(Jan 27): SK Hynix Inc shares jumped, headed for an all-time high closing level, after local media said the company is the sole supplier of advanced memory for Microsoft Corp’s new artificial intelligence (AI) chip.

The stock rose as much as 7.7% on the Korea Exchange, erasing an early loss on the latest tariff threat from US President Donald Trump. The shares have continued to climb this year, extending an AI-fuelled rally that has driven the South Korean company to a market value of nearly US$400 billion.

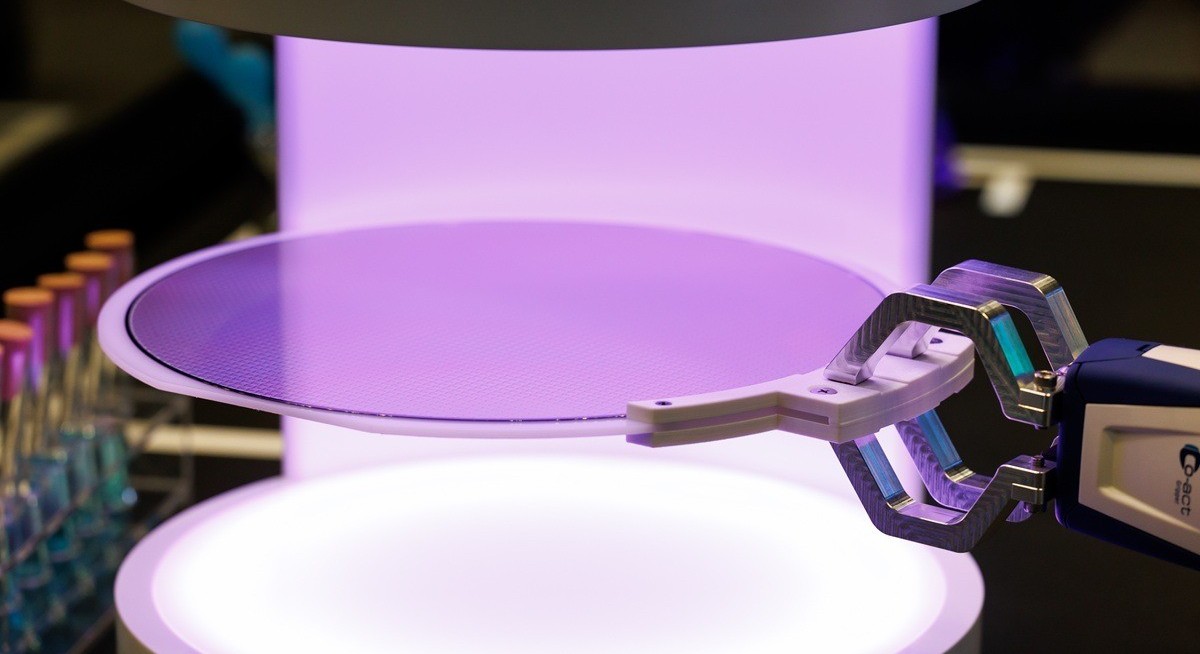

Each of the Maia 200 accelerators unveiled by Microsoft on Monday will use six units of SK Hynix’s HBM3E, Maeil Business Newspaper reported, citing chip industry and brokerage sources. SK Hynix is unable to confirm or disclose any customer-related information, a company spokesperson said in a text message.

The firm’s shares have surged tenfold in around three years, riding investor enthusiasm for AI, thanks to its early supply deal with Nvidia Corp. Pricing of legacy memory chips has started to improve as well, boosting the outlook for SK Hynix ahead of its results due Thursday.

Tuesday’s gain was supported by “dip buying and rising HBM earnings expectations,” said Jung In Yun, chief executive officer at Fibonacci Asset Management Global. “We will probably see SK Hynix earnings meeting expectations again,” he added.

See also: Micron invests US$24 bil in Singapore to boost chip output

Another positive tailwind came as Citigroup Inc hiked its price target for SK Hynix by 56% to a street-high 1,400,000 won. They maintained their "buy" rating and opened a 30-day upside catalyst watch on the stock.

“The memory market is shifting towards semi-customisation, with memory customers required to sign a contract a year prior to actual product delivery,” analyst Peter Lee wrote in a note Monday. “In 2026, we foresee global DRAM/NAND pricing growth to be significantly better than expected.”

Uploaded by Liza Shireen Koshy