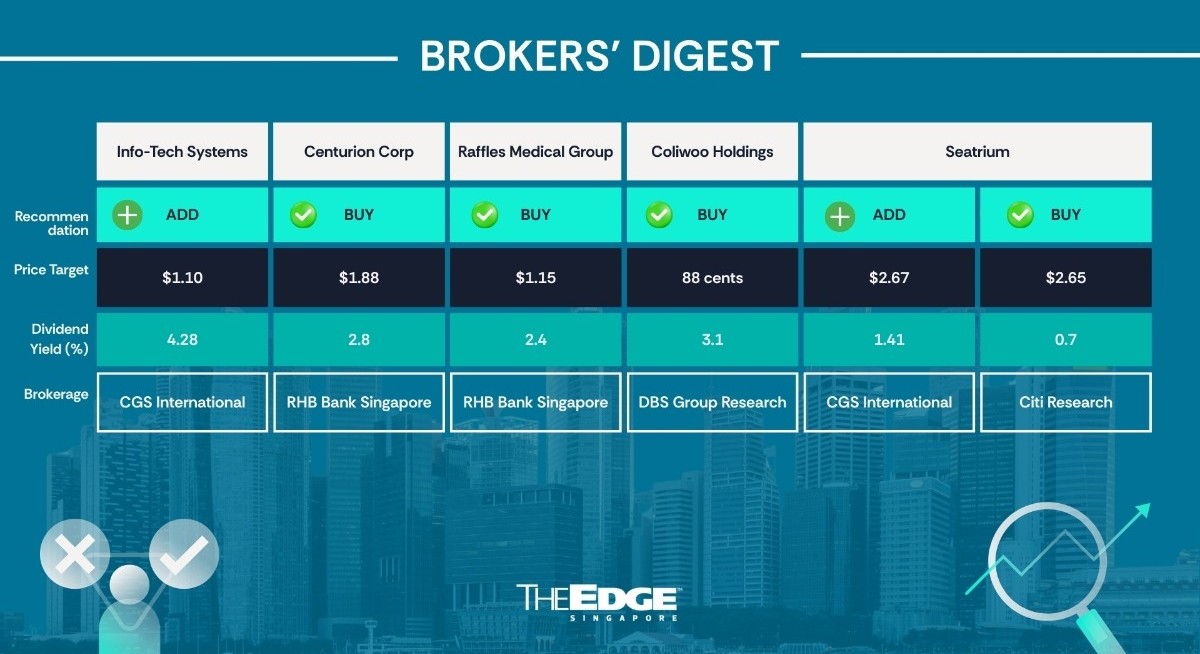

CGS International (CGSI) analysts Meghana Kande and Tan Jie Hui have maintained their bullish view of Info-Tech Systems (SGX:ITS

“We think the stock has strong re-rating potential following its 13% share price drop since its IPO in July 2025, as the market begins to appreciate management’s execution,” state the analysts in their Jan 21 note.

Info-Tech Systems, the first company to list on the mainboard last year, went IPO at 87 cents. The share price dropped to as low as 76 cents before rebounding after it announced positive profit guidance on Jan 21.

As stated by the software company, its FY2025 earnings will be a “considerable increase” compared to the preceding FY2024 ended Dec 31, 2024.

See also: uSMART initiates ‘hold’ on Fraser and Neave with target price of $1.91

Info-Tech Systems attributes the better numbers, which will be reported on Feb 24, to higher Academy revenues generated in 2HFY2025, as well as continued growth in its HR management and accounting systems.

The CGSI analysts note that the company has expanded the number of courses it teaches from five at the end of 2024 to 13 now. Besides HR and accounting topics, newer courses focus on the applications of AI in business contexts, which they believe will generate greater appeal and drive higher-than-expected revenue.

Kande and Tan currently project that the company will report FY2025 core earnings of $14 million, which they say could “positively surprise”.

See also: DBS sees potential fair value of $1.80 for MetaOptics; ‘path to breakeven becoming visible’

This implies that the company’s final dividend, in line with its 50% payout ratio policy, could exceed the interim payout of 1.55 cents, raising the yield to nearly 5%.

In the near term, the company has a new customer relationship management product to be introduced, which they view as a “positive” signal, an affirmation by the company’s management that is executing as guided.

The analysts expect the company to tap its existing base of more than 25,000 customers to cross-sell this new product.

Kande and Tan estimate that the CRM product can generate $3 to 4 million in revenue in FY2026 and continue to grow thereafter.

“We reiterate our ‘add’ call on Info-Tech for its growth trajectory, underpinned by deeper market penetration and greater adoption of new products,” the analysts say.

Their target price of $1.10 is based on 17 times FY2026 earnings, a discount of around 50% relative to global peers due to Info-Tech’s smaller size. — The Edge Singapore

Centurion Corp

Price target:

RHB Bank Singapore ‘buy’ $1.88

For more stories about where money flows, click here for Capital Section

Positive on prospects

Alfie Yeo of RHB Bank Singapore has maintained his “buy” call on Centurion Corp (SGX:OU8

With expectations of a slightly higher market valuation on the REIT, Yeo has correspondingly raised his target price to $1.88 from $1.86.

“We remain positive on Centurion’s prospects, as the group focuses on property development, acquisitions, and being CAREIT’s manager post spin-off of its assets to the latter,” states Yeo in his Jan 22 note.

There is another reason to stay positive on this stock. “Shareholders may receive another dividend in specie when Centurion pares down its stake further in CAREIT next year,” says Yeo.

Recently, Centurion sold the 732-bed Epiisod Macquarie Park student accommodation in Sydney for A$345 million, or $280 million.

As this asset was already earmarked for CAREIT’s portfolio before its listing last year, Yeo had accounted for the divestment in his valuations.

In future, with the REIT in place, Centurion’s growth strategy will shift to property development.

While the remaining assets not yet sold to CAREIT will continue to drive growth, Centurion will be focusing on strategic acquisitions in areas including the Middle East. At the same time, it will be receiving management fees from the REIT and other assets.

In addition to existing projects in Australia and the UK, Centurion is eyeing Saudi Arabia and the United Arab Emirates for new worker accommodation projects. “Management is progressing cautiously due to the higher risks involved. We, therefore, should not expect a hasty entry into the Middle East, for now,” says Yeo.

Centurion is also looking to provide other accommodation types, aside from hotels, such as built-to-rent properties in China for tenant profiles other than students, to support growth, he adds. — The Edge Singapore

Raffles Medical Group

Price target:

RHB Bank Singapore ‘buy’ $1.15

Potential earning growth in 2HFY2025

RHB Group Research’s Shekhar Jaiswal is reiterating his “buy” call on Raffles Medical Group (SGX:BSL

In his Jan 23 report, Jaiswal states that Raffles Medical offers exposure to a “high-quality Singapore healthcare compounder” with improved earnings visibility.

“Market efficiency initiatives and an iEdge Next 50 inclusion should support institutional demand, alongside buybacks and dividends,” says Jaiswal.

The analyst also predicts that the government’s Integrated Shield Plan (IP) rider reset should improve affordability and claims discipline for Raffles Medical.

On the upcoming FY2025 results, to be announced on Feb 23, Jaiswal predicts a return of growth for Raffles Medical, with 16% y-o-y core patmi growth in 2HFY2025 driven by continued recovery in its Singapore hospital’s operation and narrowing of the drag from its China operations.

“We expect momentum to extend into FY2026 and FY2027 with core PATMI growth of 14% and 17% respectively, supported by improving contribution from its China operations and a gradual return to sustained profits in the insurance business. Our FY2026 and FY2027 forecasts are above consensus,” states Jaiswal.

Meanwhile, from April 1, new IP riders cannot cover MOH-set minimum deductibles and must carry a co-payment cap of at least $6,000 (excluding the minimum deductible), while the minimum 5% co-payment remains.

Jaiswal foresees this could be a mild headwind for Raffles Medical’s hospital volumes, particularly for lower-acuity and more discretionary cases, as patients face higher out-of-pocket costs.

“That said, the tighter rider structure should curb claims-led cost inflation, supporting private healthcare affordability and, by extension, demand sustainability over the medium term,” comments Jaiswal.

From the analyst’s perspective, he foresees that the revised rider framework will improve underwriting quality for new customers at Raffles Medical’s insurance business by curbing claim frequency and low-value utilisation.

“However, the lower rider premiums mean that Raffles Medical’s growth focus will shift to policy count and mix.”

“This also creates a differentiation opportunity where the market has noted Raffles Medical’s ability to hold rider premiums flat for two consecutive years, and in the new regime, disciplined claims management and stronger provider network governance should support retention and new business momentum,” says Jaiswal. — Teo Zheng Long

Coliwoo Holdings

Price target:

DBS Group Research ‘buy’ 88 cents

Potential earning growth in 2HFY2025

DBS Group Research is initiating a “buy” call on recently listed Coliwoo Holdings (SGX:W8W

Analysts Geraldine Wong and Derek Tan say: “We price in additional operational beds growing with Coliwoo’s two-year room growth target, with a one-year operational ramp-up to stabilisation.”

Coliwoo has the lion’s share of co-living room keys in Singapore, with close to 20% of the market, and dominates the supply pipeline. The company’s legacy business model in space configuration and modification enables it to scale rooms at an unprecedented rate and repurpose older buildings into co-living assets, unlike peers operating under the owner-operator model or competing in the private residential market. The listed portfolio comprises 2,933 rooms across 25 properties, with a strong FY2025 occupancy of 96.1%.

According to research by Cushman & Wakefield, the co-living segment remains underserved in today’s rental market, with beds accounting for just 6% of total rental housing stock in Singapore in 2025.

Co-living fills a clear gap by serving foreign students and foreign professionals - a community of over 400,000 residents and growing. Latest housing policies place higher barriers to property ownership for foreigners, which in turn is driving demand structurally higher.

For Wong and Tan, Coliwoo offers flexible lease terms and its plug-and-play model creates a fuss-free living format that resonates with young renters. Portfolio room rates are kept at a palatable sub-$3,000 per month, giving the brand strong pricing appeal compared to traditional rental options.

On that note, Coliwoo will see close to 600 keys delivered in 2026, including 141 Middle Road, 159 Jalan Loyang and Bukit Timah Fire Station, which is already completed and launched. The company targets delivering another 800 keys per year in FY2026 and FY2027.

Coliwoo has demonstrated its execution prowess in delivering forward keys and is in the process of securing another 1,140 keys (including SLA tenders with results pending) within a short span of three months since the IPO. This will make up about 70% of its two-year key strategy for 2026–2027.

“Execution of beds comes slightly ahead of our expectations and builds confidence that Coliwoo is on track to fulfil its key target of 4,000 keys by end-2026,” say Wong and Tan, noting the medium-term growth includes high-potential regional markets such as Jakarta, Bangkok, Kuala Lumpur and Johor Bahru.

The analysts also view that Coliwoo, while a spin-off listing from LHN, could emerge as a pure-play accommodation REIT in the future. — Samantha Chiew

Seatrium

Price targets:

CGS International ‘add’ $2.67

Citi Research ‘buy’ $2.65

‘Arbitration noise’

CGS International (CGSI) and Citi Research have maintained their respective positive calls on Seatrium (SGX:5E2

CGS analyst Lim Siew Khee and Meghana Kande remain steadfast in their “add” call and target price of $2.67, while Citi’s Luis Hilado reiterates his “buy” rating and target price of $2.65.

In its Jan 22 filing, Seatrium says it disagrees with Aibel over the direct scope of work and the allocation of scope responsibilities for the DolWin 5 project.

Aibel is also claiming an additional EUR17 million for some issues that it alleges fall within the scope of work for both parties. The arbitration requests were filed with the Stockholm Chamber of Commerce.

Seatrium says that there is a mutual desire for these differences to be “amicably resolved” by an independent tribunal, and hence both parties filed the requests.

The Dolwin 5 project contract comprises the design, engineering, procurement, construction, installation and commissioning of a 900 MW offshore converter platform. Keppel Offshore and Marine (before its merger with rival Sembcorp Marine to form Seatrium) and Aibel joined forces to secure the contract in 2019.

Seatrium asserts that, despite Aibel failing to “achieve a timely design freeze”, it has fulfilled its direct scope in Singapore, with the platform sailing to Aibel’s facility for further works.

Seatrium also claims that both parties mutually agreed that Aibel would be responsible, after sailaway, for works within Seatrium’s direct scope that were not completed due to Aibel’s late design freeze.

Lim and Kande point out that the project, worth $560 million to Seatrium, was secured pre-merger and is not part of TenneT’s 2 GW programme, in which Seatrium has four high-voltage direct current (HVDC) orders.

They also note that the project is on a progressive milestone billing basis and that, based on Seatrium’s preliminary assessment, its direct scope-of-work claims exposure is capped at EUR5 million.

As such, coupled with Seatrium recently resolving its dispute with Masersk, CGSI believes that “litigation noises” could cap Seatrium’s share performance. They maintain their valuation of Seatrium at $2.67, which is 1.3 times the 2026 forecasted P/B, giving a 10% discount to the counter’s historical P/B of 1.5 times. Margin expansion is a re-rating catalyst, while cost overruns and project cancellations remain risks to watch.

Meanwhile, Citi’s Hilado also notes that the project is on a progressive milestone payment. He has tried to narrow down the remaining payments due to Seatrium and points out that, based on the 9MFY2025 order book breakdown, the project should be part of a bucket of potential residual revenue bookings worth $438 million. He is unsure whether Seatrium’s demand of EUR180 million is representative of the remaining balance, as it may include penalties and other damages.

In addition to oil price volatility, the potential damage to Seatrium’s standing from a pre-merger contract dispute is another factor that could weigh down the share price, according to Hilado.

Despite the above, Hilado reaffirmed his target price of $2.65, which implies an estimated P/E of 17 times for 2025. He expects the market to recognise Seatrium’s long-term prospects, as new, higher-margin contracts should support higher returns. — Lin Daoyi