RHB Bank Singapore ‘buy’ 55 cents

High-yield essential infrastructure play

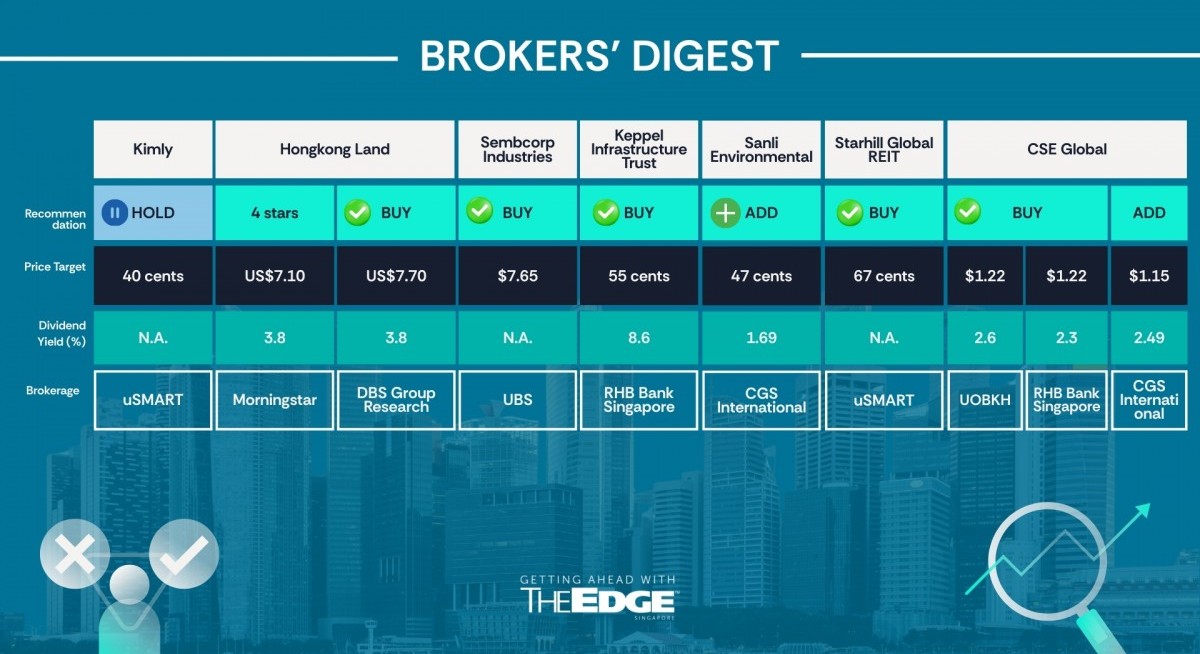

RHB Bank Singapore analyst Shekhar Jaiswal has initiated a “buy” call on Keppel Infrastructure Trust (KIT) with a target price of 55 cents, as he views the trust as a high-yield essential infrastructure play.

KIT offers diversified exposure to essential infrastructure across energy transition, environmental services, and distribution and storage, the analyst notes in his Nov 26 report.

See also: Thomson Medical narrows losses in 1HFY2026 by 20.6% to $10.2 mil

It also has availability-based, fixed-fee, inflation-linked cash flow backed by sovereign and quasi-sovereign counterparties.

Jaiswal also likes KIT for its recent moves, such as the acquisitions of Victorian bus service provider Ventura, the Keppel Marina East Desalination Plant and Global Marine Group (GMG), as well as its move to conduct active capital recycling. The trust has been redeploying its divestment proceeds into higher-yielding assets and extending its long-duration, infrastructure-like income, he adds.

To him, KIT, supported by Keppel’s origination and operating capabilities, and with a visible deal pipeline, is “well-positioned” for accretive growth. At the same time, its forward yield of 8.6% to 8.7% appears to be “unduly elevated” relative to its risk profile.

See also: 'Platform' level combination 'best' way to merge CLI and Mapletree: UOBKH's Loh

Between FY2024 and FY2027, Jaiswal is forecasting a CAGR of 1.2% for KIT’s funds from operations (FFO), with distributions fully covered over FY2025 to FY2027. The analyst is also estimating KIT’s distribution per unit (DPU) to grow at a CAGR of 0.7% over the same period.

His target price is derived from a dividend discount model that factors in a cost of equity of 8.5%, based on a 2.8% risk-free rate, a 5.8% market risk premium, and 1.5% terminal growth.

Key near-term catalysts include earnings contributions from GMG and a clearer expression of its digital infrastructure strategy and capital deployment. GMG’s contributions have not been factored into Jaiswal’s estimates, implying further upside.

At the same time, KIT’s distributable income growth should be supported by concession and contract extensions in Singapore and bolt-on acquisitions funded through capital recycling and balance sheet capacity.

Meanwhile, key risks include uncertainties over the renewal of contracts, as well as potential changes in regulations and policies across KIT’s Singapore concession assets. Acquisition and integration risks from its platform and bolt-on deals could also dilute KIT’s DPU if returns underperform or capital expenditures exceed expectations.

Jaiswal also sees operational risks such as outages, sustaining capex on ageing assets and higher leverage to fund growth, which may pressure cash flow and constrain distribution growth.

For FY2025, the analyst anticipates KIT’s total turnover to be $2.24 billion, with recurring net profit of $61 million and a dividend yield of 8.6%. — Felicia Tan

For more stories about where money flows, click here for Capital Section

Sanli Environmental

Price target:

CGS International ‘add’ 47 cents

Lower target price following placement

William Tng of CGS International (CGSI) has trimmed his target price for Sanli Environmental from 51 cents to 47 cents to reflect a larger share base following a $10 million placement.

On Nov 24, the engineering firm announced plans to issue 38.5 million new shares at 26 cents each, a discount of 9.34% to the volume-weighted average price of 28.68 cents.

Tng, in his Nov 24 note, remains upbeat on the company’s prospects, keeping his “add” call. He notes that its earnings growth will have resumed in 1HFY2026 ended Sept 30, with a 87% y-o-y gain to $3.2 million, in line with his expectations.

The 1HFY2026 bottom line was also boosted by $1.5 million gain from the sale of an asset, but offset by $1 million in special bonuses paid.

In recent weeks, Sanli won two new orders, prompting Tng to raise his earnings forecasts. The first contract, worth $281 million, announced on Oct 21, is from the Land Transport Authority (LTA) for works on the Cross Island Line Phase 1 and the Cross Island Line-Punggol Extension. On Nov 10, the Public Utilities Board (PUB) awarded Sanli a $205 million contract to develop the Changi NEWater Factory over two years.

Tng has applied the same FY2027 P/E of 15.9 times, which is two standard deviations above its FY2022–FY2025 four-year average. However, given the enlarged share base, his target price has been trimmed to 47 cents.

For Tng, key re-rating catalysts would be higher-than-expected order wins and margin expansion, and faster progress in its magnesium hydroxide slurry production business.

On the other hand, downside risks include unfavourable government policies, such as a higher local labour content ratio or levies that may impact margins, as well as more intense industry competition, which presumably leads to compressed margins. — The Edge Singapore

Starhill Global REIT

Price target:

uSMART ‘buy’ 67 cents

Operational resilience

uSMART’s Eng Thiam Choon has initiated “buy” on Starhill Global REIT with a target price of 67 cents. In his report dated Nov 25, Eng describes how Starhill Global REIT continues to demonstrate operational resilience through proactive lease renewals, asset enhancement initiatives, and prudent capital management.

“Notably, the 12-year master lease renewal with Toshin for Ngee Ann City ensures income visibility, while asset upgrades at Wisma Atria and Myer Centre Adelaide, enhancing tenant experience and property value,” Eng adds.

Portfolio occupancy remains robust at 94.6% in FY2025, with a weighted-average lease expiry of 7.6 years based on gross rental income, underpinned by high tenant retention and master leases that provide predictable cash flows.

On the financial front, Starhill Global REIT posted stable growth with FY2024/25 gross revenue rising modestly and net income reaching $108.8 million, supported by fair value gains and currency appreciation in key markets.

“The REIT declared a distribution per unit (DPU) of 3.65 cents in FY2025, up 0.6% y-o-y, translating to a healthy 5-year average dividend yield of 6.66%, above peers,” Eng comments.

Meanwhile, its gearing ratio remains conservative at 36%, well below the 50% regulatory limit, giving it ample debt headroom for strategic acquisitions or asset enhancements.

Eng recommends a medium- to long-term allocation for Starhill Global REIT, underpinned by a stable dividend payout over the past five years, a healthy balance sheet providing financial flexibility for future opportunistic investments and potentially higher yields, and a management team that actively manages its debt.— Teo Zheng Long

CSE Global

Price targets:

UOB Kay Hian ‘buy’ $1.22

RHB Bank Singapore ‘buy’ $1.22

CGS International ‘add’ $1.15

Potential DC projects win in 4QFY2025

Analysts from UOB Kay Hian, RHB Bank Singapore, and CGS International (CGSI) are maintaining their respective “buy” ratings for CSE Global following the recent 3QFY2025 business update.

In their report dated Nov 24, John Cheong and Heidi Mo from UOB Kay Hian have maintained their “buy” call on CSE Global with an unchanged target price of $1.22. The target price is based on 21 times the FY2026 P/E ratio, which is one standard deviation above the mean.

CSE Global’s 3QFY2025 revenue of $258 million, up 21% y-o-y, was mainly in line with the expectations of Cheong and Mo, while 9MFY2025 revenue of $699 million was 76% of their full-year estimate.

The UOB Kay Hian analysts predict that CSE Global’s electrification segment will benefit from rising DC demand as AI adoption increases, especially in the US.

In August, CSE Global won a $59 million DC extension order from its existing US hyperscaler client. In addition, CSE is in the qualification phase with more hyperscaler clients. “We believe the size of the contract wins will continue to increase due to increased adoption of AI,” the team adds.

Meanwhile, in his report dated Nov 24, Alfie Yeo of RHB Bank Singapore continues to like CSE Global for its positive outlook, led by a firm orderbook of $467 million as of September and a sequentially stronger 2HFY2025 on better earnings traction.

“We view CSE Global’s warrant issue to Amazon positively, backed by the latter’s planned US$1.5 billion of orders going forward,” he adds.

Hence, he is maintaining a “buy” call on CSE Global with a target price of $1.22. The target price is based on a 20 times FY2026 P/E ratio.

Finally, Lim Siew Khee and Tan Jie Hui of CGSI highlighted in their report dated Nov 21 that CSE Global’s management remains optimistic about securing sizeable orders in 4QFY2025, particularly in the electrification segment, with several large negotiations in advanced stages.

The company’s management had guided that overhead expenses will likely be front-loaded as the company gears up for upcoming large-scale contracts. This includes hiring additional technical and engineering staff, rental expenses for the new 241,000 sq ft facility, and early investments in equipment.

“With this addition, total capacity rises to about 700,000 sq ft, and we anticipate it expanding further to 800,000 sq ft by the end of FY2025 to support anticipated contract volumes. While these steps are essential for operational readiness, we expect near-term costs to rise with limited immediate revenue, which results in temporary margin compression before utilisation and production scale improve from FY2026 onwards,” Lim and Tan add.

The team is retaining its “add” call on CSE Global, supported by strong multi-year visibility from the AWS programme, which may exceed US$1.5 billion over five years. Their target price remains at $1.15, based on a 15 times FY2027 P/E ratio, 0.5 standard deviations above the 10-year average. — Teo Zheng Long

Hongkong Land

Price targets:

Morningstar ‘4 stars’ US$7.10

DBS Group Research ‘buy’ US$7.70

Remains ‘undervalued’

Morningstar Equity Research analyst Xavier Lee is maintaining his US$7.10 ($9.28) fair value estimate for “narrow-moat” Singapore-listed property developer Hongkong Land, which last week posted 13% lower y-o-y underlying profit for 3QFY2025 ended Sept 30.

“The shares remain undervalued, trading at an 11% discount to our valuation,” says Lee in a Nov 20 note, with a four-star rating on Hongkong Land against Morningstar’s five-tier scale.

While Hongkong Land’s operating trends are “in line” with Lee’s forecasts, its performance was weighed down by lower contributions from the Hong Kong office portfolio and pre-opening expenses related to new investment properties in mainland China.

Hongkong Land’s Hong Kong office portfolio showed early signs of stabilisation, says Lee, with committed vacancy improving to 6.4% as of the end of September, compared with 6.9% at the end of June. This was driven by stronger leasing demand amid a recovery in capital market activity.

Despite improved leasing momentum, Lee believes the city-wide grade A office vacancy rate of 13% will take time to normalise before rental growth resumes on the back of tighter space availability.

“The company noted continued deterioration in mainland China’s residential sector, citing limited new policy stimulus,” notes Lee. “Hongkong Land plans to review the carrying value of its build-to-sell assets at year’s end, and we think further non-cash provisions in the segment are possible.”

For now, Lee thinks Hongkong Land offers “decent shareholder returns”. “As of Nov 20, USD$110 million remains available under its ongoing share buyback program, which we expect will support share price performance.”

While Hongkong Land has guided for a y-o-y decline in FY2025 underlying net profit (excluding provisions), it remains committed to a mid-single-digit dividend growth.

Lee’s FY2025 dividend forecast of 24 US cents per share implies a yield of 3.8%.

Last week, DBS Group Research maintained its “buy” rating on Hongkong Land, with a slightly higher target price of US$7.70, up from US$7.60. The target price of US$7.70 is a 31% discount to DBS’s December 2026 net asset value estimate on Hongkong Land.

On Oct 31, Hongkong Land completed the sale of its Singapore- and Malaysia-based residential developer, MCL Land, for $739 million. Net proceeds from the divestment totalled $839 million, including cash distributions before completion.

The group has now secured 50% of its target of recycling at least US$4 billion of capital by the end of next year. — Jovi Ho

Wee Hur Holdings

Price target:

CGS International ‘add’ 95 cents

Additional contracts in the bag

Natalie Ong and Lim Siew Khee of CGS International have kept their “add” call on Wee Hur Holdings and with prospects of more construction orders in the pipeline, they have raised their target price for this counter from 91 cents to 95 cents.

In their Nov 25 note, the analysts observe that Wee Hur orderbook has been boosted by three projects, bringing its total to $950 million by the end of this year.

The first is from the successful tender of Upper Thomson Road Parcel A via government land sale (GLS) by Wee Hur itself and its controlling shareholder. The construction contract is likely to add $290 million. Next, there is a potential contract for the construction of Wycombe Abby School, worth an estimated $150 million. In addition, potential additions and alterations for DoubleTree by Hilton, the former Hotel Miramar, will add another $15 to $30 million.

With these three orders, the company’s construction order book for FY2026 is seen to reach $1.3 billion, from an earlier projection of $1 billion, the analysts say.

Ong and Lim note that the Upper Thomson Road Parcel A was won with a bid of $613.9 million, or $1,061.56 psf ppr. The analysts say Wee Hur might be able to achieve margins in the low 20s range by developing this project. Assuming a 40% stake, Wee Hur could enjoy a gain of 5.55-cent per share in the valuation of this stock.

Elsewhere, Wee Hur is actively diversifying its revenue with investments in two new businesses — hospitality and education. Via a joint venture, Wee Hur is involved in Wycombe Abbey School.

It has also formed a partnership with the fund Aravest and US-based hotel operator Hilton to refurbish and rebrand the former Hotel Miramar into DoubleTree by Hilton.

“We believe these will allow Wee Hur to leverage on its partners’ expertise to enter new businesses, while securing contracts for its construction business.

In addition, the company is growing its student accommodation business too. It has already seeded another fund to hold 188 Grenfellin Australia, which is slated for completion in 2HFY2027.

There are also the two workers’ dormitories Wee Hur already operates here in Singapore.

“We believe Wee Hur is a beneficiary of Singapore’s construction upcycle as well as strong demand for workers and students’ accommodations,” state Ong and Lim. — The Edge Singapore

Sembcorp Industries

Price target:

UBS ‘buy’ $7.65

Value unlock in India?

UBS has issued a “buy” call on Sembcorp Industries (SCI), valuing the energy company at $7.65 per share, up from its last done share price of $6.13 on Nov 24. The rationale is that SCI could unlock proceeds of $3.5 billion to $5.5 billion from its Indian portfolio if it were fully monetised.

“Amid news reports that SCI is exploring acquisitions in Australia and Thailand, we consider how much proceeds the company could generate, and profits that could be recognised, in a potential capital recycling exercise,” says UBS.

“Our conclusion: We estimate that SCI could potentially unlock between $3.5 billion and $5.5 billion in gross proceeds if it were to fully monetise its India renewable energy portfolio. The actual amount recognised would depend on the stake that SCI eventually retains,” adds UBS.

UBS assumes the portfolio is valued as a cash-generating asset. These assets are currently under construction. Secondly, the average feed-in tariff (FiT) of INR3/kWh ($0.015/kWh) reflects a mix of vanilla (below INR3) and hybrid (above INR3) renewable energy projects. The third assumption is an aggressive ebitda margin of 90%, and profit margins of 25%. Projects take time to stabilise and this third assumption is extremely optimistic given a short-term time frame.

Fourth, UBS assumes a loan-to-value ratio of 70% and an average cost of debt of 7.5%, both of which are on the optimistic side.

UBS compares the potential valuation of SCI’s Indian portfolio to Adani Green Energy and NTPC Green Energy, which are valued at 11 times to 14 times EV/Ebitda and at P/E ratios of around 35 times.

Based on an EV/Ebitda multiple of 11, the EV works out to around $8 billion, the report reasons. “We estimate SCI could unlock $3.5 billion in gross proceeds after paying down debt,” UBS says.

If SCI decides to retain 50% of the portfolio based on the $3.5 billion value unlock, gross proceeds could amount to $1.7 billion. Sembcorp has 1,776 million shares outstanding. “This could bring SCI’s 2027 Net debt/Equity ratio down to 1.0–1.2 times from 1.6 times,” UBS says, adding that the negatives have been priced in. — The Edge Singapore