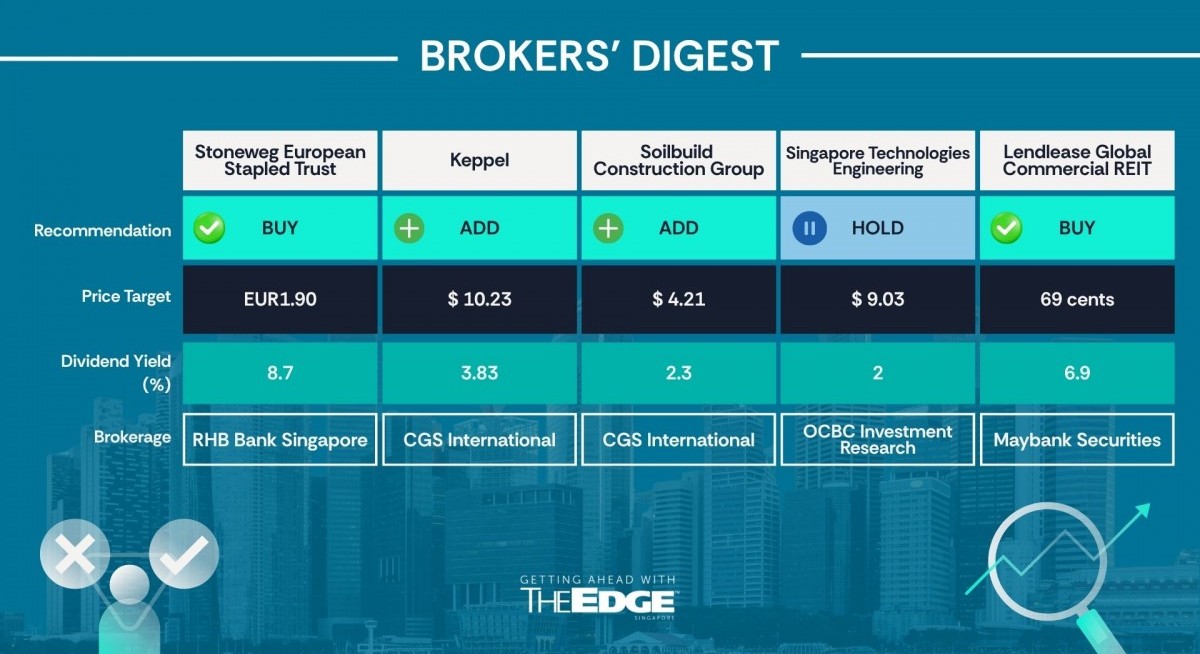

OCBC Investment Research ‘hold’ $9.03

Growth story ‘intact’; risk-reward profile ‘balanced’

Shares of ST Engineering have recovered from their 15% drop right after its 1HFY2025 ended June 30 results, and are again pushing new highs of nearly $9, in line with the gains of the broader market.

From the perspective of Ada Lim of OCBC Investment Research, the company’s “growth story remains intact, but the risk-reward profile is starting to look balanced”. “The structural increase in global defence spending will likely remain intact regardless of the outcome of the Russia-Ukraine conflict. This should support ST Engineering’s visible earnings growth trajectory,” says Lim.

See also: Tickrs initiates coverage on PC Partner with ‘buy’ call and $2.20 TP, FY2025 profit to ‘surge’ 72%

However, she points out that current valuations appear stretched, given that the company is trading at a forward 12-month P/E of 29.2 times, which is considered “elevated” compared to selected defence peers listed in the US and Europe, which average 27.1 times.

In addition, the company's active capital management efforts should lead to lower gearing and, therefore, higher distributions per unit.

For example, on Sept 1, the company announced the sale of its 46.5% equity interest in CityCab to joint venture partner ComfortDelGro; it had earlier divested stakes in a broadband venture and its US construction equipment unit LeBoy. “Investors may wish to consider accumulating the stock on corrections or pullbacks from current levels,” says Lim. In line with the gains of the share price, Lim has downgraded her call to “hold” from “buy”. — The Edge Singapore

See also: Analysts mostly bullish on EQDP's impact on SGX; Morningstar views tailwind as ‘temporary’

Lendlease Global Commercial REIT

Price target:

Maybank Securities ‘buy’ 69 cents

Lower funding costs and benign macro factors

Krishna Guha of Maybank Securities has upgraded his call on Lendlease Global Commercial REIT from “hold” to “buy”, underpinned by falling interest and risk-free rates, as well as resilient Singapore retail sales.

In addition, the REIT’s active capital management efforts should lead to lower gearing and therefore higher distribution per unit.

In his Oct 6 note, Krishna points out that over the past quarter, the Singapore-dollar base rate, the three-month Singapore overnight rate average (Sora), has declined more than 60 basis points (bps) to 1.44% while the 10-year yield has fallen by 30 bps to 1.92%, which helps lower financing cost and lift fair value.

For more stories about where money flows, click here for Capital Section

Citing Maybank’s house view, benign macroeconomic conditions are set to continue, with the three-month Sora forecast to decline to 1.10% by the end of this year and to 0.70% by next year, along with a stable 10-year yield.

Meanwhile, GDP growth is expected to remain resilient at 3.2% this year and 2.0% next year, with some contribution from retail sales and tourism data. In August, retail sales, excluding motor vehicles, rose 4.6% y-o-y, a pick-up from 4.1% in July; visitor arrivals grew 5% y-o-y for Jul and August, and occupancy rates rose 1.3 percentage points to above 90%. “These factors should be supportive of occupancy and rent reversion for malls,” says Guha.

On the capital management front, the REIT announced in August the sale of the office component at Jem for $462 million, in line with its valuation. Following the sale, its distribution per unit (DPU) will experience a 2.2% dilution, and its net asset value (NAV) will decrease by 1.3% on a pro forma basis.

Yet, the deal will strengthen the capital structure by lowering gearing to 35% from 42.6% and help position the REIT for future growth.

“The REIT’s strategic focus is Singapore, with future collaboration with its sponsor to explore M&As with growth potential and opportunistic non-core disposal,” says Guha.

For FY2026 and FY2027, Guha has raised his DPU forecasts by 3.9% and 1.6%, respectively, driven by lower borrowing costs. Coupling this with the lower cost of equity, he has raised his target price to 69 cents from 57 cents. — The Edge Singapore

Riverstone Holdings

Price target:

UOB Kay Hian ‘buy’ 98 cents

AI-led cleanroom demand

Heidi Mo of UOB Kay Hian, citing end demand from activities related to artificial intelligence (AI), has raised her target price for rubber glove maker Riverstone Holdings from 71 cents to 98 cents. The cleanroom segment, according to Mo in her Oct 8 note, remains the Malaysia-based company’s key earnings driver, contributing around 40% of revenue but nearly 70% of gross profit.

Riverstone, led by executive chairman Wong Teek Soon, expects 10% q-o-q volume growth in 3QFY2025, supported by stronger demand from the semiconductor and AI-driven data-storage industries.

She expects average selling prices and the US dollar-Malaysian ringgit (USD-MYR) exchange rate to hold at around 4.25, while newly commissioned production lines have also come online. “While there is yet to be a full rebound, these lay the groundwork for a more meaningful recovery in 4QFY2025,” says Mo.

Besides the electronics segment, Riverstone is also seeing margins for its healthcare segment edge up, as the company avoids low-margin orders. US tariffs on pharmaceutical goods will not cover medical consumables such as gloves. “Even if related costs arise within the supply chain, they would likely be absorbed by distributors or healthcare providers, given the essential and low-value nature of gloves. Hence, we expect the impact of the tariffs on Riverstone’s earnings to be minimal, and the policy’s push for US pharmaceutical onshoring may even lift long-term cleanroom demand,” says Mo.

She notes that Riverstone, backed by a substantial net cash position of RM602 million ($184 million), has established a strong dividend track record, consistently paying out more than 100% of its earnings in the preceding FY2022 to FY2024.

With scant capex requirements, Riverstone has ample flexibility to sustain high payouts, which, by extension, provides strong support for the stock, even as quarterly earnings recovery remains gradual. Mo estimates the dividend yield for 2026 will be an “attractive” 7.3%.

For FY2025 to FY2027, Mo has lowered her earnings projections by 9%, 6%, and 5%, respectively, to account for a slower-than-expected recovery in the ringgit-US dollar exchange rate, which will weigh on margins.

However, she has applied a higher valuation multiple of 20 times FY2026 earnings, up from 16 times FY2025, to reflect Riverstone’s competitive advantage in cleanroom gloves, superior profitability compared to its peers, a strong balance sheet, and dividend payout policy, thereby leading to a higher target price of 98 cents.

Riverstone, trading at 15 times FY2026 earnings, is currently at a discount of more than 40% compared to its peers, which are trading at 26 times their earnings, despite offering a better yield. — The Edge Singapore

Banyan Tree Holdings

Price target:

UOB Kay Hian ‘unrated’

Residences segment to drive growth in 2027

UOB Kay Hian’s Adrian Loh is giving some attention to Banyan Tree Holdings in an unrated report dated Oct 7, where he cites the group’s strong brand equity for its hotels, as evidenced by numerous awards from TripAdvisor, Forbes, and the Thailand Tourism Authority.

While the company’s hotel investments segment is often in the limelight, especially with the 2025 opening of the Mandai Rainforest Resort by Banyan Tree, Loh expects its residences segment (or property development) will be the earnings driver over the 2025–2027 period, with strong sales of its projects in Phuket totalling $329 million in 2024, up 23% y-o-y.

“We note that the company has recorded consecutive historic highs for its pre-sales in 20222024. Importantly, this segment is now larger than hotel investments, with 1HFY2025 ended June 30 segmental profit having jumped 121% y-o-y, generating a record 26% profit margin (+9.3 percentage points y-o-y),” says Loh.

Banyan Tree’s key customers for its residences are from Russia, while the potential return of Chinese buyers could be a blue-sky scenario.

In the hotel investment segment, there have been no new investments due to the company’s efforts to move toward a more asset-light model. Management stated that it will not invest in new hotels, except for those located in Phuket. The company anticipates adding approximately 15 new hotel management contracts annually.

Meanwhile, the fee-based business is expected to experience steady growth. This business encompasses hotel management, spa services, interior design, and other related services. Banyan Tree currently manages 80 resorts and hotels, 73 spas, 68 gallery outlets and three golf courses.

In the future, one relatively new area to focus on is licensing its brands to branded residences, which attract a licence fee (valid for 20 years) as well as fees for other services.

For 1HFY2025, Banyan delivered a strong all-round rebound, with revenue rising 15% y-o-y to $206 million. Operating profit gained 21% y-o-y to $43 million, thanks to the handover of 83 Laguna Beachside units and contributions from new branded residences. Its patmi was up 45% y-o-y to $9 million due to a turnaround in associate contributions and lower finance costs.

One issue that Loh pointed out is the stock’s free float due to its key shareholders: the Ho family, Qatar Investment Authority, Far East Organisation, Accor SA and China Vanke. With this, in addition to other management and board ownership, the company’s free float amounts to 26.09%, or approximately $142.5 million, based on its market capitalisation of $546.1 million.

“However, we highlight that in 2025, the company’s average daily trading liquidity has increased 10-fold and since the beginning of September has averaged around $900,000/day,” notes Loh. He adds that the stock is trading at 0.8 times 1HFY2025 P/B, despite its share price experiencing a significant year-to-date increase. — Samantha Chiew

Soilbuild Construction Group

Price target:

CGS International ‘add’ $4.21

Stronger earnings, higher dividends, cheaper valuation

Lim Siew Khee of CGS International (CGSI) has initiated coverage of Soilbuild Construction Group with an “add” recommendation and a target price of $4.21, citing the company’s entry into a multi-year upcycle, underpinned by an order book of $1.19 billion.

“We believe Soilbuild can ride the momentum of Singapore’s construction upcycle and increased interest in small-mid caps due to Singapore’s Equity Market Development Programme,” states Lim in her Oct 7 note.

Besides a hefty contract from the port authority, Soilbuild has numerous contracts on hand to build public housing. In addition, it operates an eco-friendly precast business with facilities in both Singapore and Johor, in response to the government’s increasing encouragement to adopt such construction methods.

Lim expects the company’s revenue to grow at an 18% CAGR between FY2024 and FY2027, reaching $763 million in FY2027. Additionally, the company aims to generate improved operating margins of 13% by FY2027, up from 7% in FY2024, thanks to easing cost pressure.

She expects Soilbuild to generate stronger operating cash flow and a turnaround of net debt position into net cash in the current 2HFY2025, which will open up the possibility of higher dividends paid by the company, whose controlling shareholders, executive chairman Lim Chap Huat and his son Lim Han Ren, hold nearly 82% of the shares.

With the convergence of various positive factors, Soilbuild’s earnings are expected by Lim to more than double this current FY2025 to $61 million and continue to grow to $80 million by FY2027.

Soilbuild now trades at nine times FY2025 earnings, which is a significant discount compared to the 15 times fetched by Boustead Singapore, Wee Hur, and Lum Chang. Lim’s target price of $4.21 is based on 10 times FY2026 earnings. — The Edge Singapore

Keppel

Price target:

CGS International ‘add’ $10.23

Bifrost subsea cable in service

A relatively under-radar bit of Keppel’s sprawling business, its subsea cable system segment, Bifrost, has reached a key milestone and can help bring about “positive share price reaction”.

On Oct 2, Keppel announced that Bifrost has achieved “ready for service” status and that commercial data traffic will go ‘live’ soon.

“We believe the RFS status is an important milestone that enhances Keppel and Singapore’s positioning as a regional digital hub, supports growing AI/cloud workloads,” state CGS International (CGSI) analysts Lim Siew Khee and Meghana Kande in their Oct 2 note, where they have kept their “add” call and target price of $10.23.

As a recap, the Bifrost consortium comprises Meta, PT Telekomunikasi Indonesia International, Keppel Telecommunications & Transportation, and Amazon. This is the first subsea cable system directly linking Singapore to the West Coast of North America via Indonesia through the Java Sea, Celebes Sea and Guam.

The cable spans over 20,000 km and is equipped with a design capacity of 260Tbps and sub-165ms latency, which is 10 ms faster than incumbent routes. Alcatel Submarine Networks was the leading construction company for this cable system, which has an initial cost of some US$760 million ($984 million).

Via a joint build agreement, Keppel and its private fund co-investors own five out of 12 fibre pairs in Bifrost. Of these, two fibre pairs have been committed to customers through indefeasible rights of use for over 25 years. In comparison, the remaining three fibre pairs are being negotiated with potential clients, according to Keppel.

Lim and Kande believe that the contribution from Bifrost is likely to help offset the earnings lost in what Keppel groups under its “connectivity” segment following the divestment of its subsidiary M1’s mobile business.

Keppel expects the investment in Bifrost to generate an IRR of more than 30% and also collect operational and maintenance fees for the five fibre pairs of more than $200 million per fibre pair over 25 years.

The analysts have factored in $21 million of gains for the sale of the first two pairs to be recognised in 4QFY2025, with $5 million of offshore & marine fees in the coming FY2026.

Keppel had earlier sold the first fibre pair in 2021 for US$100 million to Converge ICT Solutions and Lim and Kande. They say Keppel is actively marketing the remaining fibre pairs, aiming to book all-in-gains of $85 million from selling the third and fourth fibre pairs in FY2026. — The Edge Singapore

Stoneweg European Stapled Trust

Price target:

RHB Bank Singapore ‘buy’ EUR1.90

Exposure to new growth in data centres

Vijay Natarajan of RHB Bank Singapore has kept his “buy” call and EUR1.90 ($2.86) target price on Stoneweg European Stapled Trust, on prospects of “exciting” net asset value (NAV) growth potential with the REIT’s investment in a data centre fund raised by its own sponsor, which has yet to be recognised by investors.

Meanwhile, its distribution per unit is set to rebound this coming year due to organic growth and post-finance cost normalisation.

In his Oct 7 note, Natarajan points out that the REIT’s target to increase the mix of its logistics, industrial and data centre (DC) assets to account for around 70% of its portfolio by 2027 from 59% now is a positive step that should help narrow the discount to NAV, which is at around 25%.

“Portfolio rebalancing will be done via ongoing divestments of non-core office assets, with proceeds reinvested in higher growth sectors and asset enhancement opportunities,” says Natarajan, adding that year to date, the REIT has completed three office asset divestments for EUR34 million, bringing total divestments since 2022 to EUR303.7 million. Natarajan expects another EUR50 to 100 million worth of divestments in the next few quarters.

On the other hand, management is starting to explore acquisition opportunities both from its sponsor’s pipeline and externally, with interest costs stabilising and the anticipated economic recovery from government fiscal stimulus policies.

AiOnX, the data centre fund, is seen as a key growth pillar for the REIT, which invested EUR50 million in June for a 6.7% stake. Since then, the REIT has already enjoyed a 50% uplift, or EUR 24.8 million in fair value gains, on the back of the fund’s acquisition of the fifth data centre asset in the UK.

The five data centres are currently in the early stages of development, with either a secured or reserved power capacity of 1,446MW and visibility for an additional 563MW, for a total of 2,009MW, making AiOnX one of the largest data centre players in Europe. “Much of the available and proposed capacity is in high demand, with long-term contracts in place or in active discussions from hyperscalers,” says Natarajan.

Meanwhile, there is also organic growth, with rent reversion in 1HFY2025 “healthy”, increasing by 11.9%, and is expected to remain positive, with a 20% upside potential. Occupancy is likely to increase by 4QFY2025 as well.

Natarajan believes that the REIT’s portfolio valuations have bottomed, with a potential 5%–10% upside in the next two years, in addition to further NAV upside anticipated from planned asset enhancements.

He expects distribution per unit to reach a bottom in the current FY2025 and to grow by 3% per annum in the coming FY2026 and FY2027, driven by operational improvements. — The Edge Singapore