Following Starhill Global REIT’s (SGX:P40U

“Starhill Global REIT’s 1HFY2026 financials were in line with forecasts. Portfolio occupancy is expected to move back up to the high 90% level with the signing of new major tenants in China and Australia,” says Natarajan in his Feb 3 note.

Natarajan adds that the REIT’s rent reversion outlook remains positive, in the “mid-single digits”, while interest cost expense should inch lower with additional savings from the issuance of new perpetual securities. With a healthy balance sheet, he also sees that this provides the REIT room for tactical acquisitions.

With Starhill Global REIT trading at about 20% discount to book value, its valuation remains attractive.

See also: Maybank lowers FY2026 DPU by 3.8% on ESR-REIT due to ‘potential income vacuum’ from divestments

Meanwhile, Australian courts have dismissed anchor tenant Myer’s claims against the REIT for an alleged breach of lease terms, issuing a partial final award. “The tribunal will separately decide and award on the A$5 million ($4.43 million) costs incurred by the REIT manager on legal and professional fees. This amount has been fully provided for in the financials and should the cost award be favourable, the REIT manager expects part of these costs to be recovered,” says Natarajan.

He also says that the sale of Wisma Atria’s office units is likely to proceed. So far, Starhill Global REIT has divested eight units at Wisma Atria at a premium of around 20% to 30% over valuation.

“The divestments are net asset value (NAV) accretive but with a slight negative impact on dividend per unit (DPU), assuming debt repayment. The REIT still owns a 66.1% stake and is open to further strata sale, but it intends to retain a majority stake above 50%,” he says.

Meanwhile, the REIT’s market anchor lease at its China asset was terminated in December 2025, with outstanding rental arrears of $2.4 million, which were mitigated by security deposits and a rental arrears allowance. “A new replacement tenant has been signed at a slightly lower rent with income contribution expected from March 2026,” says Natarajan.

See also: RHB upgrades KORE to ‘buy’ at raised TP of 30 US cents on ‘surprise’ 2HFY2025 dividend resumption

In Australia, about two-thirds of the Technicolor vacated space in Adelaide has been taken up on a long-term lease by University Senior College, with the remaining space being marketed.

Lastly, in Singapore, the Toshin master lease’s new base rent has been set a1% higher than the previous base rent through June 2028, while the variable rent based on a profit threshold is “less likely” in the near term, notes Natarajan.

In all, Natarajan has revised his distribution per unit forecasts for FY2027 to FY2028 by 2% to 3%, adjusting his interest cost assumptions, foreign exchange and cost of equity by 50 basis points, given its low gearing.

Key drivers for the REIT, as noted by him, include an increase in visitor arrivals, a pick-up in high-end retail sales, and, lastly, good sponsor support and master leases that provide base income.

Conversely, key risks include an unexpected slowdown in retail sales driven by inflationary pressures and a weakening economy, a resurgence in interest rates, and the structural decline in the allure of Orchard Road and the shorter land tenure of its Singapore assets. — Douglas Toh

CSE Global

Price target:

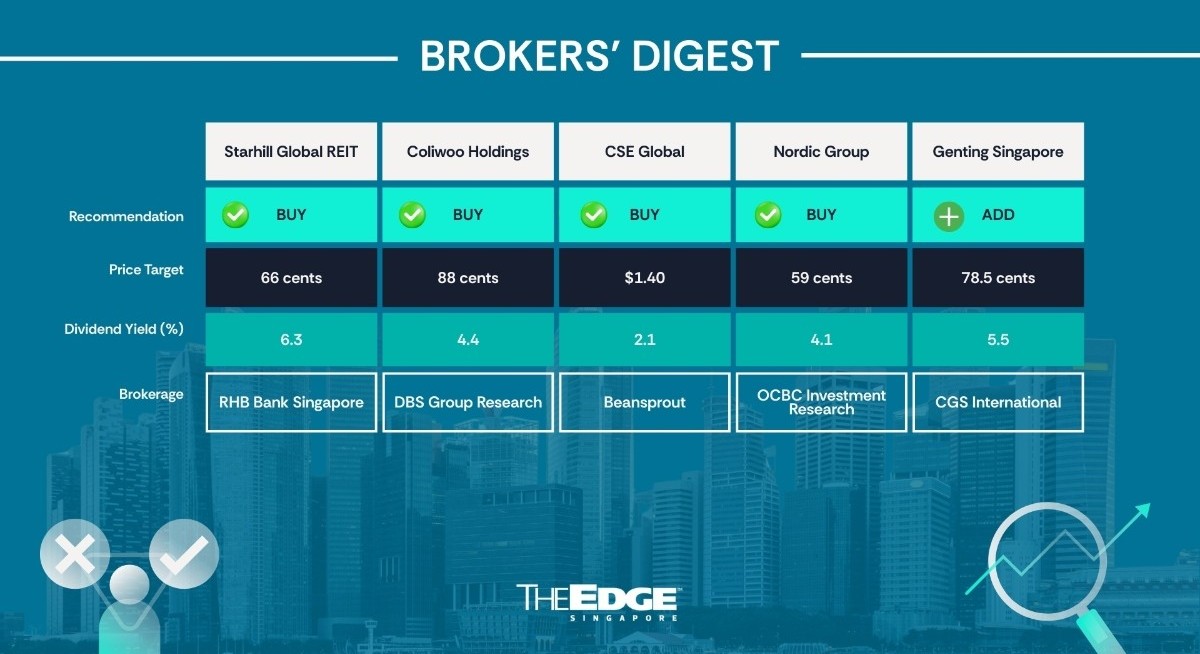

Beansprout ‘buy’ $1.40

Positioned for structural capex growth

Beansprout analyst Ng Hui Min has initiated a “buy” call on CSE Global (SGX:544

For more stories about where money flows, click here for Capital Section

In her Jan 28 report, Ng believes that CSE Global is “strategically positioned” at the heart of structural capex themes in data centres, electrification and critical communications, which should support multi-year earnings visibility as customers invest in power, grid upgrades and always-on digital infrastructure.

Back in 2025, CSE Global’s management shifted order priorities toward data centres and general infrastructure while de-emphasising new greenfield water and wastewater projects due to less attractive risk-reward and commercial terms.

From Ng’s perspective, electrification remains the key growth engine for CSE Global, supported by grid upgrades. “Management highlighted sustained demand for power-related work, driven by rising electricity consumption, grid upgrade needs and power-intensive infrastructure such as LNG terminals, alongside an expected ramp in data centre activity from 2HFY2025 ended Dec 31, 2025,” says Ng.

Meanwhile, CSE Global’s communications segment is more recurring- and run-rate-driven, supported by maintenance, time-and-materials work, rental services, and ongoing radio and network support, with growth led by the US and Australia. “Its critical communications business has meaningful exposure to government-related entities, implying low substitution risk,” explains Ng.

At the same time, the analyst sees the Amazon partnership as a key catalyst for CSE Global. “Amazon may acquire up to 62,968,580 CSE Global shares through 2030 via warrants at 76.7 cents per share, conditional on up to US$1.5 billion ($1.9 billion) of orders over five years, implying about 8% ownership and $48.3 million proceeds to support its US expansion, reinforcing the group’s positioning in AI-driven data centre buildouts,” Ng comments.

Based on Ng’s discounted cash flow valuation, CSE Global is worth $1.40 per share, representing a 30.8% upside from the current price of $1.07. “The valuation is based on a 7.9% weighted average cost of capital and a 3.0% terminal growth rate. CSE Global currently trades at 9.4 times forward EV/Ebitda and 18.0 times forward P/E ratio. — Teo Zheng Long

Coliwoo Holdings

Price target:

DBS Group Research ‘buy’ 88 cents

$101 mil acquisition a conversion opportunity

DBS Group Research is keeping a “buy” call and 88 cents target price on co-living operator Coliwoo Holdings (SGX:W8W

The 250-room hotel with a ground-floor retail asset sits on JTC land with a 30+30-year initial lease tenure, to expire come January 2068. Coliwoo plans to complete the transaction by March 31 and convert the asset to co-living use. This includes increasing the number of rooms from 250 to 360 and refreshing existing amenities at the hotels.

According to analyst Geraldine Wong, Coliwoo remains strategic in its entry into the current Park Avenue Hotel Changi, with substantial opportunities to tap the precinct. There is currently only one other hotel, Dorsett Changi, serving the Expo and Changi Business Park precinct, with rates ranging from $180 to $300 per night.

“Coliwoo’s new asset will be able to leverage on major groups of travellers in the precinct. Diversified demand audience will include business travellers within the Changi Business Park precinct, group travellers to Expo, potential accommodation demand from nearby education institute SUTD (Singapore University of Technology and Design),” says Wong.

“We believe that Coliwoo can easily charge rents above $3,000 per month and still remain price competitive to competitors,” she adds.

Wong also believes there remains upside from this conversion, driven by the addition of 110 rooms, which will translate into an uplift in asset valuation.

According to her sensitivity analysis, the asset could be revalued to $160 million, or $3,000 per month, on a slightly higher 5% cap rate assumption on about 42 years remaining leasehold. In terms of net asset value, Wong figures this could mean a double-digit uplift on FY2025 pro forma figures. — Samantha Chiew

Nordic Group

Price target:

OCBC Group Research ‘buy’ 59 cents

Upside from Micron’s expansion

Bryan Goh of OCBC Group Research has reiterated his “buy” call on Nordic Group (SGX:MR7

The company is benefitting from broader trends. “Moderating inflation and interest rate cuts since then have created favourable macro tailwinds which are supportive of the industrials sector and Nordic,” state Goh in his Jan 30 note.

“The continued resilience of Asian economies amidst current global macroeconomic uncertainties, Singapore’s capital market reforms and Nordic’s exposure to secular growth trends in tech, defence, and sustainability will also act as enablers for Nordic’s growth in the longer term, making it an attractive investment opportunity, in our view,” he adds.

Last month, US semiconductor firm Micron Technology announced a US$24 billion ($30.5 billion) investment over the next decade to expand its facilities in Singapore and Nordic, which is set to benefit from “stronger tailwinds”.

The expansion includes a substantial 65,000 sqm increase in cleanroom capacity, which Goh says will require water and hydraulic management systems critical to the high-purity cleaning processes used in wafer fabrication.

“As an existing provider of hydraulic solutions through its subsidiary, Envipure, we believe that Nordic is uniquely positioned to capture these opportunities,” says Goh.

“With the facility’s targeted operational commencement in 2H2028, we anticipate that this project will have a medium-to-longer term impact on Nordic’s growth profile rather than an immediate one,” he adds.

In addition, Nordic plans to enter the worker dorm market, targeting a “meaningful” 800-bed capacity presence. This will help the company save on accommodation costs, estimated by Goh to be around $4 million a year, equal to 27% of the company’s administrative expenses n FY2024 ended Dec 31, 2024, suggesting a “sizeable uplift” to net margins.

“While compelling, the project is contingent on regulatory approvals and construction timelines, meaning the benefits will likely materialise in the medium-to-long term,” warns Goh.

Also, Nordic is boosting synergies between its various operating subsidiaries. Specifically, it is implementing cross-training programs across Avon and Starburst to drive labour flexibility and optimise resource allocation.

“This initiative broadens the skillsets of its engineers, enabling redeployment without incurring costs associated with just-in-time hiring or outsourcing.

With economies of scale, this move is seen to yield sustainable cost savings and improve overall margin resilience, says Goh.

As these various developments take time to manifest at the bottom line, Goh is keeping his FY2026 earnings estimates and, therefore, his fair value at 59 cents for now. — The Edge Singapore

Genting Singapore

Price target:

CGS International ‘add’ 78.5 cents

Expectation of gradual earnings growth from 1QFY2026

CGS International is reiterating its “add” call and 78.5 cents target price on the Resort World Sentosa (RWS) operator Genting Singapore (GENS) (SGX:G13

This comes on the back of competitor Las Vegas Sands (LVS), the operator of Marina Bay Sands (MBS), releasing its 4QFY2025 results, which saw a hold-adjusted ebitda of US$761 million, 36.4% higher y-o-y, due to a quarterly record net gaming revenue of US$1.2 billion ($1.53 billion), 52.0% higher y-o-y.

LVS’s gross gaming revenues (GGR) for VIP and mass gaming segments were also at a record high during the quarter. Non-gaming revenue also grew, attributable to higher room revenue from the completion of its suite renovation and refurbishment programme in 2QFY2025.

In a local context, the Singapore Tourism Board (STB) reported that Singapore’s monthly international visitor arrivals only rose 4.9% in October 2025 and 4.8% y-o-y in November 2025, implying a seasonally weaker tourist visitorship q-o-q.

“We think this highlights that MBS’s revenue growth was outsized versus the broader tourism industry in Singapore,” says analyst Tay Wee Kuang, who also believes that this suggests that RWS could continue to see market share declines in 4QFY2025 ended Dec 31, 2025, which would translate to a softer 4QFY2025F adjusted Ebitda for GENS.

Overall, Tay believes GENS will begin to show gradual y-o-y and q-o-q earnings growth from 1QFY2026. “We believe it should take time for GENS to ramp up profit contribution from its new attractions launched in FY2025, including the Singapore Oceanarium as well as its all-suite hotel The Laurus by Marriott, introduced in 2H2025 as part of RWS 1.5,” he adds. — Samantha Chiew