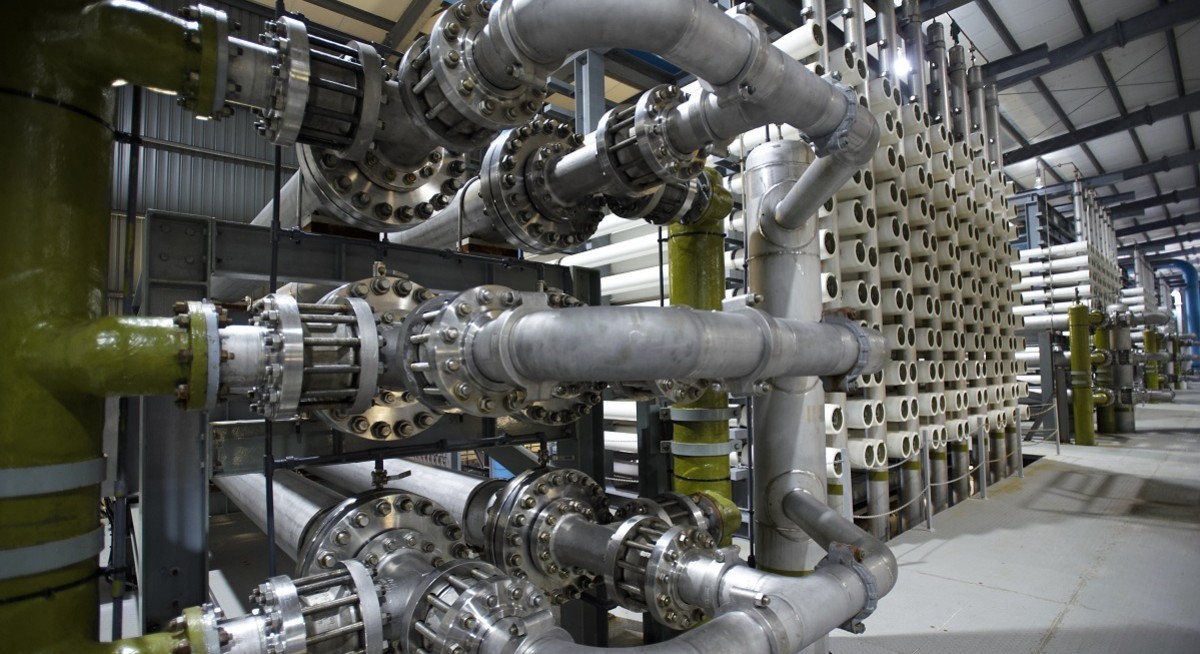

The plant is located in Tuas and has a supply capacity of up to 30 million gallons per day (136,380 cubic metres per day).

“Desalination, Singapore’s fourth National Tap, is a weather-resilient source that adds to Singapore’s water security. With SSDP in good working order, we are pleased to continue our strong partnership with KIT," says Ong Tze-Ch’in, Chief Executive of PUB.

In tandem, KIT, through its Trustee-Manager, Keppel Infrastructure Fund Management Pte Ltd (KIFM), has appointed Keppel Ltd.’s Infrastructure Division, the plant’s current operations and maintenance (O&M) operator, to continue its O&M service contract for another three years.

“We are pleased to be awarded this service extension, which underscores the trust placed in Keppel by national water agency, PUB. Our deep technical know-how and decades of operating experience provide us with a unique edge as a global asset manager and operator," says Cindy Lim, CEO of Keppel’s Infrastructure Division.

See also: Quantum Healthcare’s Thomas Tan resigns as CEO

Kevin Neo, CEO of KIFM, says the extension of the concession will contribute steady and predictable cash flows to KIT.

The above transaction is not expected to have any material impact on the net tangible assets per share or earnings per share of Keppel or KIT for the current financial year.

As at 12:30 pm, Keppel REIT units changed hands at 47.5 cents.