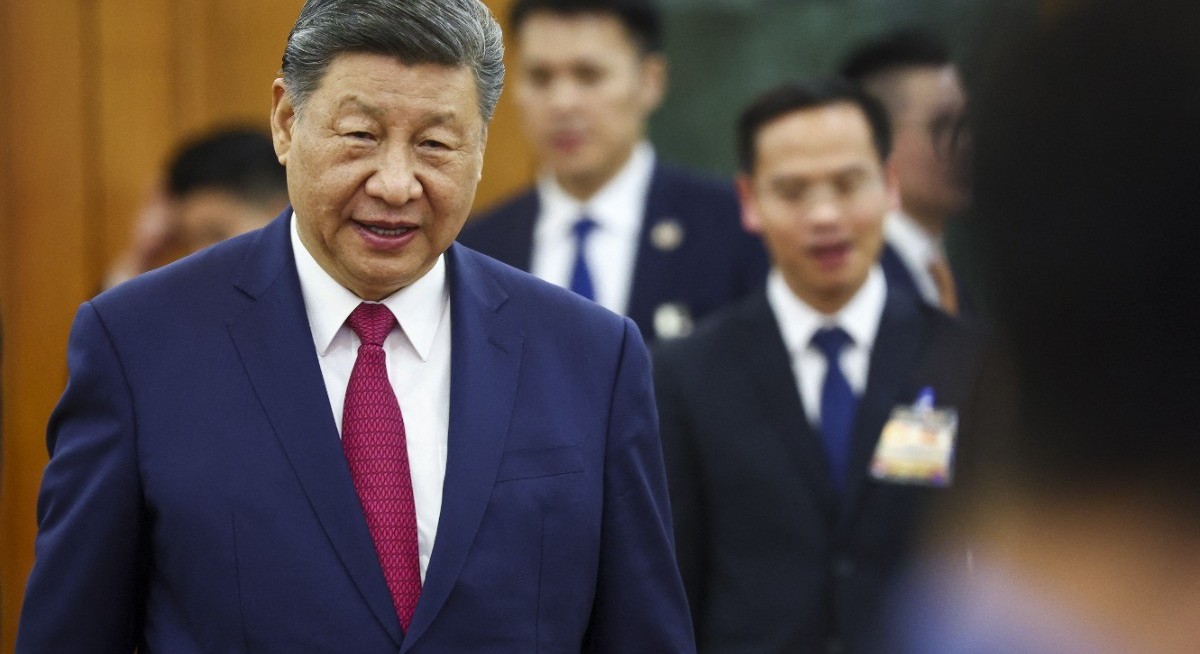

“China’s economy has forged ahead under pressure, developing toward the new and the excellent while demonstrating strong resilience and vitality,” Xi told the gathering, according to a transcript of his remarks published by the state Xinhua News Agency. “We have successfully achieved our main economic and social development targets.”

Earlier on Wednesday, his government released data showing the manufacturing purchasing managers index (PMI) rose to 50.1 in December from 49.2 in November, ending an eight-month contraction streak. That pickup was confirmed by a separate private survey, which also climbed above the 50-mark separating expansion and contraction.

Xi is expected to further comment on the outlook for the world’s second-largest economy in his annual New Year’s Eve address in the evening. While the PMI recovery is modest, it helps Beijing justify its drip-feed approach to supporting the economy while avoiding sweeping measures many on Wall Street have called for throughout 2025.

See also: Taiwan may push back timeline to meet green energy goal after missing it last year

“In the near term, due to the robust external demand, policymakers don’t show the urgency to step up stimulus,” said Larry Hu, the head of China economics at Macquarie Group. “But if exports slow sharply, Beijing will launch bigger domestic stimulus to fill the gap.”

China’s 30-year bond futures sank as much as 0.8% and yields climbed in the cash market, as the better-than-expected economic data prompted investors to move away from haven assets.

The rebound comes alongside a flurry of policy announcements aimed at setting the economy up for a strong start to the new year, while illustrating policymakers’ preference for a measured approach to stimulus.

See also: CK Hutchison seeks damages via arbitration on Panama Ports

On Tuesday, China unveiled an initial CNY62.5 billion (US$8.9 billion or $11.5 billion) in consumer subsidies for 2026, extending a trade-in programme for electric vehicles and electronics, while the Ministry of Finance prolonged a tax break on home sales for individuals who have owned their properties for at least two years. Authorities also said they would front-load CNY295 billion for key projects in 2026.

The modest scale of these steps suggests Beijing sees little urgency to roll out major stimulus, with the nearly US$9 billion package a fraction of the support deployed in 2025. The People’s Bank of China has also remained quite conservative, having lowered policy rates only once in 2025.

The latest data may give policymakers more confidence that they have done enough to keep the economy on track. “Production and demand have both expanded significantly,” Huo Lihui, a statistician at the National Bureau of Statistics (NBS), said in a statement accompanying the data release.

Huo highlighted that 16 of the 21 industries surveyed showed improvement, with the PMI for high-tech manufacturing jumping to 52.5. Expectations for production and business activity surged to the highest since March last year.

Two-speed economy

A closer look at the NBS report, however, reveals a “two-speed” model that has become the hallmark of the Chinese economy.

While the official non-manufacturing index rose to 50.2, services activity saw a second straight month of contraction for the first time since late 2023. Weak consumer spending continues to leave the economy vulnerable to risks abroad, particularly as a trade surplus exceeding US$1 trillion draws growing scrutiny from global trading partners.

To stay ahead of Singapore and the region’s corporate and economic trends, click here for Latest Section

There are warning signs even within the buoyant manufacturing sector. Goldman Sachs Group Inc economist Yuting Yang said in a note that a persistent gap between input and output prices is squeezing companies’ profits. With the sub-indexes for input costs at 53.1 and output prices at 48.9, factories are paying more for raw materials while cutting finished goods prices to clear inventory.

Together with other recent indicators, the economic backdrop remains fragile as the year draws to a close. Investment lost further ground in November, consumer spending growth slowed sharply and the property sector deteriorated, reflecting persistent weakness in domestic demand.

Xi has previously signalled a tolerance for slower growth in some regions and even said recently that China should crack down on “reckless” projects, highlighting his focus on the quality, rather than pace, of economic growth.

For 2026, this could mean a continuation of targeted support for “new quality productive forces” such as high-tech manufacturing, a likely focus of a new five-year plan being drafted and to be released in March.

Uploaded by Tham Yek Lee