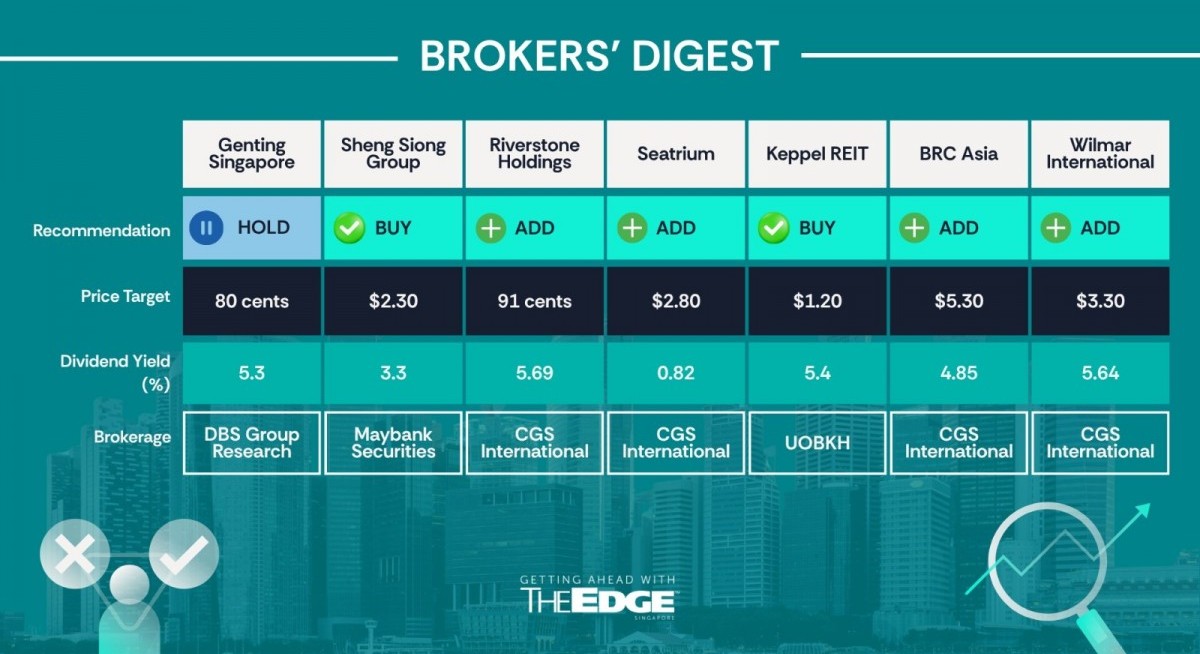

CGS International ‘add’ 91 cents

Tng flags lower earnings from currency shifts

William Tng of CGS International has held his “add” call on glove maker Riverstone Holdings. He expects the company to report better 2HFY2025 earnings but warns that there will be some drag from a weaker US dollar (USD) versus the ringgit, the reporting currency.

For 3QFY2025 ended May, Tng expects the company to report earnings that are up 31% q-o-q, thanks to electronics-related demand for gloves used in cleanrooms, but down 18% y-o-y to RM59 million ($18.12 million).

See also: StarHub’s weak FY2026 guidance leads DBS to review call while Morningstar flags overvaluation

Citing market leader Top Glove, which reported its earnings recently, the costs of raw materials have eased for the industry. Tng, in his Oct 13 note, notes that Riverstone should also benefit.

However, having factored in a weaker US dollar, Tng is expecting FY2025 earnings to dip by 8.3%. Even so, he is keeping his “add” call as he believes that the decline has already been priced in.

“In our view, 2HFY2025 earnings are on track for better h-o-h performance despite our earnings cuts, while its 5.7%–7.2% dividend yields limit share price downside.

See also: IFAST share price dips despite strong earnings 4QFY2025 announcement; DBS maintains ‘buy’ at $12

Tng values the company at 91 cents, which is based on 15.6 times FY2027 earnings, a valuation multiple that is +0.5 standard deviations (s.d.) above its average P/E in the past 10 years.

Tng says he has applied the +0.5 s.d. premium given its earnings exposure to higher margin cleanroom gloves versus its competitors and management’s commitment to return excess cash earned during the Covid-19 pandemic to shareholders.

Re-rating catalysts will include stronger-than-expected glove demand recovery and better sales of cleanroom gloves on the back of a recovery in the electronics sector.

On the other hand, downside risks include weaker-than-expected gross margins due to changes in product mix and a stronger ringgit against the USD. Additionally, the increased competition in the Asia and Europe markets, resulting from higher US tariffs that have prompted Chinese suppliers to divert their glove output to these regions, will also be a negative factor. — The Edge Singapore

Seatrium

Price target:

CGS International ‘add’ $2.80

For more stories about where money flows, click here for Capital Section

US$475 mil order cancellation by Maersk

Lim Siew Khee and Meghana Kande of CGS International were surprised by Maersk’s termination of a US$475 million ($618 million) order with Seatrium. As they await further details on the termination, the analysts expect a knee-jerk reaction to Seatrium’s share price.

If the case becomes protracted, they expect Seatrium to cover $20 million in related costs for the current FY2025, ending December 31.

For now, they are keeping their “add” call and $2.80 target price as they still see Seatrium reporting core profit growth and margin recovery for this year.

On Oct 10, Seatrium said that the order for a nearly completed wind turbine installation vessel (WTIV) was cancelled by the customer, Maersk Offshore Wind, a subsidiary of the shipping giant.

The contract was awarded in 2022 to pre-merger Sembcorp Marine for delivery in the coming FY2026. This vessel was to be deployed at a US offshore wind farm, Empire Wind 1, operated by Equinor.

“We suspect the termination by Maersk is due to the unstable offshore wind market in the US and potentially lower life cycle returns from the project,” state Lim and Kande in their Oct 10 note.

In April, the US government issued a stop-work order on the Empire Wind project, which was lifted the following month.

Equinor had already taken US$763 million in impairments in 2QFY2025 related to the combined Empire Wind 1/South Brooklyn Marine Terminal project, driven by reduced expected synergies from future offshore wind projects due to regulatory changes and increased exposure to tariffs.

“That said, Equinor noted that project development was still on track,” according to the analysts, adding that daily rates for a 14MW-20MW WTIV are now around US$300,000 to US$350,000.

Lim and Kande note that Seatrium is reviewing the validity of the termination and considering legal and or commercial actions, potential claims for wrongful termination, or other remedies. “We think Seatrium could negotiate with Equinor or find another operator to take over the vessel.”

They also point out that the project was won in 2022, when the industry was at its doldrums and margins of orders won back then tend to be lower at just 5% to 6% ebit.

Assuming 80% of revenue has been recognised, they estimate a profit impact of $30 million for the contract.

On the other hand, the construction work on the 810MW Empire Wind 1 offshore substation platform for Equinor, with a 2026 delivery, likely worth $150 million, remains unaffected, say Lim and Kande.

With prospects of improving core profit and better margins this year, they are keeping their “add” call. Downside risks are order cancellations and project cost overruns, while catalysts include sizeable order wins and stronger-than-expected margins.— The Edge Singapore

Keppel REIT

Price target:

UOB Kay Hian ‘buy’ $1.20

From office to resilient retail

Jonathan Koh of UOB Kay Hian has kept his “buy” call and $1.20 target price on Keppel REIT following the acquisition of an effective stake of 75% in a Sydney mall for $334.8 million. “This marks Keppel REIT’s first retail asset and represents a strategic expansion into the retail sector, diversifying its traditionally office-focused portfolio,” states Koh in his Oct 9 note.

The freehold Top Ryde City Shopping Centre, described as a “regional mall”, has a lettable area of 77,054 sqm and is anchored by major non-discretionary tenants such as Aldi, Coles, Woolworths and Kmart, which contribute to 77% of the gross rental income. Other notable tenants include Australia Post, Priceline Pharmacy, KFC, Subway and Westpac.

It has a committed occupancy rate of 96% and a long weighted average lease expiry of 4.2 years, which means it offers defensive characteristics and stable income generation. According to Koh, regional malls in Australia enjoyed the lowest vacancy rates among retail formats at 2.1% last year. With the acquisition, Keppel REIT’s largely office portfolio will grow to $9.8 billion in value, with retail assets making up 4.2% of the portfolio.

Koh notes that this acquisition is accretive to the REIT’s distribution per unit (DPU), with an expected initial property yield of 6.7% and a pro forma adjusted DPU accretion of 1.34% in 2024. Following the deal, slated for completion in 1QFY2026, the REIT’s aggregate leverage is expected to remain stable at 41.6%.

According to Koh, the Top Ryde City Shopping Centre benefits from population growth in its surrounding region, where the City of Ryde’s population increased by 16.2% between 2015 and 2024, outpacing 8.8% for the rest of New South Wales.

Koh says that within a 3km catchment area, average household income is A$128,164 ($109,032), versus A$95,175 for the rest of New South Wales. “This demographic trend supports long-term consumption growth. The mall is well-positioned to capture increasing footfall and tenant demand as retail space per capita is projected to decline amid rising population,” says Koh.

Keppel REIT will fund 60% of the deal via a private placement priced at 98.3 cents per unit and the issuance of subordinated perpetual securities. The remaining 40% will be financed using Australian dollar-denominated loans at a cost of low- to mid-4%, which serve as a natural hedge against currency fluctuations. “This balanced funding structure supports financial flexibility while mitigating forex risks associated with cross-border investments,” says Koh.

“The expansion and diversification into retail assets is much welcome as they are defensive, resilient and provide more attractive net property income yield. Keppel REIT intends to remain Singapore-centric and office-focused,” adds Koh, noting that the REIT will cap the exposure to retail assets at 20% of portfolio valuation.

At current levels, Keppel REIT trades at an attractive valuation based on a distribution yield of 5.7% and a P/NAV (Price/Net asset value) of 0.85 times. — The Edge Singapore

BRC Asia

Price target:

CGS International ‘add’ $5.30

More demand with higher-density developments

Natalie Ong of CGS International (CGSI), citing a new peak in Singapore steel demand, has raised her target price for BRC Asia from $4.30 to $5.30. Besides the official projection of construction demand between $39 and $42 billion this year, Ong, in her Oct 9 note, points out that many of the new projects are high-density developments in nature and will therefore result in demand for reinforced steel sold by the likes of BRC Asia to surpass the historical peak in 2015. “As taller buildings face more gravitational and lateral loads, they require more complex structural systems that incorporate more structural and reinforced steel,” says Ong.

While the company does not produce structural steel components, she expects it to benefit from the increased cut-and-bend and mesh elements required for higher-density developments.

Citing statistics from the Building and Construction Authority (BCA), construction demand in the first eight months of the year, based on contracts awarded, was up 8% y-o-y; steel demand from Jan to July was up $25 y-o-y, which is at the higher end of BCA’s projections for the whole of this year.

Ong is reiterating her “add” call for this stock as BRC Asia, as the market leader with a share of more than half, is benefitting not just from the construction upcycle but also growing interest in small- to mid-caps here in Singapore.

Her higher target price of $5.30 is pegged to one standard deviation (s.d.) of BRC’s 12-year P/E of 15 times, versus the 20-year historical construction cycle high of 12 times used previously.

Ong says that over the last seven years, dominant building material players in Singapore — BRC Asia and Pan United Corp traded at 13 times/17 times forward P/E at the +1/+2 s.d. levels.

Re-rating catalysts include strong improvements in offtake volumes and earnings-accretive M&A, while downside risks include counterparty credit risks and economic slowdown negatively impacting construction demand. — The Edge Singapore

Wilmar International

Price target:

CGS International ‘add’ $3.30

The worst could be over

CGS International is upgrading its call on Wilmar International to “add” from “reduce”, with a higher target price of $3.30 from $2.70. According to analyst Jacquelyn Yow, the worst may be over for the group, allowing investors to look forward to improved business segment performance. “We believe the 13% drop in Wilmar’s share price from its recent peak in March 2025 would have factored in most concerns over the court case that concluded with a US$709 million ($920 million) fine imposed by the Indonesian Supreme Court,” she says.

With that, she expects Wilmar’s businesses to recover gradually in FY2026–FY2027, led by China. Based on channel checks, she expects Wilmar’s China soybean crushing margin to come in higher than peers in 3QFY2025, supported by its competitive feedstock pricing and stronger demand for soybean meal.

“We expect Wilmar to report a 3QFY2025 net loss of US$400 million to US$420 million, taking the fine into consideration. Excluding this, we forecast 3QFY2025 core net profit at US$290 million to US$310 million (+29% q-o-q, +50% y-o-y), underpinned by higher utilisation of China soybean crushing plants and healthy margins; gradual recovery in China consumer spending; and higher crude palm oil (CPO) prices,” says Yow.

After factoring in the US$709 million fine, Yow expects Wilmar to report a net loss of US$400 million to US$420 million in 3QFY2025, although core net profit should improve across all business segments.

In the food products segment, she anticipates continued q-o-q and y-o-y sales volume growth, particularly for medium pack and bulk products, supported by stable margins. For the feed and industrial products segment, the group is expected to report higher sales volume and healthy margins in the oilseed & grains sub-segment, partially offset by challenging refining margins in the tropical oil sub-segment. Strong CPO prices in 3Q2025 are expected to support performance in the plantation and sugar milling segment, in the research house’s view.

“While some overhang issues remain in Indonesia — such as potential land confiscation and ongoing investigations into rice mislabelling — these are viewed as relatively minor compared to the one-off penalty already concluded,” says Yow. — Samantha Chiew

Genting Singapore

Price target:

DBS Group Research hold’ 80 cents

Parent company may tap for more dividends

Genting Singapore’s minority shareholders may enjoy indirect benefits from the privatisation bid of Genting Malaysia by Genting Berhad, according to DBS Group Research on Oct 14.

The latter is offering RM2.35 (72 cents) per share to acquire the remaining 50.64% of Genting Malaysia in a RM6.7 billion deal. Genting Berhad plans to fund the deal with RM6.3 billion of new debt. The privatisation bid aims to secure clear majority control of Genting Malaysia, thereby better supporting its New York casino bid.

DBS Group Research notes that if Genting Malaysia wins the licence, Genting Berhad’s leverage would rise materially, given the proposed US$5.5 billion ($7.14 billion) investment.

Meanwhile, Genting Berhad, which controls Singapore-listed Genting Singapore, may seek “higher-than-expected” dividends from the subsidiary entity to help fund group debt service.

“Given Genting Singapore’s strong net cash position and robust free cash flow, we see higher dividends from Genting Singapore as the most probable avenue to support the group’s leverage,” says DBS.

According to DBS, the consensus view is that Genting Singapore will pay a 4 cent per share dividend for the current FY2025, which will be unchanged from the previous year, given “challenging operations”.

“Any indication of a payout above this level could be a positive re-rating catalyst,” says DBS, whose “hold” call and 80 cents target price remains. — The Edge Singapore

Sheng Siong Group

Price target:

Maybank Securities ‘buy’ $2.30

Favourable macro backdrop

Hussaini Saifee of Maybank Securities has reiterated his “buy” call and $2.30 target price on Sheng Siong Group, given how the supermarket chain operator is seen to be well-positioned amid a favourable macro backdrop.

Besides a growing population — led by a bigger foreign workforce here to support the construction boom — Sheng Siong is enjoying demand too from government vouchers that will help fuel “resilient consumption”. He notes that supermarket sales rose 9.2% y-o-y in July and August, well ahead of 1HFY2025’s 1.7% growth.

With 10 new stores added year-to-date, Sheng Siong has not only exceeded its own target of eight new stores but is also outpacing competitors such as Giant and Cold Storage, which are scaling back. Saifee, citing channel checks, is observing strong early traction at Sheng Siong’s new Kinex and Cathay stores.

In contrast, nearby stores like CS@Plaza Singapura and CS@Joo Chiat or Giant@Marine Parade show “relatively muted” foot traffic.

The company has been in the news recently for a $520 million distribution centre that will help support improvements in efficiencies and multi-year growth ahead. Saifee estimates that the centre will increase Sheng Siong’s annual depreciation and amortisation costs by around $10 million.

This estimate is based on construction costs of $360 million, plant and machinery of $120 million, and land lease costs of $46 million, with useful lives ranging from 10 to 40 years.

“The more automated facility is expected to boost operational efficiency, support store and stock-keeping unit growth, and reduce reliance on temporary warehousing during peak seasons, such as Chinese New Year and Hari Raya,” he says.

He believes that higher depreciation and amortisation costs will reduce Sheng Siong’s FY2027 and FY2028 net profit after tax by approximately 5%. However, there’s potential upside from the better efficiencies.

The stock is now trading at 20 times earnings, in line with peers. “Sheng Siong offers a superior growth and margin profile,” says Saifee. — The Edge Singapore