Deliberations are ongoing and details such as the IPO size may change, the people said, noting that the number could also be about US$1 billion.

A Baidu spokesperson didn’t respond to email requests for comment. China Securities, CICC and Huatai also didn’t respond, and Citic declined to comment.

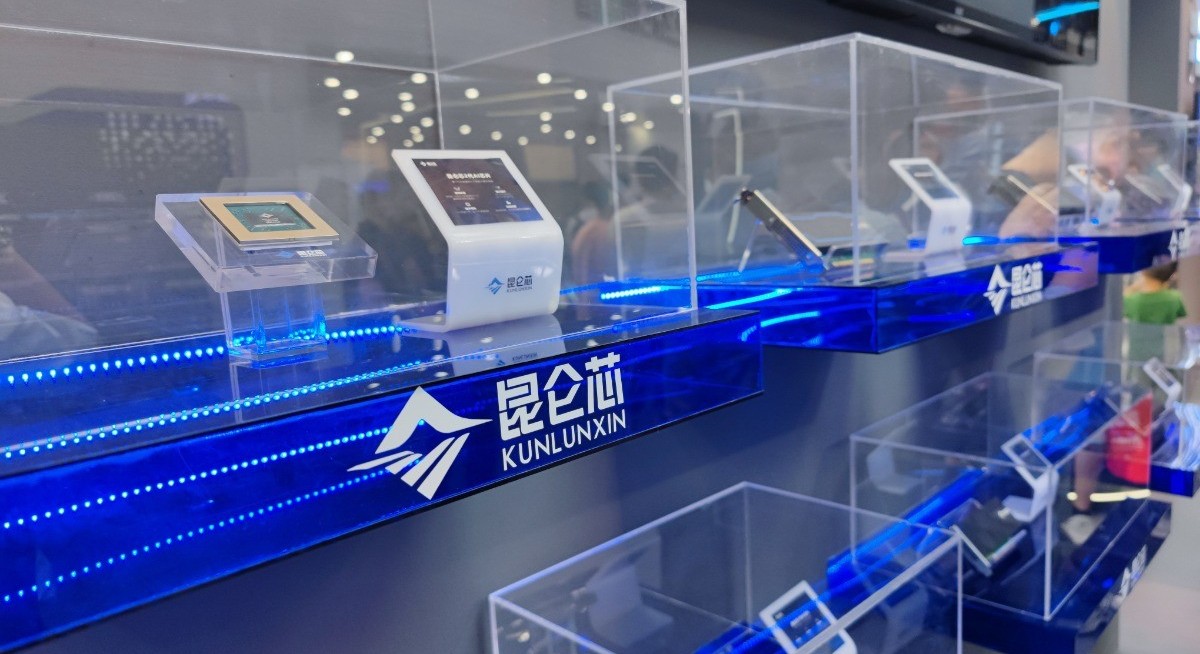

Kunlunxin, which makes chips that power servers in data centres, confidentially filed for the IPO last week, Baidu said on Jan 2.

AI-related companies are going public in Hong Kong to tap investor demand for a sector deemed strategic by Beijing as it pushes for technological self-reliance. AI chip designer Shanghai Biren Technology Co’s shares jumped 76% on their Hong Kong debut last week, while others that listed on mainland Chinese exchanges at the end of last year posted triple-digit first-day gains.

See also: Goldi Solar said to consider US$350 mil India IPO — Bloomberg

Kunlunxin was created in part to sate Baidu’s appetite for computing power to run its online businesses, and it is one of a few Chinese companies capable of designing the powerful accelerators essential for AI operations. Along with firms like Huawei Technologies Co and Cambricon Technologies Corp, Kunlunxin is likely to be central to Beijing’s effort to wean the country off US technology such as Nvidia Corp chips.

Uploaded by Tham Yek Lee