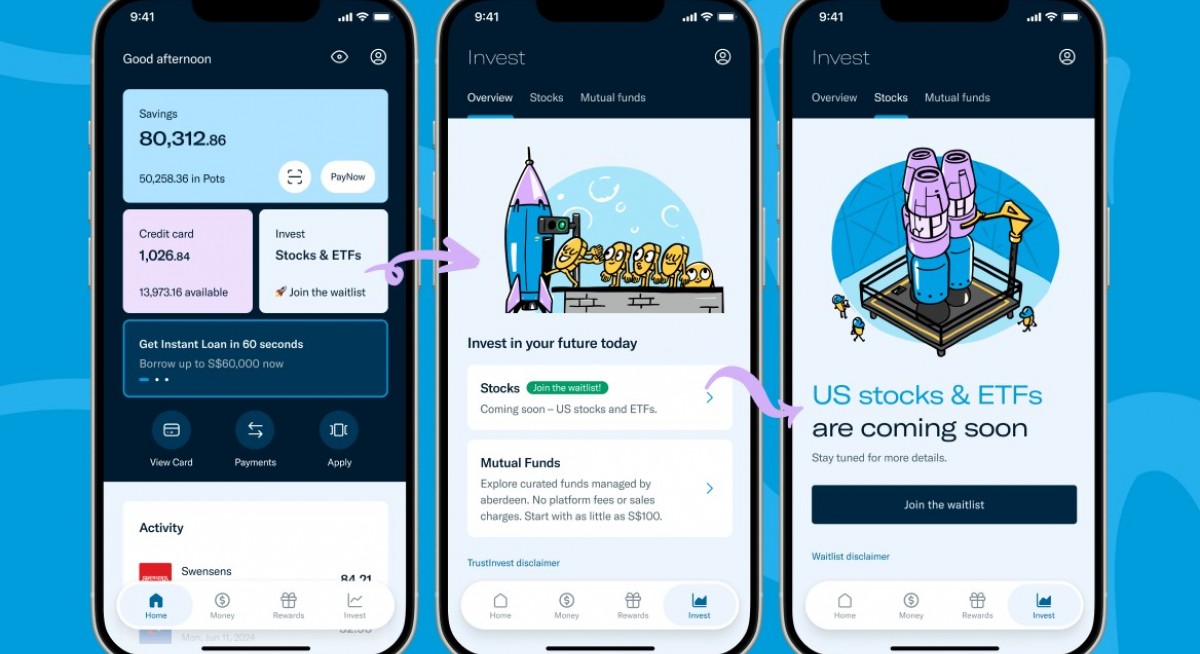

Trust customers who join the TrustInvest waitlist will be invited to open their stocks account on a first-come, first-served basis over the coming weeks, says a spokesperson to The Edge Singapore.

In an Oct 15 announcement, Trust says it will become the first banking app in Singapore to offer its customers fractional trading.

Responding to The Edge Singapore, Trust says customers will be able to trade fractional shares on TrustInvest’s trading platform from US$10 ($12.94).

Trust did not respond to questions about the fee structure, the number of accounts it will welcome in this initial batch, the specific US exchanges that will be supported and whether it received additional licences from the Monetary Authority of Singapore to offer stockbroking services.

See also: Private capital software provider Carta opens new Singapore office

Instead, the digital bank says it will share more details in the coming months.

Dwaipayan Sadhu, CEO of Trust Bank, says: “Following the success of our initial TrustInvest launch, we are excited to expand our offering so that customers can trade US stocks and ETFs. Offering fractional trading means that all our customers can access a wide range of investments, with the confidence of doing so through an easy to use and seamless banking app.”