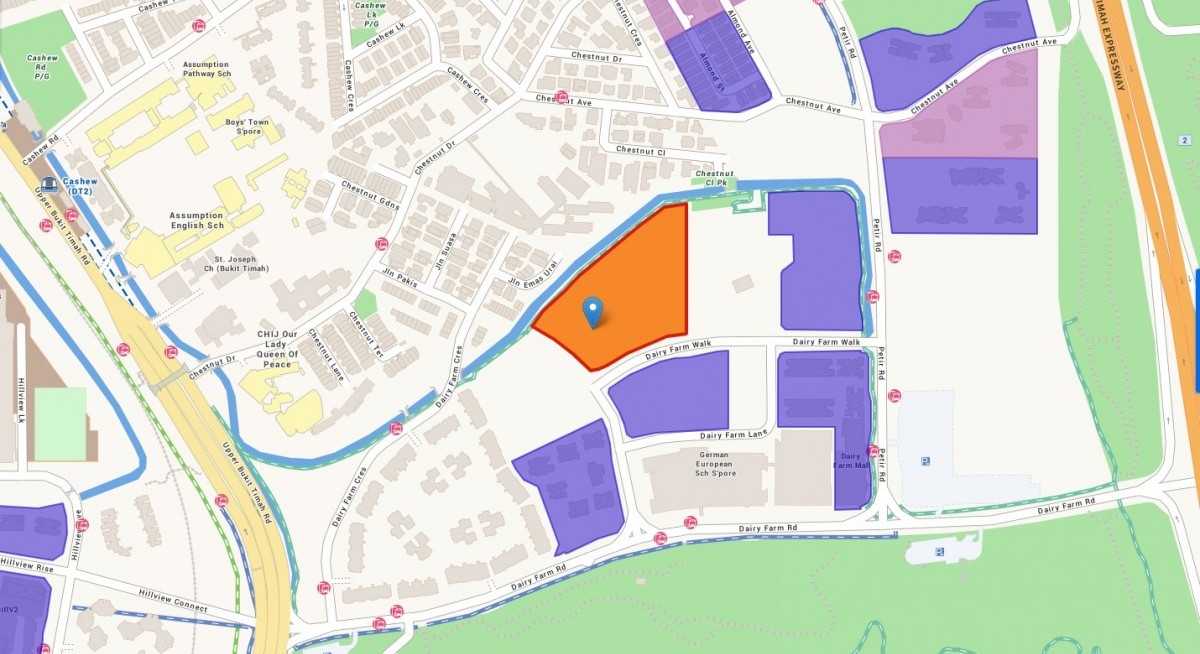

This land parcel is the fifth GLS residential plot to be placed for tender in the Dairy Farm area since 2012.

There are five existing projects at Dairy Farm Walk and Dairy Farm Road: freehold condo The Dairy Farm; two leasehold projects, The Skywoods and Dairy Farm Residences; and two projects under development, The Botany at Dairy Farm and Narra Residences.

With no western Outside Central Region (OCR) residential sites on the 1H2026 GLS confirmed List, the latest Dairy Farm Walk parcel stood out as a “rare opportunity” for developers targeting this segment, says Marcus Chu, CEO of ERA Singapore. “[This] likely contributed to the strong turnout and competitive bidding.”

That said, the top bid at today’s tender close is 5.7% lower than the winning land rate of $1,020 psf ppr for the site of Narra Residences that closed in January 2025, and 1.8% lower than the top bid of $980 psf ppr at The Botany at Dairy Farm parcel, which closed in March 2022 with seven bidders.

See also: Narra Residences draws over 3,500 visitors on opening preview weekend

There was one unit left unsold at The Botany at Dairy Farm by Sim Lian Group as of December 2025 and the 540-unit Narra Residences will launch at the end of January.

Upcoming supply

See also: At 14.6%, ski homes in Andermatt top price growth in the Alps: Knight Frank

The first private GLS tender close of 2026 saw a “relatively lukewarm response” compared to recent OCR tenders, says Tricia Song, CBRE’s research head for Singapore and Southeast Asia.

Comparatively, the recent suburban sites at Bedok Rise (380 units) drew 10 bids and a top bid price of $464.8 million, or $1,330 psf ppr on Dec 2, 2025. Upper Thomson Road Parcel A (595 units) also received five bids, but with a top bid of $613.94 million, or $1,062 psf ppr, notes Song.

Song says developers are cautious as the area has a “limited pool of upgraders” and “there are more attractive upcoming sites” in the 2H2025 and 1H2026 GLS programmes.

The top bid came in at the lower end of expectations, according to Leonard Tay, research head at Knight Frank Singapore.

At a land price of $962 psf ppr, the breakeven cost could possibly range between $1,800 psf and $1,900 psf depending on technical, material and design considerations, with launch prices starting from $2,000 psf, says Tay.

With a possible average price of around $2,100 psf when launched, this might appeal to HDB upgraders in the west of Singapore, employees working in the commercial and industrial zones in the West, as well as local homebuyers looking to downgrade from landed housing in the nearby Chestnut and Cashew landed estates, adds Tay.

There are three completed projects at Chestnut Avenue/Petir Road: Foresque Residences, Tree House and Eco Sanctuary. These projects, together with the five existing projects at the Dairy Farm area, comprise almost 3,700 units.

“Perhaps developers at today’s tender showed restraint in their bids by not exceeding the previous tenders of The Botany at Dairy Farm and Narra Residences sites on a psf ppr basis, given the existing and upcoming supply of private non-landed homes in the immediate area,” writes Tay.

Competition from Narra; terrain challenges

The most recent GLS plot sold in the vicinity was the neighbouring parcel awarded to SNC2 Realty, Apex Asia Alpha Investment Two, Soon Li Heng Civil Engineering and Kay Lim Realty at a land rate of $1,020 psf ppr in January 2025.

That plot of land is now being developed as Narra Residences, which will be launched later this month.

In fact, the latest Dairy Farm Walk site may potentially face competition from Narra Residences when it is launched for sale in 2027, says Mark Yip, CEO, Huttons Asia. “The tender bid is measured so as to create a competitive product.”

In addition, bids for the latest tender are lower as the plot ratio is 1.4, compared to the previous tender in Dairy Farm Walk, which had a plot ratio of 2.1, adds Yip.

A lower plot ratio limits how much floor space can be built on a piece of land; it also means that the development will be spread across multiple low-rise blocks which would then entail more lifts and common facilities to be built, says Wong Siew Ying, head of research and content, PropNex.

There are also “some challenges” in developing the site as it is sloping towards the landed enclave and it is near Mindef, says Yip.

The sloping terrain, when combined with the need for more low-rise blocks and lifts, may result in relatively higher construction costs, adds Wong. These factors could have led to more conservative bids from developers.

Still, as this is likely the largest plot in the Dairy Farm enclave and with a height limit of up to six storeys, the developer can create a “very different product” from the other projects in the area, writes Yip.

“The site will have relatively unblocked views over the Chestnut Avenue Good Class Bungalow (GCB) area and landed enclave. The estate is well-served with amenities like Dairy Farm Mall, HillV2 and Hillion Mall. Numerous schools like Assumption English School, Assumption Pathway, Bukit Panjang Primary School and CHIJ Our Lady Queen of Peace are within 1km. International schools like German European School and The Perse School are across the site,” he adds.

Compared to Knight Frank Singapore’s forecast average price of around $2,100 psf, PropNex’s Wong thinks the average price could be even higher, at above $2,150 psf.

CBRE’s Song thinks the strong turnout at Narra Residences’ preview should send average prices at this upcoming development even higher, at between $2,200 and $2,300 psf.

Profitable transactions

Although this is the fourth land parcel to be released within this area in recent years, private homes in the locality remain popular for its good location, readily available amenities and healthy price appreciation, notes Justin Quek, deputy group CEO of Realion (OrangeTee & ETC) Group.

CBRE notes that older resale projects in the area, such as Tree House, Foresque Residences, Eco Sanctuary and The Skywoods, transacted at median prices of $1,539 to $1,689 psf in 2025.

The median price psf of Dairy Farm Residences, the first project in that locale, has appreciated by 16.9% from $1,566 psf in 2019 to $1,830 psf in 2025, says Quek.

Moreover, earlier launched projects in the area have completely sold out, such as The Botany at Dairy Farm and Hillhaven, which is slightly further away.

“With a lack of supply in the area, market demand would be sufficiently spaced out to absorb units from Narra Residences before the launch of the project here, ensuring steady sales in the future,” adds Quek.