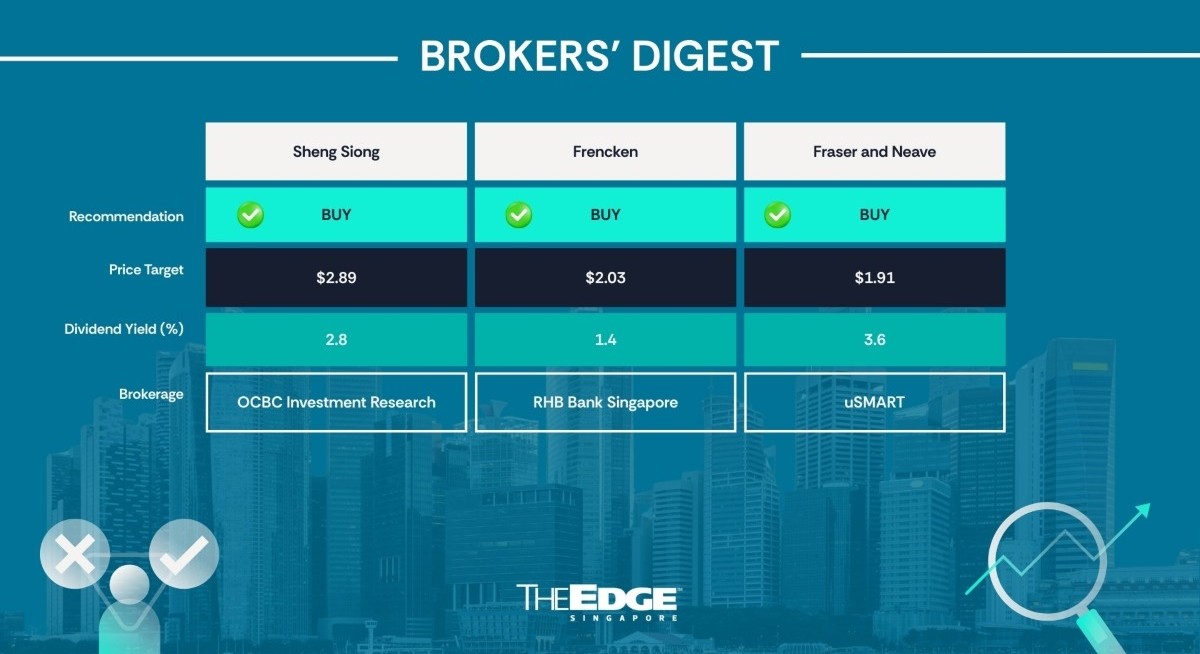

OCBC Group Research has downgraded its call on supermarket operator Sheng Siong (SGX:OV8

Analyst Chu Peng says: “We view Sheng Siong Group as a defensive play amid rising inflation and slower economic growth. Demand for groceries could be supported by a shift in consumption patterns toward value for money amid inflationary pressures and a higher cost of living. Moreover, grocery sales could be supported by Singapore Budget 2025’s announcement on inflation offset measures such as the CDC vouchers.”

The group ended 2025 strongly, with its share price rising about 60%, significantly outperforming the 23% gain in the Straits Times Index (STI).

While the stock was among the top performers among companies under OCBC’s coverage, Chu notes that the outperformance was due to a combination of strong earnings visibility, a defensive nature, market-share gains from store expansion, and support from CDC cash handouts and EQDP flows.

See also: StarHub’s weak FY2026 guidance leads DBS to review call while Morningstar flags overvaluation

“While these drivers should continue into 2026, Sheng Siong’s valuations look demanding,” says Chu, adding that the stock is currently trading at a forward P/E of 24.8 times, more than two standard deviations (s.d.) above its historical average of 19.6 times.

Meanwhile, Chu points out that retail sales rose 2.7% y-o-y in December 2025, according to data from the Singapore Department of Statistics. This moderated from 6.2% y-o-y in November 2025 and fell short of consensus expectations of 8.0% y-o-y.

In 2025, retail sales growth reached 2.8% y-o-y, double the 1.4% pace in 2024 and the strongest since 2022 (10.7%). Looking ahead, OCBC Group Research expects retail sales to grow by 2%-3% y-o-y in 2026, supported by a steady pipeline of new products and consumer experiences. — Samantha Chiew

See also: IFAST share price dips despite strong earnings 4QFY2025 announcement; DBS maintains ‘buy’ at $12

Frencken Group

Price target:

RHB Group Research ‘buy’ $2.03

Demand picking up from customer restocking

Alfie Yeo of RHB Bank Singapore has kept his “buy” call and increased his target price for Frencken Group (SGX:E28

And of course, its key customer in the semiconductor space, ASML, is seeing “firm” 2026 growth, notes Yeo in his Feb 6 note.

“Frencken remains exposed to ASML, which is a strong beneficiary of the semiconductor equipment sector’s growth,” says Yeo, citing forecasts of 8% CAGR between 2025 and 2027 by industry association SEMI.

According to SEMI, global sales of semiconductor equipment by OEM manufacturers are expected to reach US$133 billion ($168 billion) in 2025, up 13.7% from the previous year, and further increase to US$156 billion in 2027.

Specifically for ASML, the Dutch company has guided revenue between EUR34 billion ($51.2 billion) and EUR39 billion for FY2026, up 4% to 19%.

Yeo expects Frencken, which has key operating sites in Malaysia, to benefit from the country’s positive external macroeconomic outlook.

For more stories about where money flows, click here for Capital Section

For one, citing his colleagues on the economics team, Yeo says that tariff risks will ease, supporting global trade and demand and fuelling a more positive outlook for manufacturing and exports.

RHB’s economists expect Malaysia’s exports to grow by 9.3% this year, a pick-up from 6.5% last year, driven by strong global demand.

In Singapore, where Frencken also operates, full-year industrial production is expected to increase by 4%, driven by “firmer” electronics and non-electronics exports, positive spillover from the ongoing global electronics upcycle, and resilient regional demand.

Specifically, Yeo expects Frencken to see more demand in the second half of the year as ASML clears excess inventory by the end of June. As such, he has raised his earnings forecast for FY2026 and FY2027 by 5%.

Yeo has also applied a higher valuation multiple of 19 times earnings, up from 17 times, which puts it more in line with Frencken’s peers, as the company is seen to enjoy a stronger earnings outlook and market re-rating on the back of fund flows and higher liquidity in the Singapore market. — The Edge Singapore

Fraser and Neave

Price target:

uSMART ‘hold’ $1.91

Undergoing structural transformation

uSMART has initiated a “hold” call on Fraser and Neave (SGX:F99

In his Feb 9 initiation report, analyst Ng Xin Yang says F&N is currently undergoing a structural transformation, pivoting from a downstream brand owner to a vertically integrated agri-food operator.

“F&N retains entrenched dominance in Asean Food & Beverage, with No.1 position in canned milk in Thailand and Malaysia and a leading isotonic drink (100Plus) in Singapore and Malaysia,” states Ng.

The analyst notes that cash flow from the Dairies segment is being deployed to F&N AgriValley in Malaysia, aimed at insourcing the fresh milk supply to create a “farm-to-table” moat, thereby structurally reducing exposure to commodity and forex volatility.

From Ng’s perspective, F&N’s latest FY2025 result reflects an earnings-loading phase with revenue growing by 7.4% y-o-y to $2.32 billion on volume recovery in Dairies and Beverages, but profit after tax declined 4.0% y-o-y to $210.4 million, due to higher effective tax rates following the expiry of Thai Board of Investment (BOI) incentives and a 14% decline in associate contributions from Vinamilk. “Encouragingly, gross margins remained resilient at 31.3%, supported by cost pass-through and operational efficiencies despite input cost volatility,” adds Ng.

Looking ahead, the analyst believes the transition from capex to commercialisation is underway, with the Malaysia integrated dairy farm and Cambodia dairy facility on track for commercial production in 1QFY2026.

“While start-up costs may weigh on near-term earnings, these assets provide a medium-term hedge against raw material and forex risks,” Ng comments. As such, Ng has assigned a “hold” rating on F&N with a target price of $1.91, implying a 26.5% upside.

“Despite the apparent valuation upside, re-rating remains constrained by the Group’s conglomerate structure and low free float of around 12%, which constrains institutional ownership and liquidity,” says Ng.

Ng explains that the above valuation is anchored by the market value of F&N’s listed stakes, with a 20% holding company discount applied at the aggregate level. In contrast, Times Publishing is valued at 0.6 times EV/Revenue and the core business at a conservative nine times EV/Ebitda, pending clearer evidence of earnings accretion from new capacity. — Teo Zheng Long