Bedrock Ventures is a wholly owned subsidiary of private developer Woh Hup. The CDL-led consortium is structured on a 90:10 equity split.

If CDL and Woh Hup are awarded the site, the JV will explore a residential development comprising approximately 520 units across three high-rise, 26-storey residential blocks. The development will also feature an integrated early childhood development centre, according to a CDL statement.

Sherman Kwek, CDL’s group CEO, says: “We are very pleased to have emerged as the top bidder for this highly sought-after Tanjong Rhu Road site and at such a narrow margin over the next bidder... This also marks our first JV with Woh Hup and together with their strong construction expertise and reputation for quality, we look forward to creating an icon within this transformative precinct.”

Near-record bid price

See also: Newport, Narra, Coastal Cabana launches reverse seasonal slowdown for new home sales in January

The tender for the site opened on Nov 26, 2025. The top bid of $1,455 psf ppr marks the second-highest Rest of Central Region (RCR) price on record since Jiak Kim Street — now the site of the 455-unit Rivière — awarded in December 2017 for $1,733 psf ppr.

At a land rate of $1,455 psf ppr, the top bid for Tanjong Rhu Road site exceeds the land rates of GLS sites awarded in the prime Districts 9, 10 and 11 in 2025, notes Leonard Tay, head of research at Knight Frank Singapore.

“These were Holland Link (D10) that was awarded for $1,432 psf ppr in August 2025, River Valley Green (Parcel B) (D9) that was awarded for $1,420 psf ppr in February 2025, and Dunearn Road (D11) that was awarded for $1,410 psf ppr in July 2025.”

See also: At 14.6%, ski homes in Andermatt top price growth in the Alps: Knight Frank

The bid of more than $1,400 psf ppr underscores the confidence developers have in the Tanjong Rhu area, says Mark Yip, CEO, Huttons Asia.

Since June 2025, CDL has won the GLS tenders at Lakeside Drive, Senja Close and the first Woodlands Drive 17 site. This steady pipeline of development land ensures property development business continuity for the next three years, adds Yip.

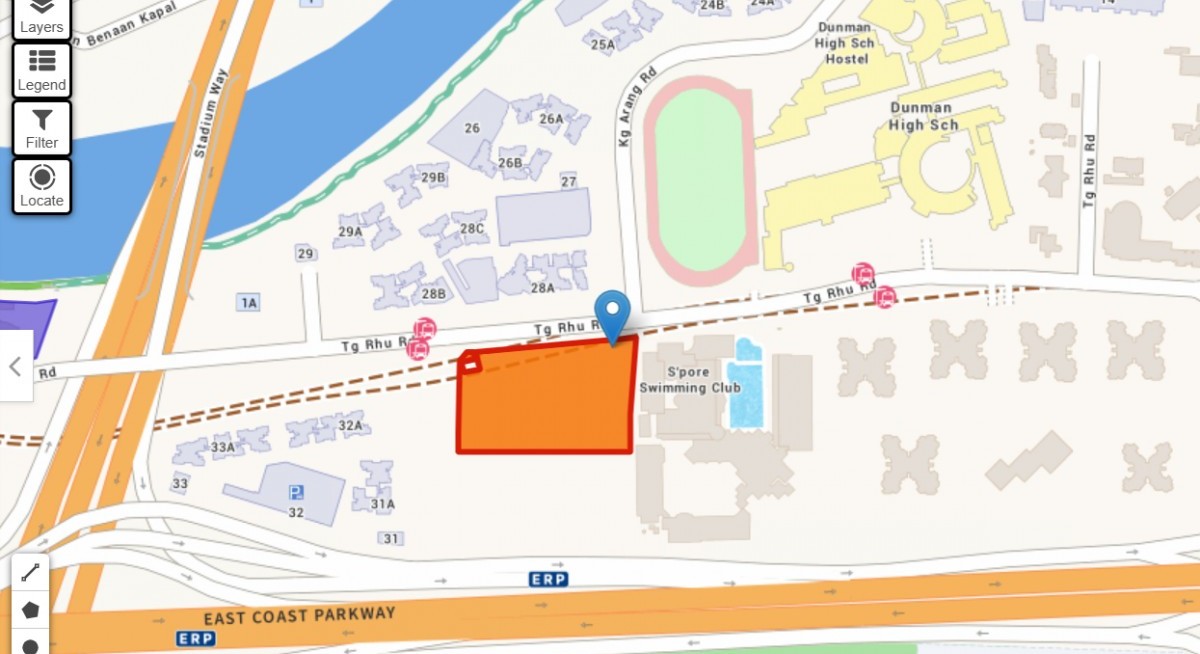

The first GLS site in Tanjong Rhu since 1997 is also the first site in the southern waterfront precincts of Marina and Kallang, which were revealed during the National Day Rally 2024.

The site measures 12,239.3 sqm with a maximum permissible gross floor area of 45,286 sqm. The site has a 99-year lease.

“The strong interest for the Tanjong Rhu site could be attributed to ongoing rejuvenation efforts in the area, which will enhance the overall liveability of the precinct,” notes real estate consultancy Newmark.

The freehold, 40-unit La Ville, now being redeveloped as the boutique Arina East Residences at 6D Tanjong Rhu, was sold en bloc for $152 million to Hong Kong-listed ZACD Group in 2025 at a land rate of $1,540 psf ppr.

Arina East Residences was launched in June 2025 to a “muted response” — selling only 10 of its 107 units at an average price of $3,008 psf, says CBRE Singapore and Southeast Asia research head Tricia Song.

It sold a total of 25 units in 2025 at a median price of $2,939 psf. The developer has since offered some discounts to move lower-floor units and has sold three units at a median price of $2,784 psf in Januray this year, based on latest caveats.

Pent-up demand

Still, there may be pent-up demand for homes in this location as only Arina East Residences was launched recently in the Tanjong Rhu area, says Justin Quek, deputy CEO of Realion (OrangeTee & ETC) Group.

“Low existing available stock in the wider D15 area may also boost potential buying demand for this project here. Many D15 new launches have generally sold out a significant portion of their inventory, with some projects such as Tembusu Grand and Emerald of Katong having as few as 11 and three units left for sale respectively as of December 2025’s URA monthly developer sales data,” writes Quek.

The dwindling supply of unsold city-fringe homes could also have contributed to the competition for this plot among developers, who are keen to build up their RCR new launch inventory, says Wong Siew Ying, head of research and content at PropNex.

There were 4,142 units of unsold uncompleted private homes in the RCR in the pipeline as at 4Q2025, an all-time low since URA records were available in 2006, adds Wong.

Homeowners staying in the nearby landed properties and looking to right-size their homes may be interested in the future development here, says Quek. “Notably, older existing properties in the Tanjong Rhu area may come with bigger floorplates, which also translates to higher overall price quantums. Therefore, the timely introduction of a new project here with more efficient layouts and pricing may be enticing to buyers looking for a new home.”

Shedding ‘image of inconvenience’

The prime location of this site makes it highly coveted, says Huttons Asia’s Yip. It is a short walk to Katong Park and Tanjong Rhu MRT Station on the Thomson-East Coast Line, which will connect residents to the CBD and Changi Airport.

Tanjong Rhu has “shed off its image of inconvenience” in recent years with ongoing rejuvenation plans, which helps explain why developers were willing to pay a premium for this site, says Wong Shanting, research head at Newmark.

Amenities are plentiful with Kallang Wave Mall and the upcoming HDB precincts in the area, notes Yip. East Coast Park is also located nearby. The site may be within 1km of Kong Hwa School, a co-ed Special Assistance Plan (SAP) primary school.

Just across the road from the site are the Tanjong Rhu Riverfront Build-To-Order (BTO) projects, which should see more amenities offering convenience for future residents, adds Wong.

However, this area may consist of reclaimed land, which increases the costs and complexity of construction, warns Yip. There is also a height constraint placed on buildings in this Tanjong Rhu site to not exceed 100m Singapore Height Datum (SHD).

“This may limit the number of storeys to not more than 30 storeys, similar to the surrounding HDB BTO projects,” adds Yip.

Yip and Wong both estimate that the selling price may start from $2,900 psf.

Tay of Knight Frank Singapore thinks launch prices could start from $2,900 psf with a possible average price of around $3,000 psf to $3,100 psf.