEH’s shareholders’ funds declined. “When we adopted IFRS 17, there was a change in the valuation basis,” he notes. This was partly due to the way profits are released (see “Winds of change in valuations for insurance companies”).

Interest rate trends also often impact sales of GEH’s products. Most of GEH’s liabilities are in local currency. But, because of the US risk-free rate holding above 4% (compared with the 10-year Singapore Government Securities yield 2.16%), GEH has experienced a bump in the sale of its US dollar products. “There is a huge interest in Universal Life (UL),” Tan says of GEH’s Prestige range of products for high net worth individuals (see “Inside Great Eastern’s Universal Life play”).

GEH’s Prestige Legacy Index is a US dollar-denominated UL plan combining potentially higher growth through participation in market indices while limiting risk exposure during market downturns. Policyholders are assured of lifelong protection against death and terminal illness. GEH also offers retirement products available in Singapore dollars and US dollars, such as Great Index Income (Singapore dollars) and Prestige Index Income (US dollars).

“We do see a significant increase in interest in the US dollar versions of these products,” says Tan. As at Jan 20, yields on US treasuries are at around 4.9% while yields on 30-year Singapore Government Bonds are at 2.27%.

CSM can be likened to NII and NIM

Life insurance is a long-dated, complex business. Yet Tan breaks down its jargon, new regulations and impact in clear, accessible terms. For instance, IFRS 17 (which replaced IFRS 4) introduced CSM. It was designed to make life insurance financial reporting more in line with the way banks view net interest income (NII) and net interest margins (NIM).

IFRS 17 was little understood when it became effective for annual reporting periods beginning on or after January 1, 2023. The argument was that it brought greater transparency and compatibility to financial statements. What does that mean?

When a bank receives a deposit or disburses a loan, it does not recognise either the deposit or the loan as income or expense. The bank’s income comes from net interest income (NII), based on the net interest margin.

Under IFRS 4, when GEH received a premium, it was incorporated in the revenue line, and when GEH paid out claims, it was classified as an expense. “I guess insurance is the only industry that recognises profit on a cash flow basis, which is not consistent with the other industries. Under IFRS 4, when we received [insurance] premiums, which are a cash inflow, we recognised them as revenue. When we had a claim, we recognised it as an expense,” Tan says.

He adds: “To make us consistent with the rest, when we receive a premium, or we pay our claims, it is no longer recognised in the revenue or expense line, it’s only the profit margin that flows through the CSM.”

The CSM release is similar to the spread between the loan interest rate and deposits, akin to a bank’s net interest margin. “By doing this, it makes insurers’ [financial] accounting more similar to banking.”

Previously, as a result of new business strain, life insurers suffered a loss in the first year of an insurance product. “Before IFRS 17, in the first year, the cash outflow is definitely a lot, because you have to pay the commission, the underwriting expenses. The profit only comes in from year two onwards,” says Tan.

Under IFRS 17, the life insurer recognises earnings and expenses as they come through. “We project the profitability of the product for the entire life and put it under the CSM, and we release it every year. With the introduction of the CSM, we no longer have a first-year loss,” Tan continues, referencing the NBS.

CSM is calculated at contract inception as the difference between the fulfilment cash flows and the present value of premium, so that on day one, the profit is zero. The future profits are then spread over the future lifetime of the contracts as the CSM is released through the P&L. The amount of CSM released to the P&L each period is determined based on the coverage units in the period. The coverage units are determined for each contract by considering the quantity of the benefits provided under a contract and its expected coverage period.

Comprehensive equity

GEH’s FY2024 annual report references comprehensive equity, defined as the total of shareholders’ equity plus net CSM, where net CSM is CSM net of reinsurance, non-controlling interest and tax.

“This measurement provides additional insights for our shareholders and analysts, complementing our embedded value disclosures and improving transparency under the new accounting framework. In 2024, comprehensive equity grew by 5.3% to $14.098 billion,” GEH’s annual report says.

“If you take IFRS 17 financial statements’ shareholder equity, plus the CSM net of tax, and you add them together, you get comprehensive equity, which is equivalent to embedded value in a sense,” Tan says.

Like GEH, its peers in Asia, AIA and Prudential PLC, publish both comprehensive equity and embedded value. In Europe, because of IFRS, the insurance sector is moving towards comprehensive equity, and some European life insurers no longer publish embedded value. “We are still running both,” he continues.

Tan started in GEH in an investor relations role. “When I first joined Great Eastern, a lot more analysts covered us. There were a few who knew insurance quite well,” he remembers. Currently, most analysts in Singapore have dropped insurance coverage and consolidated insurance coverage into financial institution coverage. “Over the years, we have fewer insurance specialists. At the moment, I think all the analysts, or the few that I talk to, are mostly bank analysts, so I don’t get that many in-depth questions.”

That context is why Tan welcomed the chance to dig deeper. The CFO Interview has provided him with the opportunity to expand on this complicated, somewhat fascinating part of financial services.