On July 31, the New Keppel announced a 25% y-o-y rise in net profit to $431 million in 1HFY2025. This excludes Old Keppel, which is the non-core portfolio for divestment. The rise in net profit was underpinned by earnings in the infrastructure segment and higher contributions from real estate.

“On the back of its asset-light strategy and focus on growing recurring income, the New Keppel achieved an annualised ROE of 15.4% in 1H2025, improving from 13.2% in 1H2024, while its recurring income grew 7% y-o-y to $444 million in 1H2025, compared to $414 million in 1H2024,” the company said in a press release.

Keppel’s asset management fees in 1HFY2025 stood at $195 million at a feeto-FUM (funds under management) ratio of 48 basis points (bps). Interestingly, CapitaLand Investment’s (CLI) fee-to-FUM ratio in FY2024 was also 48 bps.

In prepared remarks, group CEO Loh Chin Hua of Keppel says: “The New Keppel is delivering strong earnings from only a part of our balance sheet. This leaves significant value to be unlocked from releasing that part of the balance sheet that is not required by the New Keppel. By reporting the non-core portfolio separately, we aim to provide greater transparency on our performance as a global asset manager and operator. Looking ahead, we will focus on accelerating the growth of the New Keppel and monetising the $14.4 billion non-core portfolio, which includes $2.9 billion of embedded cash and receivables. This positions Keppel for a further re-rating as we unlock capital for growth, to reduce debt and to reward our shareholders.”

See also: Metro Holdings divests 26% stake in Boustead Industrial Fund

Keppel’s management did not detail the $14.4 billion non-core portfolio, but it comprises the legacy offshore & marine assets, including rigs, some property assets mainly in China and Vietnam, and limited connectivity assets. M1’s consumer business could possibly be included.

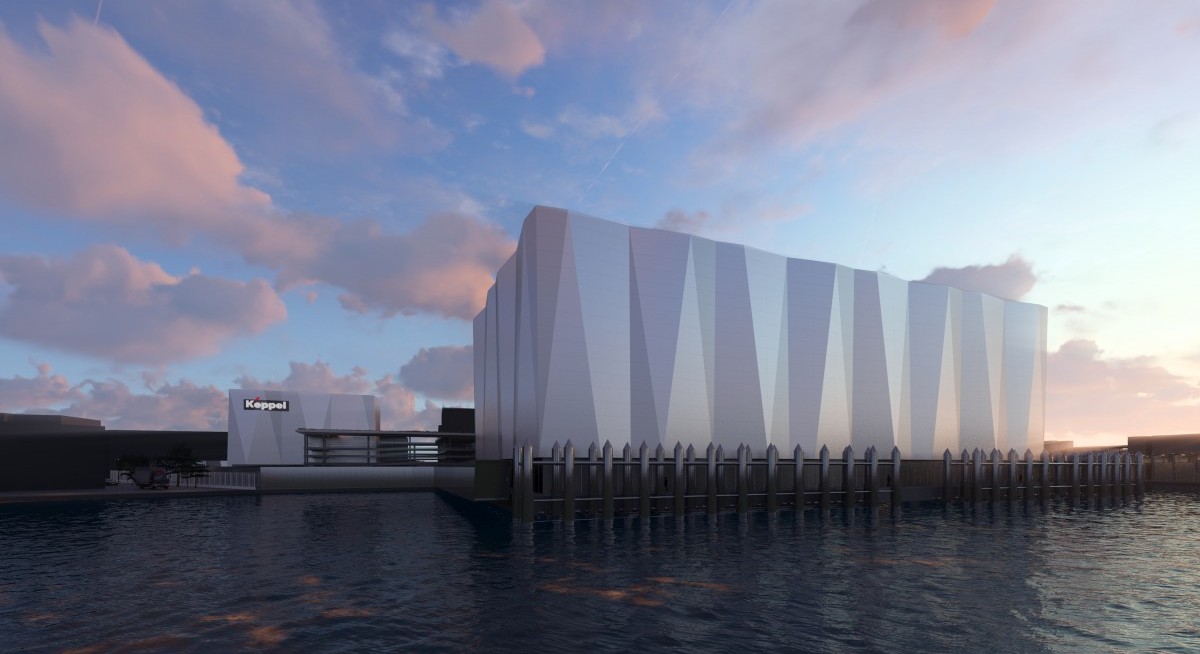

For property, it really depends on whether it is core or non-core. “Keppel Bay Tower was actually on our balance sheet. A few years ago, it was sold to Keppel REIT. It was non-core and now it’s part of our FUM, which is core. Of course, there’s an option this could happen to Keppel South Central. But we need to get the leasing up first, to stabilise the asset,” Loh says. The occupancy and advanced discussions cover some 50% of Keppel South Central.

‘Compare us to global peers’

See also: Cosco Shipping International (Singapore) expects to report FY2025 earnings of $7.4 million

How should investors look at the New Keppel? “We think the market should look at us and [compare us to] some of the global peers in the asset management space. We are a bit unique. We don’t just have asset management. We also have very strong operations as well,” Loh replies. Brookfield, KKR, Blackstone, or BlackRock — these are the peers that perhaps the market should look at, Loh adds.

In 1H2025, Keppel announced FUM of $91 billion, and a pipeline of $39 billion comprising infrastructure ($15 billion), digital infrastructure and data centres ($15 billion), and real estate ($9 billion). Keppel also announced a 15 cents interim dividend (unchanged y-o-y) and a $500 million share buyback. “We are thinking about returning capital, with the shares in the share buyback programme to be used to fulfil the equity share plan for employees and also to be used as currency for future M&A. There is a phase 2 of the Aermont acquisition to be funded by shares in 2028,” Loh says.

Phase 1 of the Aermont acquisition in April 2024 was partly financed by Keppel shares priced at $7.16 from an earlier share buyback programme where the shares cost $5.80. “We have done our homework well and set a cap on the pricing of the first and second tranches,” Christina Tan, Keppel’s CEO of fund management and chief investment officer, says, referring to the Aermont acquisition. Keppel’s share price on July 30 was $8.18.

Listed REITs and unlisted funds

When asked about an optimum feeto-FUM ratio, Tan says: “For the global managers, you will see a range from 40 bps to 50 bps. For our modelling, we had used 50 bps in terms of a $200 billion target, resulting in a fee of about $1 billion.”

In 1H2025, two-thirds of FUM are in private funds and one-third in listed funds. “Going forward, 60:40 would be quite a good number to have. In terms of segments, we don’t really allocate. The books are quite heavier on the real estate side. Going forward ... essential services such as infrastructure, digital infrastructure and data centres are in demand, so we would see an allocation of probably a third each,” Tan says.

Unlike CLI, where the fee income verticals are more apparent, Keppel has an operating arm for infrastructure and digital infrastructure. “If we, for instance, build more power plants, we can own and operate more assets. As a result, the operating fees and the operating income will also go up. In that way, the management fees and operating services are reinforced, with both rising,” Loh says.

As Keppel transforms, investors, analysts and financial reporters who cover Keppel may need to look at New Keppel holistically (and horizontally) across its verticals of infrastructure, real estate and connectivity. In addition to its ability to generate FUM and fee income, Keppel’s operational expertise in power generation, desalination plants and data centres will be a differentiator as it tussles with peers such as Brookfield, Goodman Group, CLI — which is a real asset manager — for FUM, fee income and investor attention