Incidentally, McCarthy’s own mentor and the father of information theory, Claude Shannon, disagreed with the term. According to McCarthy, Shannon felt that “too flashy a term might attract unfavourable notice”. However, McCarthy decided to stick with the term as he felt it would help attract more attention and funding.

The issue with the term, however, never really went away. AI was originally meant to describe the discipline of recreating human intelligence in computers. Today, it is being used to encapsulate all sorts of things, from products that are capable of doing tasks that require intelligence to any product or service with some level of automation involved. In fact, artificial general intelligence or AGI seems closer to the concept that McCarthy was thinking of.

That may have essentially been the original sin committed by McCarthy. AI does not have a discrete definition. Instead, it is amorphous and can mean anything to anyone. That is especially evident today, where people cannot seem to agree whether we are in an AI bubble, which country is going to win the “AI race” and what’s the best way to achieve AGI. There are countless questions and no shortage of explanations, but no definite answers.

AI bubble or not, things will change

See also: Taiwan’s AI wealth is spilling across Asia and Singapore is positioning itself as the hub

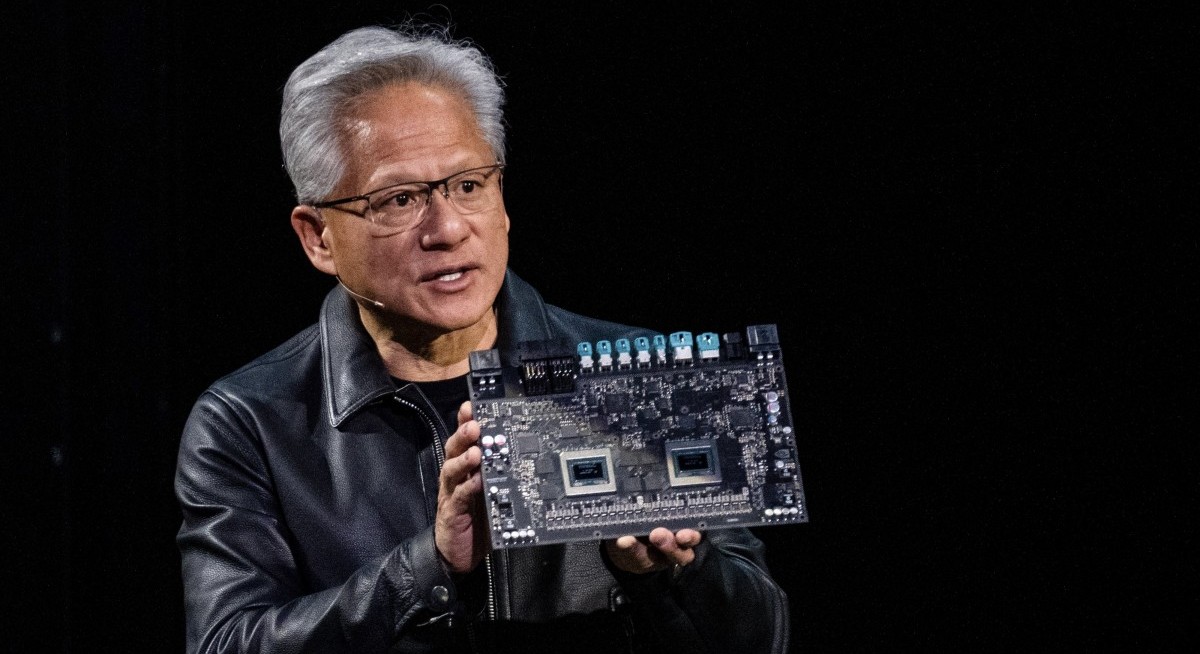

The ambiguity over AI and where it is headed has not stopped businesses and investors from pouring capital into the industry. Shares of the top AI-related companies in the US have rallied, whether it be chipmaker Nvidia, which went up by 39.65% in 2025, or tech giants Alphabet and Meta, which are up 65.80% and 13.74% respectively over the same period.

Nvidia, in particular, has become a hot topic in discussions of AI. On one hand, business leaders such as Meta CEO Mark Zuckerberg and Tesla CEO Elon Musk have been eagerly scooping up Nvidia chips to power their AI ambitions. But on the other hand, investors such as Michael Burry of The Big Short fame have called the AI boom a “glorious folly”. The hedge fund manager took a short position against Nvidia before de-registering his fund, Scion Asset Management, on Nov 10, 2025.

Most analysts are sanguine about where AI is headed, though some have also acknowledged that the market is currently in an unprecedented position. Vis Nayar, CIO of Eastspring Investments, does not like the term “AI bubble” because what really matters to him is the type of productivity gains that can be wrangled from AI. He sees parallels between the spending on AI today and the railroad boom that took place in the UK in the 1800s.

See also: Is the Chinese stock market an undervalued giant?

“The rail network was phenomenally good for England or Britain, but the hundreds of companies that were set up and listed to build the railroads all kind of went bankrupt. What was left behind was an incredibly valuable infrastructure,” Nayar says during Eastspring’s media roundtable on Nov 25 last year.

For Navin Saigal, BlackRock’s Asia-Pacific head of global fixed income, it is the outpacing of tech investment over consumption as a component of US GDP that is exciting. While the level of investment could fall over time, there is also a possibility that it remains elevated for the next one to three years.

“It has profound implications for asset allocation, because it means that investment can continue to drive aggregate GDP growth even when consumption and employment continue to moderate,” Saigal said during BlackRock’s media roundtable on Dec 3 last year.

Given that the US Federal Reserve’s mandate is to achieve full employment and price stability, and not GDP growth, there is a possibility that the central bank will continue to make interest rate cuts even as growth stays resilient. “That scenario is not getting enough attention because it means both stocks and bonds could arguably do well at the same time,” Saigal says.

That could very well be the case. Goldman Sachs Asset Management says in its investment outlook for 2026 that it expects capital expenditures by AI hyperscalers to continue to exceed expectations. “Analysts have underestimated AI capex every quarter for the past two years, suggesting a continued upside risk to the broader AI trade’s durability heading into [the 2025] year-end,” it adds.

Barclays Private Bank takes a slightly different view in its 2026 outlook report. The bank says that while AI will continue to contribute to US GDP in 2026, the pace of new investment commitments will probably slow down. “This may still translate into solid GDP growth (a backwards-looking indicator) but may not support equity markets as much,” it adds.

For more stories about where money flows, click here for Capital Section

This could pose a problem to countries that are heavily reliant on AI to drive their growth. Taiwan is home to the world’s largest chipmaker, the Taiwan Semiconductor Manufacturing Company (TSMC). Its share price rose by 43.72% in 2025 as the tech industry rushed to feed its insatiable hunger for chips.

“Almost all the world’s chips are made in Taiwan. TSMC has almost all the world’s advanced processor production. Without Taiwan, there’s no artificial intelligence,” says Chris Miller, economic historian and author of Chip War: The Fight for the World’s Most Critical Technology.

According to DBS Bank economist Ma Tieying, the rally in Taiwan’s stock market in 2025 has seen it swell to three times the size of Taiwan’s entire economy, a clear sign of overheating.

Taiwan’s reliance on semiconductors as a growth engine means things could sour very quickly if the Trump administration were to scrap its tariff exemptions on semiconductors, Ma says during the bank’s macro insights livestream on Dec 3 last year.

Don’t just look at Nvidia

When it comes to investing, analysts from Macquarie recommend moving away from companies tied to Nvidia’s supply chain to Google’s suppliers instead. In its Nov 26, 2025, note, analysts Arthur Lai, Daniel Kim, Jeffrey Ohlweiler and Kaylin Tsai say they prefer:

- Global Unichip Corp (target price or TP: TWD1,665)

- Broadcom (target price: US$420)

- ISU Petasys (TP: KRW144,000)

- MediaTek (TP: TWD1,680)

- Luxshare (TP: RMB72)

- Zhongji Innolight (TP: RMB700)

In a separate report, also published on Nov 26, Macquarie says investors should first focus on memory chip producers, followed by component makers, then original design manufacturers (ODMs), and finally the consumer tech brands.

For memory chips, analysts Cherry Ma, Kaylin Tsai, Ellie Jiang and Daniel Kim recommend South Korean chip makers SK Hynix (target price: KRW800,000) and Samsung Electronics (target price: KRW175,000). “We think, unlike previous memory upturns, the current AI-driven memory upswing is likely to last beyond 2026,” they write, adding that memory continues to be a key bottleneck in AI computing.

As for components, the research house recommends sensor makers like:

- AAC Technologies (target price: HK$48.40)

- Conant Optical (TP: HK$60.80)

- OmniVision (TP: RMB173.60)

- Sunny Optical (TP: HK$102)

In addition, Macquarie recommends application processor makers such as TSMC (TP: TWD1,710) and MediaTek (TP: TWD1,680). Japanese companies such as TDK (TP: JPY2,600) and Murata Manufacturing (TP: JPY3,600) are the names to watch when it comes to battery and electronic components.

In terms of ODMs, Macquarie says Hon Hai Precision (TP: TWD310) and Luxshare (TP: RMB72) will benefit if Apple is able to grow its market share for its smartphones and other mobile devices in the AI era.

Finally, Chinese tech giants such as Xiaomi (TP: HK$54.20) and Lenovo (TP: HK$12.26) could become global market leaders in the fields of AI mobile devices and AI personal computers, respectively.

Barclays, on the other hand, recommends diversifying beyond the US mega caps and into regions like the UK, Europe and select emerging markets such as China. The bank suggests focusing on companies with strong balance sheets, a high return on equity, and consistent earnings growth. “After lagging during the AI-led rally, quality is well positioned to regain leadership as volatility rises and fundamentals regain focus,” it says.

For those who are still keen on making a bet on AI, Barclays suggests focusing on sectors that are using AI to raise their productivity. This includes healthcare companies using AI for diagnostics and drug discovery, as well as manufacturing and logistics companies turning to robotics and automation.

The energy sector will be an area of interest as well since the “rapid expansion of AI infrastructure is amplifying global energy demand”, says Barclays. AI will help drive investments into clean energy, electric grid modernisation, and next-generation materials.

“Good decision-making allows for contradictory ideas: AI can be revolutionary and create value, but not all AI companies will be good investments,” says Alexander Joshi, Barclays Private Bank’s head of behavioural finance. “A nuanced, bottom-up approach to portfolio construction is also useful, especially amid uncertainty and change.”