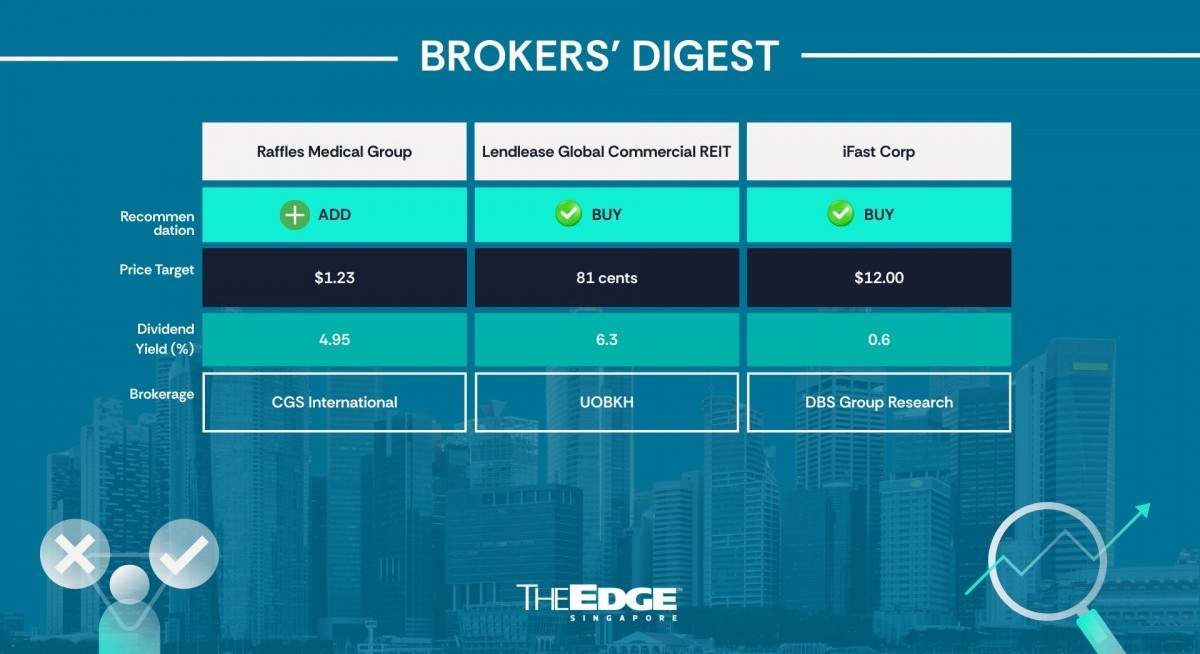

CGS International ‘add’ $1.23

Sentiment to improve

CGS International is reiterating its “add” recommendation on Raffles Medical Group (RMG) with a higher target price of $1.23 from $1.20 previously, on the back of stronger y-o-y earnings in 2HFY2025, continued turnaround in China operations and a seasonally stronger contribution from the group’s insurance business.

Analyst Tay Wee Kuang is revisiting the investment thesis for RMG, expecting investor sentiment to improve as y-o-y earnings growth resumes in 2HFY2025/FY2025, after two consecutive years of decline.

During its FY2024 results, RMG announced its intention to buy back up to 100 million shares in FY2025. However, the group has only repurchased about 20 million shares to date. “Given the group’s net cash position of about $283 million (excluding lease liabilities) as of 1HFY2025, we believe RMG could enhance shareholder returns through other means such as special dividends,” says Tay.

Assuming an average share buyback price of $1 per share, the analyst estimates RMG would have about $80 million in budget remaining, translating to approximately 4.4 cents per share.

Considering FY2026F is RMG’s 50th anniversary, he also thinks that RMG could augment its core dividend of 2.5 cents (unchanged y-o-y) with an additional 2.5 cents to bring FY2025 dividend to 5.0 cents, which translates into a total cash payout of about $92 million (representing an FY2025 yield of around 5%).

See also: Lim & Tan Securities starts Reclaims Global at ‘buy’ with target price of 60 cents

However, Tay is waiting for the group’s overseas venture to contribute more significantly. Despite venturing into overseas markets as early as 1995 and having about 32% of the group’s non-current assets outside of Singapore (in 1HFY2025), revenue contribution outside Singapore only made up about 10% of RMG’s 1HFY2025 revenue.

Notably, its China hospitals in Chongqing and Shanghai, which opened at the end of 2019 and early 2021, respectively, have yet to achieve breakeven. In 2023, RMG also entered into a strategic partnership agreement to acquire a majority stake in American International Hospital (AIH) in Vietnam, valued at US$45.6 million (US$58.8 million). Since then, AIH has also been managed by RMG under a service agreement, pending regulatory approval of the acquisition.

“We lower our FY2025–FY2027 EPS by 5.4%–8.2%, predominantly to account for a larger share base from a slower pace of its share buyback, alongside slightly higher depreciation expenses,” says Tay. — Samantha Chiew

Lendlease Global Commercial REIT

Price target:

UOB Kay Hian ‘buy’ 81 cents

Upside from PLQ Mall and revaluation of Jem

For more stories about where money flows, click here for Capital Section

UOB KayHian analyst Jonathan Koh has maintained his “buy” call on Lendlease Global Commercial REIT (LREIT), citing potential upside from PLQ Mall and the revaluation of Jem.

In his Jan 6 report, Koh mentions that LREIT could consider “moving on” next to acquire the remaining 30% stake in PLQ Mall from its sponsor, Lendlease Corp. “Assuming the agreed property value remains unchanged at $885 million or $2,789 psf, the 30% stake would be worth $265.5 million and provide a net property income (NPI) yield of 4.5%,” states Koh.

The analysts see the acquisition could be funded through a mix of equity and bank loans to keep LREIT’s aggregate leverage below 40%.

“We estimate debt headroom at $107 million based on aggregate leverage of 40%. LREIT could consider launching an equity fundraising effort through a small, preferential offering to raise between $100 million and $150 million, thereby maintaining aggregate leverage between 38.7% and 39.9%. Its cost of new debt is currently at the high end of 2% and we expect the transaction to be DPU accretive,” explains Koh.

In terms of enhancing the tenant mix at PLQ Mall, Koh states that LREIT’s management intends to embark on an asset enhancement initiative (AEI) to reconfigure NLA of approximately 16,000 sq ft at Levels 1 & 2 in 2026, which could provide an uplift to rental rates. The required capex is estimated at $10 million.

LREIT also intends to convert the holding company for PLQ Mall into a Limited Liability Partnership within the next three to six months, thereby providing tax transparency for PLQ Mall.

Koh notices that LREIT has continued to backfill vacant space at Sky Complex Building 3, albeit at a gradual pace.

The analyst notes that LREIT’s management could consider divesting Building 1 & 2, which are fully occupied by Sky Italia, a subsidiary of Comcast Corp.

“Strong credit standing of Comcast, which is rated A– with a stable outlook by Standard & Poor’s and Fitch Ratings, would attract potential buyers. Building 3 could be divested at a later stage after backfilling the bulk of vacant space,” adds Koh.

Koh sees potential upside from the revaluation of Jem, located at Jurong East MRT Station. “The higher valuation is supported by recent sales of The Clementi Mall. The Elegant Group acquired The Clementi Mall from Cuscaden Peak Investments for $809 million or $4,100 psf, which is 8% higher than the indicative guide price of $750 million,” says Koh.

According to Koh, the current valuation of $2,299 million, or $2,574 psf, is substantially lower than the pricing for The Clementi Mall.

Based on the analyst’s calculations, a $447 million increase in Jem’s valuation, or $500 psf, would reduce LREIT’s aggregate leverage by four percentage points.

In Koh’s summary, he explains that LREIT has a competitive advantage through high-quality assets and precinct dominance.

“Its assets have a long balance leasehold tenure of 83 years. Its sponsor has more than 50 years of presence and a pipeline of more than $6 billion in Singapore, which includes PLQ Office, Parkway Parade and Comcentre,” states Koh.

“Current valuation is attractive based on DPU yield. LREIT provides an attractive FY2026 DPU yield of 6.3%, compared to CICT’s DPU yield of 4.9%, FCT’s DPU yield of 5.6% and the broader S-REIT’s DPU yield of 6.6%,” concludes Koh.

Therefore, Koh is maintaining a “buy” rating on LREIT with a target price of 81 cents, based on a dividend discount model with a cost of equity of 6.75% and terminal growth of 2.2%. — Teo Zheng Long

iFast Corp

Price target:

DBS Group Research ‘buy’ $12

Financial Alliance Corp stake acquisition

DBS Group Research is keeping its “buy” recommendation and $12.00 target price on iFast Corp on the back of its acquisition of a 30% stake in Singapore-based financial advisory firm Financial Alliance Corp (FA Corp) for $19.6 million.

In a Jan 6 note, DBS says the acquisition is aligned with the group’s strategy to capitalise on the structural growth of the wealth management industry, where scale, operational efficiency, broad product access, and technology leadership are increasingly critical.

“As a leading non–insurance-owned advisory platform, FA Corp is well-positioned to benefit from industry consolidation. iFast also views FA Corp as a potential long-term winner, with a possible listing over the next two to three years,” says DBS.

DBS sees the transaction as strategically bridging iFAST’s wealth platform and its B2B advisory ecosystem, enabling deeper collaboration, enhanced adviser support and a scalable foundation for future expansion.

DBS is projecting earnings growth of 44% in FY2025, followed by 26% in FY2026 and 25% in FY2027.

“The acquisition also supports iFast’s progress toward its assets under administration (AUA) target of $100 billion by 2028–2030, up from $27.2 billion (+29.6% y-o-y) as of end-September 2025,” says DBS, adding that iFast’s AUA has historically grown at about 20% CAGR over FY2014–FY2024. — Samantha Chiew