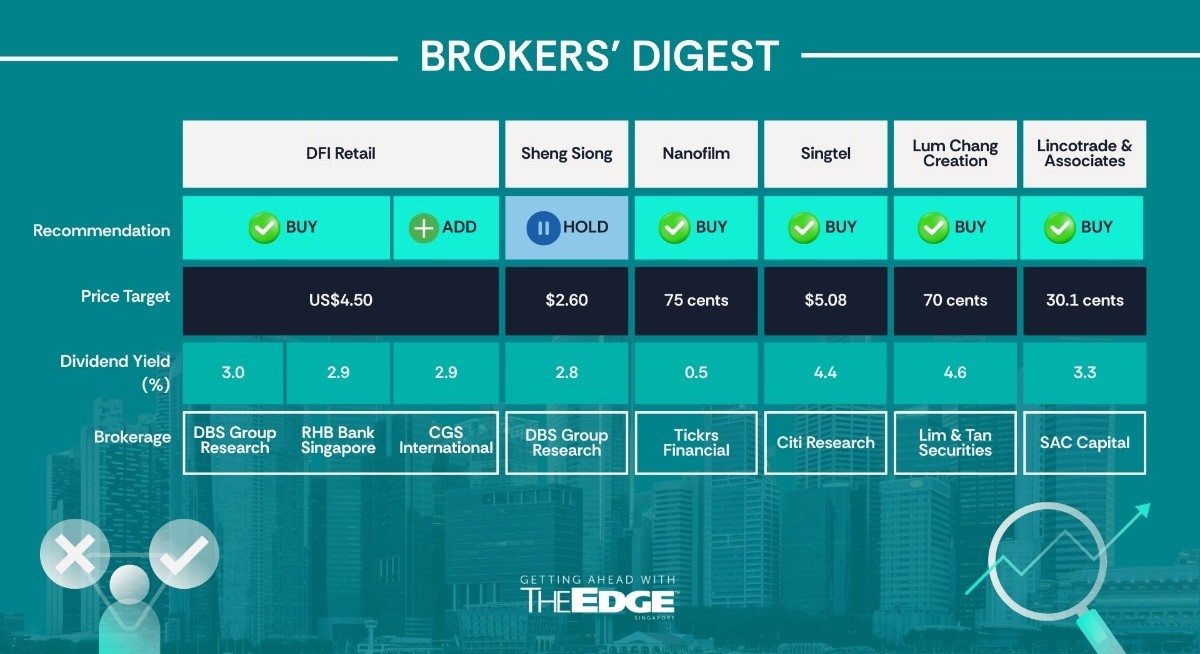

Chee Zheng Feng from DBS Group Research has downgraded Sheng Siong to “hold” with an unchanged target price of $2.60, as the analyst believes that the SG60 voucher tailwind has been priced in following the recent rally in Sheng Siong’s share price.

“Based on our read-through of supermarket sales growth in July to September, we estimate an uplift of about $250 million in 2HFY2025 attributable to SG60 vouchers, supporting roughly 4% annualised y-o-y industry growth (vs 2% in 2024),” states Chee in his Dec 5 report.

The analyst forecasts an annualised uplift of about $500 million in FY2026, which corresponds to around 6% industry growth. Accordingly, Chee sees supermarket FY2025 growth at 4.4%, up from 0.1% in 1HFY2025, with 2HFY2025 potentially trending closer to the 3% level post the initial voucher issuance surge.

The analyst is keeping his forecast unchanged, which already factors in the SG60 voucher tailwind and implies an 8% top-line growth in FY2026 (versus industry at 6%), with the additional delta driven by store network expansion.

See also: PhillipCapital, UOB Kay Hian raise respective target prices for BRC Asia following 1QFY2026 earnings

“We also expect a disproportionately stronger earnings growth of about 10% y-o-y, supported by operating leverage and economies of scale,” he adds.

Hence, Chee downgrades Sheng Siong to ‘Hold’ with an unchanged target price of $2.60 as he believes that FY2026 estimates already reflect the upside from SG60 vouchers.

“With the company trading at close to 24 times FY2026 earnings, we believe SG60 vouchers and EQDP tailwinds have been largely priced in,” says Chee. — Teo Zheng Long

See also: Citi ups target prices on all three banks; prefers Singapore banks over SGX for EQDP play

Nanofilm Technologies International

Price target:

Tickrs Financial ‘buy’ 75 cents

Positive trajectory to accelerate

Tickrs Financial analyst Jaimes Chao has initiated a “buy” call on Singapore-based deep-tech company Nanofilm Technologies International with a target price of 75 cents.

In his Dec 4 report, Chao notes that Nanofilm’s earnings are rebounding strongly after a difficult FY2023. FY2024’s revenue saw a growth of 15.4% y-o-y to $203.4 million and patmi of $7.7 million.

The momentum carries on into 1HFY2025 with 29.6% y-o-y revenue growth and a swing back to net profit of $1.6 million, compared to a loss of $3.7 million a year earlier.

“We expect this positive trajectory to accelerate, underpinned by Nanofilm’s diversified growth drivers — from a recovering 3C (Consumer, Communication & Computer) electronics business to rapidly growing new segments in automotive coatings and hydrogen energy solutions,” says Chao.

In Chao’s opinion, Nanofilm’s strategic expansion into high-growth verticals (electric vehicles, renewable energy, precision optical components) and geographies (new facilities in China, India, Vietnam and a foothold in Europe) positions it for a multi-year earnings uplift.

For more stories about where money flows, click here for Capital Section

Margins are already improving as recent expansion costs normalise and operating leverage kicks in. FY2024’s adjusted ebitda margin rose to 25.4%, from 22.3% in FY2023, while its net profit margin doubled to 3.8%.

Chao says Nanofilm’s proprietary nanotechnology and partnerships, such as with the NTI-NTU Corporate Lab, will bolster its innovation pipeline, giving it an edge in advanced materials. “With a solid net cash position balance sheet and disciplined management, Nanofilm has the capacity to fund growth and sustain dividends,” comments Chao.

In Chao’s view, given that Nanofilm is trading near book value and a P/E ratio that discounts to its historical earnings levels, he sees an attractive entry point.

“We view Nanofilm as a compelling turnaround and growth story in the advanced materials space, deserving of a re-rating as earnings recover,” adds Chao.

Chao’s target price of 75 cents is based on a 29 times FY2025 P/E ratio and eight times FY2025 EV/Ebitda. The target price is supported by a DCF cross-check using conservative assumptions of mid-term revenue growth of around 8%, terminal growth of 3%, and a WACC of around 10%.

At the 75-cent target price, Nanofilm would trade at around 23 times its FY2026 P/E ratio, still below its pre-downturn historical average (mid-20s) and reasonable relative to its growth prospects.

“We also note the consensus analyst target price averaging at around 71 cents (ranges from 62 cents to 79 cents), so our outlook is slightly more optimistic as we factor in the successful execution of Nanofilm’s new initiatives,” concludes Chao. — Teo Zheng Long

Lincotrade & Associates

Price target:

SAC Capital ‘buy’ 30.1 cents

Order book doubled

SAC Capital analysts Matthias Chan and Liu Maorong have initiated a “buy” call on Singapore-based interior fitting-out specialist Lincotrade & Associates with a target price of 30.1 cents.

In their Dec 5 report, the analysts noted that the company’s order book doubled to $113.0 million as of Sept 30, providing about two years of revenue visibility. For the three months, from July to Sept, Lincotrade secured new projects with an aggregate contract value of $61 million.

“With a strategic focus in recent years on securing commercial projects, all of the newly secured projects are commercial projects, which generally yield higher margins for the group. This strong project pipeline underpins confidence in forward revenue growth,” says Chan and Liu.

The recent proposed placement of 10 million new shares at 22 cents each, a price slightly above the prevailing market price, helps Lincotrade raise net proceeds of $2.1 million to strengthen its financial position further and finance its ongoing projects, given the larger order book.

Meanwhile, Lincotrade’s revenue from Malaysia increased significantly to $4.0 million in FY2025, compared to FY2024’s figure of just $0.1 million, mainly due to the new data centre project in Johor, Malaysia, undertaken by the company’s subsidiary in Malaysia.

In addition, Linoctrade has acquired a 30% equity stake in Linc Venture Land Sdn Bhd, which has secured a piece of land in Kuala Lumpur for a residential property development. Both analysts see the sales launch could unlock initial revenue and valuation gains for the developer, benefiting Lincotrade through its equity stake.

“Positive reception or strong pre-sales of this KL development would validate Lincotrade’s move into the property sector and potentially contribute to the share of profits in the coming years,” the team comments.

By the end of this year, Lincotrade expects to finish the addition & alteration works at its new Tuas Ave 12 factory. This includes a 204-bed workers’ dormitory on the premises.

In the analysts’ view, the on-site dormitory is a key operational catalyst, enabling Lincotrade to house its own construction workers, eliminating the need for third-party dorm rentals or dispersed accommodations.

“This will significantly reduce recurring manpower accommodation costs and improve efficiency. Unutilised bed capacity could be rented out to generate a small, recurring income stream.

Installation of solar panels at the Tuas site will further cut energy costs over the long term. Thus, Lincotrade could see a margin uptick thanks to these cost savings and sustainability initiatives coming online,” mentions both analysts.

At the same time, both Chan and Liu believe that the robust construction demand suggests a steady flow of interior fitting-out jobs will follow, since every new building or major redevelopment eventually requires interior works. They believe that Lincotrade is well positioned to tap into the sector’s growth, with demand for fitting-out work remaining resilient.

According to the team, Lincotrade’s strong FY2025 results underscore effective project execution and improved cost efficiency.

Revenue climbed 8.5% y-o-y to $73.6 million while profit attributable to equity holders rose 11.5% y-o-y to $2.6 million. The company’s strategic emphasis on securing higher-margin commercial projects has continued to pay off, lifting overall gross margin from 11.6% in FY2024 to 12.5% in FY2025.

On the dividend front, Lincotrade proposed a final dividend of 0.66 cents per share, which represents a payout ratio of about 44% of FY2025 net profit attributable to shareholders, more than double its stated policy of distributing at least 20%.

“As we expect growth in the coming years, we have forecast dividend payout to be similar to FY25. This translates to a very attractive above-market yield of 7.7% in FY2026 and 10.7% in FY2027,” conclude both Chan and Liu.

The team at SAC Capital has a target price for Lincotrade of 30.1 cents, based on its FY2026 forward EPS and a 20% discount to the mean P/E ratio of 11.0 times of its peers, representing a 50% upside from current levels. — Teo Zheng Long

Singapore Telecommunications

Price target:

Citi ‘buy’ $5.08

Recent correction offers ‘better value’

Citi Research analysts Arthur Pineda and Luis Hilado have resumed coverage of Singapore Telecommunications (Singtel) with a “buy” call and a higher target price of $5.08, after suspending ratings.

Citi last had a “buy” call on the telco and a target price of $4.92 in September. The higher target price comes as the analysts have revised their valuations for Singtel’s businesses, Bharti, Gulf, AIS, Telkomsel and its Singapore segment following the telco’s latest results.

“[Singtel] offers a combination of cash-flow generation from its developed market portfolio in Australia and Singapore, and growth elements through its emerging-market exposure in Indonesia, India, Thailand and the Philippines,” the analysts write in their Dec 8 report.

They also like that the telco has potential for a strategic review of its various assets, which could help to crystallise value.

In addition, the group’s strong cash flow from its $9 billion asset divestment programme supports a sustainable dividend yield of 5% alongside its share buyback programme.

While Singtel’s yield has compressed to 4% following its recent share price increase, the analysts like the telco’s double-digit earnings growth going into FY2027/2028, which they deem as “compelling” and better than the market’s performance.

Pineda and Hilado also expect capital flows from the equity market development programme (EQDP) to support the telco with recent mandates encompassing the MSCI Singapore and FTSE all-share indices, which are still dominated by large-cap names.

Furthermore, a potential consolidation in the market for Singtel’s Singapore business, which dragged profit growth, could catalyse market repair in 2026.

Pineda and Hilado’s new target price is based on a sum-of-the-parts (SOTP) formula, which values Singtel’s Singapore and Australian businesses at 99 cents per share after factoring in net debt and its associates at $4.09 per share.

The analysts also have a bullish target of $5.34, reflecting a 10% increase in Bharti’s target price, lower India-adjusted gross revenue (AGR) dues and better average revenue per user (ARPU) and subscriber momentum for Bharti.

In a bearish scenario, the analysts have a target of $3.93, based on a stronger Singapore dollar against regional currencies and a 30% lower target price for Bharti.

At this point, Singtel’s recent share price correction from its $4.90 peak offers “better value” in the stock.

“Concerns on potential Australia-related fines due to network outages may be mitigated by capital management activities and liquidity-driven inflow,” the analysts write. — Felicia Tan

Lum Chang Creations

Price target:

Lim & Tan Securities ‘buy’ 70 cents

Higher earnings seen

Lim & Tan Securities’ Chan En Jie has maintained his “buy” call on Lum Chang Creations (LCC), with a higher target price of 70 cents, as he sees brighter prospects for the urban revitalisation specialist ahead. The target price increase is nearly twice the initial target price of 38 cents back in July, before LCC’s trading debut. It is also pegged to an FY2026/FY2027 P/E of 11.7 times, which is the same as the average of LCC’s peers.

On July 14, Lim & Tan Securities initiated coverage on LCC, recommending investors “subscribe” to its initial public offering (IPO). The brokerage’s target price at the time represented a 52% upside to LCC’s IPO price of 25 cents and a 26.7% upside to LCC’s debut price of 30 cents per share.

In his Dec 2 report, Chan notes strong demand for LCC’s conservation and restoration services, with the company’s latest two contract wins totalling $63.4 million. The contract wins, which come from public and private sectors — Orchard Road Presbyterian Church, worth $31.5 million and the Registries of Civil and Muslim Marriages Building, worth $31.9 million — bring LCC’s order book to $160 million and will provide revenue visibility till 2028.

The Orchard Road Presbyterian Church contract is expected to be completed in November 2027, while the Registries of Civil and Muslim Marriages Building contract is scheduled for completion in January 2028.

Chan also highlights other positives, such as LCC’s asset-light model, which provides a high return on equity (ROE) of over 35%, and its position as a beneficiary of a “promising urban revitalisation specialist (URS) industry” and a healthy project pipeline.

These factors have led the analyst to add LCC to his “top picks” for Lim & Tan Securities’ client portfolio for November. LCC joins other names such as Tiong Woon and KSH Holdings under the construction category.

With this, Chan is now expecting LCC to report earnings of $17.9 million in FY2026, 35% higher than his previous forecast. The new earnings estimate translates to an “attractive” forward P/E of 8.4 times, the analyst points out.

Chan’s new target price represents an upside of 44.3% to LCC’s share price of 48.5 cents at the Dec 5 close. — Felicia Tan