However, a team of analysts at DBS Group Research have maintained their "buy" on this stock, along with a slightly higher target price of US$7.70 from US$7.60, as they cheer efforts by the company's ongoing recycling of mature assets.

The target price of US$7.70 is a 31% discount to the Dec 2026 NAV estimate of DBS.

"Ongoing share buybacks should support near-term support, while further progress on capital recycling remains the key catalyst," they add.

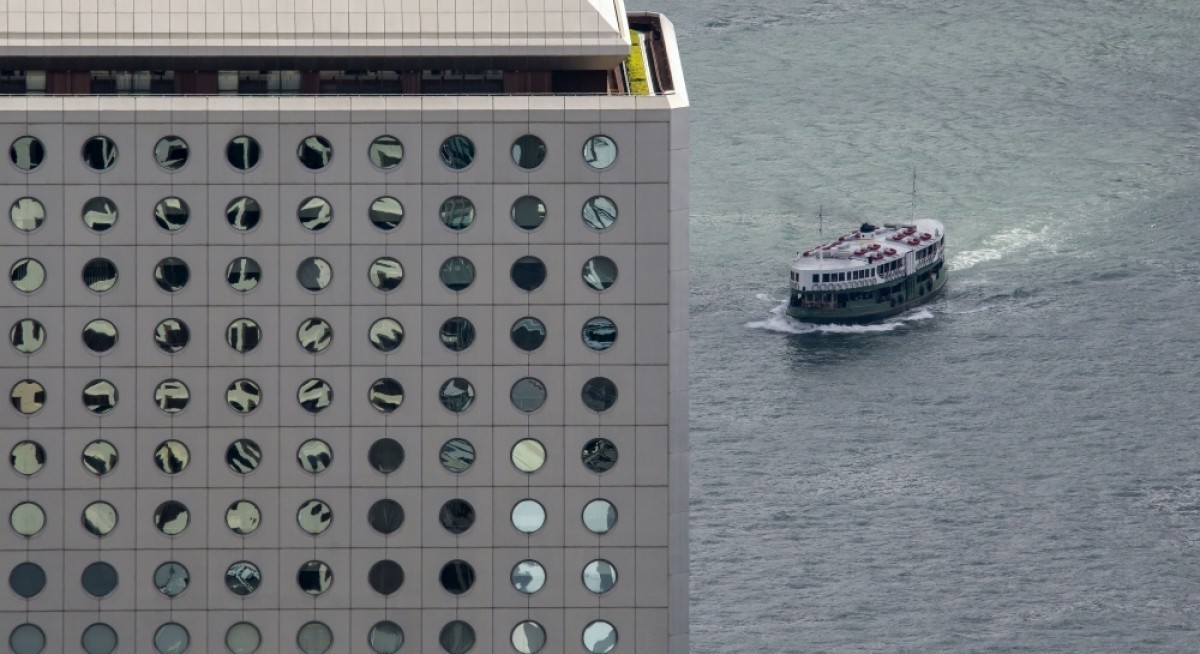

In its 3QFY2025 business update, Hongkong Land reported that its Central office portfolio vacancy has improved, thanks to stronger leasing demand.

See also: JP Morgan sees UOB holding better than OCBC

While physical vacancy in the Central office portfolio remained at 7.5% in Sept, committed vacancy improved to 6.4% from June's 6.9% amidst strengthened leasing momentum led by a recovering capital market and a strong IPO pipeline.

This compares favourably with the 11% vacancy rate in the overall Central Grade A office market, reflecting continued “flight-to-quality” demand. Nonetheless, contributions from the Central office portfolio are expected to be lower year-on-year, due to negative rental reversions.

Over at Landmark, a key property under Hongkong Land, the amount of rental collected in 3QFY2025 was largely in line with the year-earlier quarter, despite more than 30% of its lettable space at this property that was taken out of circulation because of renovation works.

See also: Brokers initiate ‘buy’ on Coliwoo with bullish stance on growth opportunities

"Furthermore, demand from the ultra-high-net-worth segment remained resilient, with top-tier customer spending up y-o-y," says DBS.

Here in Singapore, where the company owns a portfolio of prime office properties, Hongkong Land enjoyed positive rental reversions in Singapore continues despite slightly higher vacancy.

In Sept, physical and committed vacancy for its Singapore portfolio rose to 2.9% and 2.2% from June's 2% and 1.2% respectively.

Despite slightly higher vacancy, rental reversions remained in positive territory, underpinned by favourable supply-and-demand dynamics.

On the other hand, Hongkong Land continued to see muted China residential sales amid weak market sentiment.

Attributable contracted sales in China amounted to US$161 million in 3QFY2025, bringing 9MFY2025 sales to US$523 million, roughly half of the US$1 billion recorded in 9MFY2024.

DBS notes that Hongkong Land has achieved "strong capital recycling progress". In October, the company completed the divestment of its wholly owned subsidiary MCL Land to Malaysia's Sunway, generating total net proceeds of US$657 million and bringing the company to 50% of its target to recycle at least US$4 billion of capital by the end of 2027.

For more stories about where money flows, click here for Capital Section

Following the sale of MCL Land, Hongkong Land plans to extend its share buyback programme by another US$150 million, after fully using up US$200 million earmarked in April.

Since then, the company has bought back US$40 million worth of shares.

Also, with the sale, Hongkong Land's net debt fell to US$4.4 billion in October from US$4.92 billion in June, which means lower gearing of 15% from 17%, which, from the perspective of DBS, enables the company to raise dividends and pursue new investments.

Hongkong Land shares gained 0.16% to change hands at US$6.31 as at 4.10 pm, up 42.44% year to date.