UOB Kay Hian ‘buy’ US$5.30

Bolder targets and greater expectations

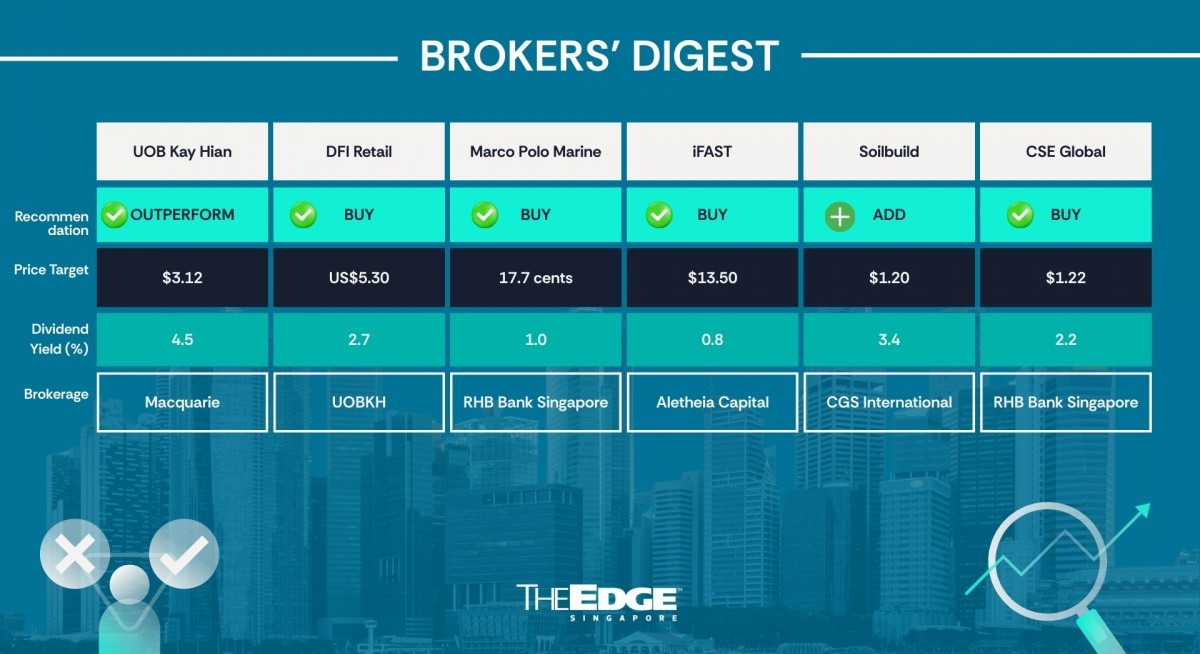

UOB Kay Hian’s Adrian Loh has raised his target price for DFI Retail Group (SGX:D01

“For the first time since our initiation in 2021, the company has communicated its long-term growth targets, thus giving us and investors greater confidence in the company’s growth trajectory,” says Loh in his Jan 19 report.

See also: PhillipCapital, UOB Kay Hian raise respective target prices for BRC Asia following 1QFY2026 earnings

The way Loh sees it, the guidance reflects a disciplined shift towards higher returns, stronger cash generation and improved capital efficiency, with targets showing a steady uplift in operating margins, underpinned by savings of US$30 million to US$35 million by FY2028.

The company has indicated different strategies for its diversified business portfolio. Its health and wellness brand, Guardian, is being repositioned as a higher-margin, expert-led retail model anchored in trust, data and personalisation. This positioning stressed “deeper wellness penetration” and aims to generate more than 35% of its sales. “Network expansion, particularly in Indonesia, underpins scale, while SKU [stock keeping unit] rationalisation, informed by extensive customer surveys, improves margins,” says Loh.

The convenience store business is expected to remain a core growth engine, with management aiming to expand margins rather than volume to drive earnings growth. High urban density, store network expansion and a strategic pivot towards higher-margin ready-to-eat offerings via food bars and refreshed store concepts will be key for this segment. While Hong Kong will remain as this segment’s “earnings anchor”, mainland China will be where “ample” continued expansion will take place, says Loh.

See also: Citi ups target prices on all three banks; prefers Singapore banks over SGX for EQDP play

On the other hand, the food segment remains a challenge due to deflationary pressures and tougher e-commerce competition. The company will compete on price and beef up the efficiency of its supply chains to drive sales growth and margins. The company will also remodel some of its stores and shift towards smaller, omni-enabled formats. For example, physical supermarkets will be “engineered” to complete multiple customer missions and fulfilment modes simultaneously. “Due to the medium-term nature of these strategies, it would appear that margins and returns can only stabilise and increase over the medium term,” Loh predicts.

The home furnishings segment, driven by its Ikea franchise, will see some growth, but is not likely to be “meaningful”. Ikea in Taiwan will be a “relative bright spot” but other markets “continue to swim against the tide of weaker consumer spending”. Drawing on DFI’s series of divestments over the past couple of years, Loh says this segment might be sold as well, given that it is the smallest contributor to operating profit, accounting for only 8% in 2024.

As such, the analyst is maintaining his “buy” call on DFI, with a higher P/E-based target price of US$5.30, up from US$4.30 previously, given that he has rolled forward his valuation to FY2026.

“In addition, we have raised our target P/E multiple to 25.1 times, which is in line with the company’s long-term average P/E multiple. Before this, we had used a target P/E multiple of 22.7 times that was 0.5 standard deviations (s.d.) below its long-term average,” Loh explains.

For now, DFI Retail shares appear to be trading at an “inexpensive” multiple, with a 11% discount to its regional peers relative to its FY2026 earnings, yet it can deliver a slightly higher yield and command the highest return on equity. “We note that at 1 s.d. above its long-term average, our target price for DFI would rise to US$6.74 in 2027,” he says. — The Edge Singapore

Marco Polo Marine

Price target:

For more stories about where money flows, click here for Capital Section

RHB Bank Singapore ‘buy’ 17.7 cents

Stronger yard revenue

Alfie Yeo of RHB Bank Singapore has become more bullish on Marco Polo Marine (SGX:5LY

“We remain upbeat on Marco Polo Marine due to its accelerating growth outlook,” states Yeo in his Jan 16 note, where he has kept his “buy” call but with a higher target price of 17.7 cents, from 14 cents previously.

In his Jan 16 note, Yeo suggests that the company’s revenue from its shipyard operations could be stronger than expected, thanks to a bigger capacity and more orders. He was previously projecting FY2026 revenue of $97 million.

Yeo now believes the yard can book $120 million in revenue instead. For one, the $198 million contract to build a vessel for Taiwan’s Academy of Marine Research can be completed in three years instead of four as previously estimated.

Yeo is also expecting stronger revenue estimates for other ship repair activities. As such, he has raised his FY2026, FY2027 and FY2028 earnings forecasts by 4%, 9% and 9%, respectively.

He believes that Marco Polo Marine is now trading at “compelling” valuations of 13 times FY2026 earnings. The company is set to deliver strong earnings growth of more than 50% y-o-y in FY2026 and to continue growing at a CAGR of 22% through FY2028. Yeo’s revised target price is based on 15 times FY2026 earnings. — The Edge Singapore

iFast Corp

Price target:

Aletheia Capital ‘buy’ $13.50

Partnership with Financial Alliance

Aletheia Capital analyst Nirgunan Tiruchelvam is keeping his “buy” recommendation on iFast (SGX:AIY

According to Tiruchelvam’s report on Jan 15, he predicts that this partnership should accelerate iFast’s growth in assets under administration (AUA) FY2026–FY2028 by around 5% per annum and drive mid-single-digit upside to revenue and ebitda on operating leverage.

“Key drivers for the incremental tailwinds from this partnership include access to a larger adviser/distribution network, faster client onboarding and conversion via a more scalable acquisition channel, and improved stickiness from recurring, adviser-led platform flows,” says the analyst.

Meanwhile, iFast disclosed that the consideration was about $19.6 million. This appears reasonable based on Tiruchelvam’s estimates, given that it is approximately 16 times FY2025’s earnings.

From Tiruchelvam’s perspective, this partnership is a long-term distribution option, not a near-term earnings event. “It expands iFast’s reach into the adviser channel, supporting faster onboarding and stickier recurring flows,” explains Tiruchelvam.

At the same time, the analyst sees upside from deeper platform integration, higher adviser productivity and greater wallet share through cross-sell. It also preserves longer-dated flexibility to deepen the relationship if key performance indicators are met.

According to Tiruchelvam, despite the superior earning visibility and balance sheet strength, iFast remains undervalued and trades at a discount to global digital wealth and platform peers.

Based on his updated forecast, iFast trades at 17 times forward EV/Ebitda, versus the peer average of 23 times. Tiruchelvam views this valuation gap as “unjustified”.

As such, Tiruchelvam has raised his target price for iFast to $13.50, reflecting higher AUA forecasts by incorporating the Financial Alliance partnership and continued confidence in the group’s long-term platform economics.

“The stock offers an attractive risk-reward profile with around 50% upside, supported by recurring revenues, balance-sheet optionality, and improving institutional penetration. The 10% buyback mandate, backed by net cash position above $1.2 billion and strong free cash flow, signals continued confidence in its intrinsic value,” the analyst concludes. — Teo Zheng Long

Soilbuild Construction Group

Price target:

CGS International ‘add’ $1.20

Towards a $1 bil order book

Soilbuild Construction Group (SGX:ZQM

The analysts have kept their “add” call on the group after hosting the latter at its Singapore Value-Up Conference in Kuala Lumpur on Jan 13.

“According to Soilbuild, its tender book remains strong at $1 billion for semiconductor plants, warehouses, Tuas Mega Port works and industrial development via unlisted Soilbuild Holding’s bid for Industrial Government Land Sales,” Lim and Then write in their Jan 15 report.

Even though construction order wins tapered on a h-o-h basis in the second half of the year due to delayed capex plans by corporates, the analysts believe there were pockets of precast orders from HDB build-to-order projects.

As such, they have maintained their order-win targets at $530 million and $450 million for FY2025 and FY2026, respectively, with a potential 5% to 10% variation in FY2025 wins due to delays in awarding construction projects.

The analysts also expect to see an uplift in Soilbuild’s margins with management expecting to complete the Tuas Mega Port’s supply-chain project, a “key contributor” to Soilbuild’s $1.2 billion order book as of 1H2025, by 1Q2027. The project is also estimated to obtain the first phase of its temporary occupation permit in April 2027, ahead of its initial completion target in 3Q2027.

In their view, early completion of the project could deliver upside to their gross profit margin (GPM) estimate of 16% in FY2027 and free up the group’s capacity to take on more projects, especially from the Port of Singapore Authority.

Ahead of Soilbuild’s full-year results, the analysts foresee Soilbuild to end the year in a net cash position with a 116% y-o-y surge in FY2025’s earnings.

“Given its low capex commitments, we up our FY2025/FY2026 dividend payout percentage to 35% from 20% (FY2024: 18%) or dividend per share of 3.2 cents, implying a yield of 3.6%,” say Lim and Then. “This is backed by FY2025 ending cash balance of $60 million (higher than its historical 10-year average of $20 million).”

The analysts have increased their target price to $1.20 from $1.05, pegged to an FY2027 P/E of 10 times, in line with the average P/Es of Singapore builders.

CGSI’s earnings and target price estimate have been adjusted from Soilbuild’s one-for-four stock split, from Jan 12. — Felicia Tan

CSE Global

Price target:

RHB Bank Singapore ‘buy’ $1.22

Positive prospects from Amazon orders

Citing positive prospects driven by upcoming Amazon orders over the coming years, Alfie Yeo of RHB Bank Singapore is maintaining his “buy” call on CSE Global (SGX:544

In his Jan 13 report, he points out that CSE Global’s contract wins back in December 2025 include a contract variation for an existing project with an existing hyperscaler customer, and three major electrification jobs worth US$124.6 million ($161.7 million).

“The projects involve designing and manufacturing power distribution centres, as well as integrating complex electrical and control systems and equipment for the LNG market in the US,” says Yeo.

Meanwhile, the execution of the contracts is expected to take place between 2026 and 2028.

“In contrast, the variation contract with its existing hyperscaler customer for the data centre (DC) market involves designing, engineering, fabrication, installation and integrating power management systems and solutions,” Yeo adds.

According to him, the variation contract work is in the US and is worth US$143.5 million ($186.3 million).

From Yeo’s perspective, CSE Global has been building strong momentum in orders from the fast-growing DC market, driven by growing demand for cloud services and he expects this variation contract to contribute positively to group numbers through FY2026.

Meanwhile, CSE Global previously announced that it is issuing 63 million warrants to its customer, Amazon, under a commercial agreement that will see the company receive US$1.5 billion in orders from the e-commerce giant over the next five years.

CSE Global further updated in December 2025 that it had received approval in principle from the Singapore bourse for the listing and quotation of these warrants

on the Mainboard, subject to a written undertaking and confirmation that it will

comply with certain rules in the listing manual.

“Overall, we remain upbeat on CSE Global and have already imputed an 8% dilution to EPS on the warrants issuance, and imputed a better earnings outlook in anticipation of Amazon’s upcoming orders.”

“The recent order wins will support our earnings estimates going forward. We see strong earnings growth next year, fuelled by Amazon’s average annual orders of $400 million. Our earnings estimates remain unchanged,” predicts Yeo.

As such, the analyst reiterates his “buy” call on CSE Global, with an unchanged target price of $1.22, representing a potential upside of 14% and a 3% FY2026 dividend yield.

“We continue to like CSE Global for its positive prospects, led by upcoming Amazon orders in the coming years. Its orderbook ($467 million as of September 2025) is now bolstered by further order wins, which should support core earnings growth.”

“CSE Global’s warrant issue to Amazon is positive, in our view, with growth backed by the latter’s planned US$1.5 billion over the next five years. Target price is based on 20 times FY2026 P/E ratio,” concludes Yeo. — Teo Zheng Long