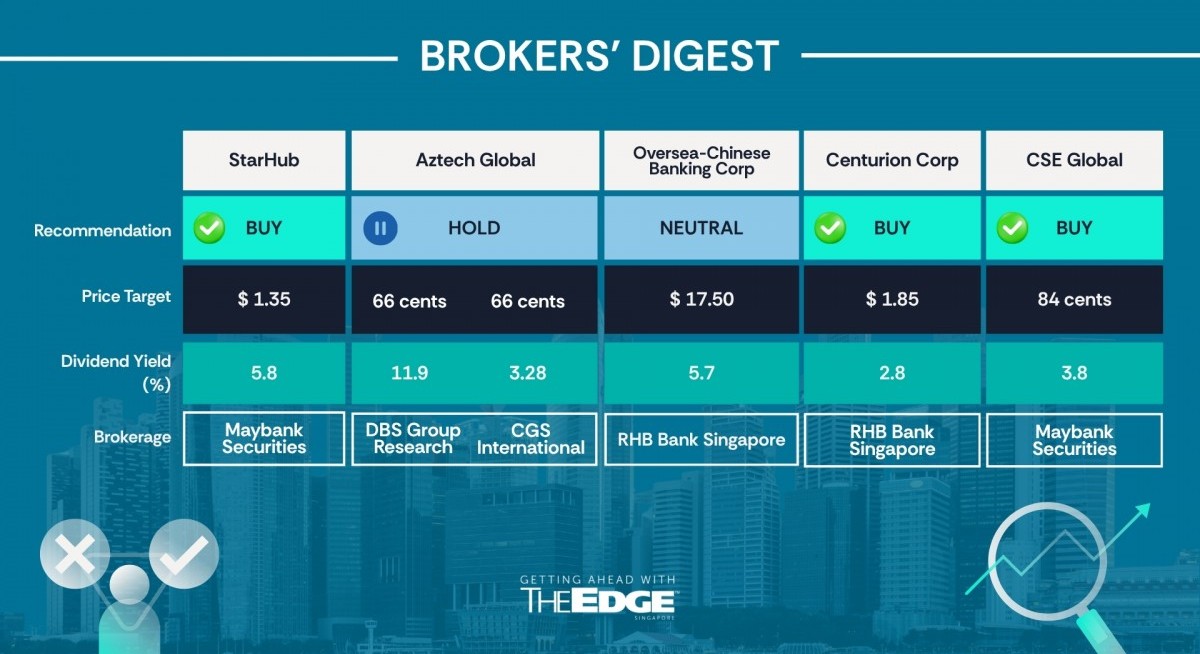

Maybank Securities ‘buy’ 84 cents

Imminent large orders from data centres

Jarrick Seet of Maybank Securities has maintained his bullish view on CSE Global, predicting that the company will likely secure large orders towards the end of the year, particularly in the data centre sector, where they are refocusing their efforts, as well as local government contracts.

According to Seet in his Oct 17 note, he understands that the company is also in the midst of qualifying for another one to two hyperscaler clients, and he expects CSE Global’s data centre order book growth to accelerate.

See also: Tickrs initiates coverage on PC Partner with ‘buy’ call and $2.20 TP, FY2025 profit to ‘surge’ 72%

Seet, who has kept his “buy” call and 84 cents target price, predicts that a win on these hyperscaler clients would help add to significant earnings growth for FY2026 to FY2028.

Previously, CSE Global made a strategic move to reserve capacity and to focus on clients in the data centre and utility spaces. In August, the company unveiled a $59 million data centre extension order from its existing US hyperscaler customer.

He expects CSE Global’s gross and net margins to improve once the larger orders are secured in 2HFY2025. With better operating leverage, the company is set to enjoy better margins too.

See also: Analysts mostly bullish on EQDP's impact on SGX; Morningstar views tailwind as ‘temporary’

In the most recent 1HFY2025, CSE Global’s gross and net margins both improved to 27.9% and 3.7%, respectively, from 27.6% and 3.5% in 1HFY2024. Revenue grew 2.8% y-o-y to $440.9 million despite the depreciation of the US dollar against the Singapore dollar.

The analyst predicts that CSE Global’s management will likely expand its capacity in the US more aggressively if the large orders are secured. Currently, it expects to more than triple its capacity by FY2027 and FY2028.

“We remain bullish on CSE Global’s outlook and see potential for a multi-year growth story,” says Seet.

On top of earnings growth, Seet also highlights that CSE Global’s 50% dividend payout guidance will provide stability for shareholders, along with upside from its positive outlook. — Teo Zheng Long

Centurion Corp

Price target:

RHB Bank Singapore ‘buy’ $1.85

For more stories about where money flows, click here for Capital Section

Lower earnings with REIT spin-off

RHB Bank Singapore analyst Alfie Yeo has lowered his FY2026 earnings estimates for Centurion Corporation by 41% to $81 million after adjusting for the future loss of contribution from the assets that the company fed into Centurion Accommodation REIT. In the same vein, Yeo has reduced his target price to $1.85 from $2.01.

In addition, Yeo has lowered his bed count assumptions, although he has factored in a new revenue stream in fee income for services rendered to the REIT as its property manager.

“Due to Centurion’s role as Centurion Accommodation REIT’s property manager, we anticipate that the additional service income will yield higher margins, which leads us to raise our gross and operating margins by three percentage points (ppts) and four ppts to 81% and 65% in FY2026,” he says in his Oct 17 report.

However, the analyst has lowered his FY2026 and FY2027 revenue estimates by 52% and 48% respectively, due to the lower bed count, but offset by the new fee income and the REIT’s distribution per unit (DPU). Yeo’s FY2027 earnings estimate has been lowered by 38%.

“We have a higher cash balance, lower debt and total assets on the REIT’s sale, due to the exit of 14 property assets,” Yeo writes.

That said, the analyst still likes the REIT’s prospects given that Centurion will now take up a new role as the REIT’s dedicated property manager, enabling it to book fee income as part of its revenue moving forward.

Centurion will recognise 10% of the REIT’s distributable income, 2% of purpose-built workers’ accommodation (PBWA) gross revenue, 5% of PBWA’s net property income (NPI), and 4% of purpose-built student accommodation (PBSA) gross revenue, says Yeo.

The analyst estimates the additional fee income to come in at $23 million for FY2026 and $24 million for FY2027, respectively, based on Centurion Accommodation REIT’s forecast in its initial public offering (IPO) prospectus.

Post the spin-off listing, Yeo notes that 19 assets remain within Centurion Corp, which include 13 PBWAs in Singapore and Malaysia, two PBSAs in Newcastle in the UK, one PBWA and two PBSAs in Hong Kong, and one Build-to-Rent (BTR) asset in China.

Looking ahead, Yeo notes that the company will focus more on property development and making acquisitions with the cash received from the sale of assets.

Centurion, which has just acquired land in London to develop a 225-bed PBSA, could consider new markets such as the Middle East for its projects. To Yeo, the company’s growth also rests on the performance of its remaining properties, with better bed and occupancy rates.

That said, Yeo recognises that a failure to report better occupancy and bed rates could pose downside risks to his organic earnings growth estimates. — Felicia Tan

Oversea-Chinese Banking Corp

Price target:

RHB Bank Singapore ‘neutral’ $17.50

2HFY2025 likely to be softer

RHB Bank Singapore is staying “neutral” on Oversea-Chinese Banking Corporation (OCBC) ahead of its results for 3QFY2025 ended Sept 30, expected to be released on Nov 7. Similar to previous quarters, RHB analysts expect OCBC’s 3QFY2025 patmi to see a mid- to single-digit decline y-o-y on lower net interest income (NII) and trading income.

That said, RHB expects investors to look ahead for clues as to how management sees 2026 shaping up. OCBC group CEO Helen Wong will retire on Dec 31; she will be succeeded by deputy CEO and head of global wholesale banking Tan Teck Long.

RHB analysts have kept their $17.50 target price on OCBC despite the expectations for a softer full-year patmi as the bank’s 5.7% yield “remains decent”.

RHB recently met with OCBC’s management, who noted that customers are exhibiting lingering uncertainty and cautiousness due to the US tariff situation. This has dampened near-term loan growth. That said, OCBC thinks customers planning to invest for the long term will likely continue with their plans, “albeit just a matter of timing”.

For example, OCBC continues to see interest from Chinese companies looking to invest in Malaysia. It has also seen firms looking to invest in Indonesia’s electric vehicle supply chain.

OCBC management also highlighted that it has been involved in loan syndication for some of the global multinationals in key financial centres abroad, according to RHB.

Domestically, mortgages have also been a bright spark, thanks to the sharp decline in Singapore’s benchmark rate.

RHB notes that OCBC’s deposit inflows remain healthy, “which should translate into balance sheet growth”. “The ongoing repricing of fixed deposit, plus the two earlier rounds of repricing for OCBC’s flagship product in May and August, should be felt more meaningfully in 3QFY2025 and help cushion the impact from the continuing benchmark rate decline,” they add.

While there was no update to OCBC’s net interest margin (NIM) guidance, OCBC continued to guide for mid-single-digit NII declines in FY2025. RHB forecasts NII falling 6% y-o-y this year on the back of a 26 basis point (bp) NIM slippage, cushioned by 5% y-o-y total assets growth.

Meanwhile, RHB thinks OCBC’s wealth business “looks to have had a good 3QFY2025” thanks to inflows and better investor sentiment and risk appetites. This was positive for client transactions. Trading income, however, is harder to predict and could impact OCBC’s q-o-q patmi growth.

“Also, while OCBC has not noted any major red flags on asset quality, credit cost is coming off a low base in 2QFY2025,” note analysts.

Overall, RHB expects Singapore banks to book weaker 2HFY2025 earnings compared to 1HFY2025, owing to a combination of seasonal factors and the US tariff policies.

“That said, we think investor focus will likely be on the outlook for 2026. With OCBC expected to complete its capital return dividends in FY2025, investors may turn their attention to management’s plan for the capital set aside earlier for the privatisation exercise of Great Eastern Holdings,” says RHB.

If the delisting had gone through, management had previously guided the impact to trim the Common Equity Tier-1 (CET-1) ratio by 40 bps.

RHB had started the year with a $19.10 target price on OCBC and a “buy” call on Feb 27, but later cut this to “neutral” and the current $17.50 fair value estimate on April 21. — Jovi Ho

StarHub

Price target:

Maybank Securities ‘buy’ $1.35

Numerous medium-term catalysts

Citing several medium-term catalysts, and also a decent yield and “strong” balance sheet which provides “downside protection”, Hussaini Saifee of Maybank Securities has kept his “buy” call and $1.35 target price on StarHub.

StarHub is competing in a local mobile industry poised to undergo significant changes with the proposed acquisition of M1’s mobile business by Simba. StarHub plans to maintain an aggressive posture to defend its position through a multi-brand strategy encompassing StarHub, Giga, and 8, says Saifee.

Citing the management, Saifee states in his Oct 16 note that StarHub sees an opportunity to capture subscriber market share as M1-Simba focuses on consolidation and network integration, while mobile virtual network operators are expected to retreat amid increased competition from incumbents targeting the low-end segment.

StarHub believes that Simba’s current lean cost structure may not be sustainable, as its designation as a so-called critical information infrastructure operator will require increased investment in cybersecurity and a potential shift to European network vendors.

In addition, Simba’s high leverage is likely to exert pressure on earnings. Given these dynamics and supported by global precedents, StarHub expects industry competition to rationalise over the next 12–18 months.

On the other hand, StarHub is enjoying strong growth in its enterprise business, led by double-digit expansion in managed services and 30%–40% growth at Ensign.

Saifee, citing management, says that smart city initiatives, such as the Punggol Digital District, are proof-of-concept projects, with the intention of scaling these capabilities across Asean markets.

In a bid to drive further growth, the company is pursuing both organic and inorganic growth in regional ICT markets, targeting Vietnam, Indonesia and the Philippines.

With $500 million in cash and a net leverage ratio of 1.9times, StarHub is looking at potential deal sizes in the $100 million to $300 million range.

StarHub’s 56%-owned subsidiary, Ensign, has become one of Singapore’s largest cybersecurity firms with revenue of nearly $400 million.

“Following this milestone, the strategic focus will shift toward margin expansion and profitability under new Ensign leadership,” says Saifee.

In another positive aspect, StarHub’s multi-year programme to deploy a more efficient internal process system, otherwise known as Dare+, has completed its investment phase. The company is now starting to unlocked savings through a comprehensive cost-optimisation programme where decommissioning legacy systems alone will help save $10 million a year, part of a broader efficiency move that can scale savings by 3–4 times that. — The Edge Singapore

Aztech Global

Price targets:

DBS Group Research ‘hold’ 66 cents

CGS International ‘hold’ 66 cents

Subdued end-market demand

Both DBS and CGS International maintain their “hold” call on Aztech Global following its 3QFY2025 ended Sept 30 business update.

On Oct 15, Aztech reported 3QFY2025 earnings of $10.8 million, down 21% y-o-y, on the back of a 20% y-o-y drop in revenue to $133.5 million, amid subdued end-market demand from key customers.

Despite volume-led contraction, Aztech’s profit before tax (PBT) margin improved slightly by 70 basis points y-o-y to 10.1%, reflecting enhanced product mix management and sustained cost discipline. However, margins narrowed sequentially due to operating deleverage, says DBS Group Research’s Ling Lee Keng in her Oct 16 note.

Overall, both 9MFY2025 revenue and net profit are broadly in line with DBS’s full-year forecast.

Ling, citing new customer wins, expanding product breadth and improved manufacturing efficiency, expects Aztech to record a better performance in the current 4QFY2025 and is maintaining a “hold” call and target price of 66 cents.

Meanwhile, William Tng of CGS International reiterates a “hold” call for Aztech as well.

In Tng’s Oct 16 note, Aztech guided that it had ytd secured 22 new project wins and onboarded 11 new customers across consumer, medtech, industrial and automotive segments.

Production for five projects commenced during 9MFY2025, with another five to start production in 4QFY2025 and the remaining projects scheduled to enter production in FY2026.

Besides winning new customers, Aztech is reducing its operating cost base through the sale of a vacant factory in Gelang Patah in Johor, Malaysia, and right-sizing its manufacturing space in Dongguan, China, via a sale and leaseback arrangement.

Tng notes the company’s improving operations but points out that Aztech’s fourth quarter tends to be weaker. Tng’s valuation basis remains unchanged at 12.2 times P/E, which is equivalent to Aztech’s five-year average.

However, Tng is increasing his target price from 60 cents to 66 cents, based on rolling over the forecast to FY2027. The returns are expected to be supported by the 3.28% dividend yield for FY2025 forecast and Tng expects Aztech to see a gradual recovery in orders from customers and incremental progress in diversifying its customer base. — Teo Zheng Long