Tan said the orders — totalling more than US$10 billion — will ship next year. OpenAI, which is seeking to address shortages in computing capacity, will initially use the chip for internal purposes, one of the people said.

Broadcom’s stock surged 9.4% to US$334.89 in New York trading on Friday, adding US$135 billion to the company’s market value. Nvidia’s shares, meanwhile, slipped 2.7%.

Tan made veiled references to the partnership in Broadcom’s quarterly earnings report Thursday, when he said his company had secured a new client for its custom accelerator business and raised forecasts for next year accordingly.

The Financial Times earlier reported that OpenAI was the customer. Broadcom and OpenAI declined to comment beyond Tan’s remarks.

See also: Microsoft’s new programme targets faster AI rollouts in Singapore

ChatGPT developer OpenAI, facing shortages of computing power especially when releasing new products, has been looking for ways to boost supply of various parts of its infrastructure needs. The company, which once had an exclusive cloud deal with Microsoft Corp, now also has agreements with Oracle Corp, CoreWeave Inc and Google.

The custom chip program is intended to ease supply constraints on Nvidia chips and to let OpenAI develop processors that are tailored to the specific needs of its models, according to a person familiar with the matter.

Accelerators are essential to the development of AI at big tech firms from Meta Platforms Inc to Microsoft. Bloomberg News has previously reported that OpenAI and Broadcom were working on an inference chip design, intended to run or operate artificial intelligence services after they have been trained.

See also: AI race: Alphabet, Amazon, Meta and Microsoft set for US$650 bil capex this year

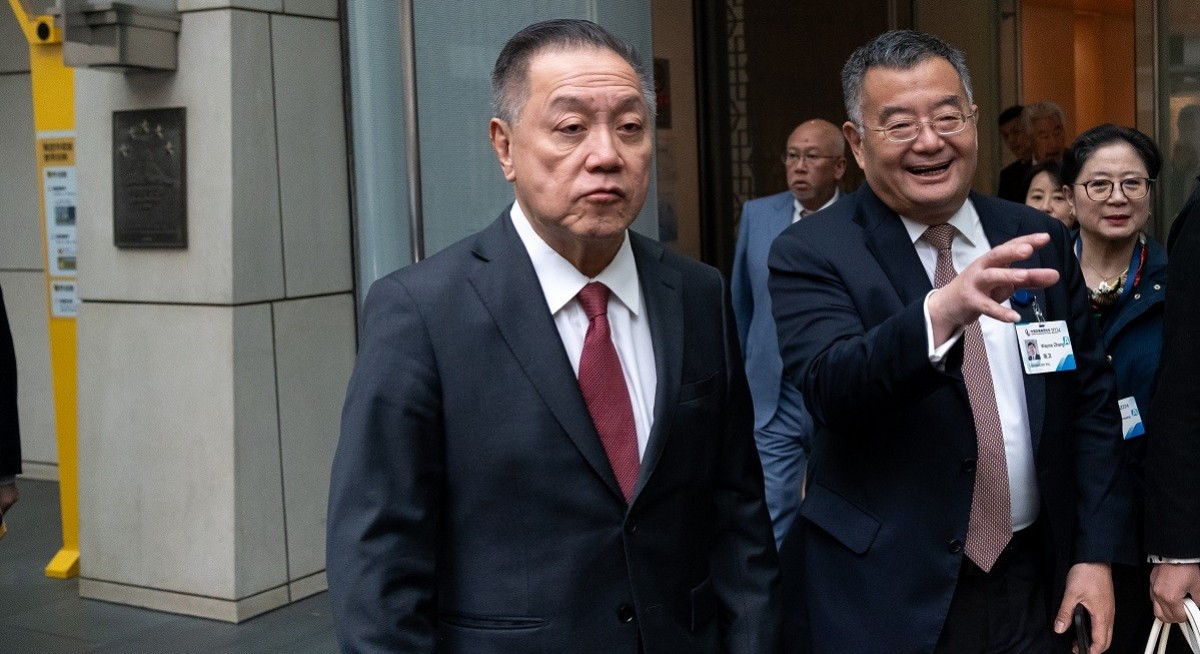

“Last quarter, one of these prospects released production orders to Broadcom,” Tan said on a conference call following the earnings report.

Broadcom is among the chip designers benefiting from a post-ChatGPT boom in AI development, in which companies and startups from the US to China are spending billions to build data centers, train new models and research breakthroughs in a pivotal new technology. On Thursday, Tan told investors the chipmaker’s outlook will improve “significantly” in fiscal 2026, helping allay concerns about slowing growth.

Broadcom Investors’ High Hopes | The shares have more than doubled since April

Tan had previously said that AI revenue for 2026 would show growth similar to the current year — a rate of 50% to 60%. Now, with the new customer that he said has “immediate and pretty substantial demand,” the rate will accelerate in a way that will be “fairly material,” Tan said.

“We now expect the outlook for fiscal 2026 AI revenue to improve significantly from what we had indicated last quarter,” he said.

Investors have been looking for signs that tech spending remains strong. Last week, Nvidia gave an underwhelming revenue forecast, sparking fears of a bubble in the artificial intelligence industry.

To stay ahead of Singapore and the region’s corporate and economic trends, click here for Latest Section

Though Broadcom hasn’t experienced Nvidia’s runaway sales growth, it is seen as a key AI beneficiary. Customers developing and running artificial intelligence models rely on its custom-designed chips and networking equipment to handle the load. The shares had been up 32% for the year.

As part of its earnings report, Broadcom said sales will be about US$17.4 billion in the fiscal fourth quarter, which runs through October. Analysts had projected US$17.05 billion on average, though some estimates topped US$18 billion, according to data compiled by Bloomberg.

During the call, Tan said he and the board have agreed that he will stay as Broadcom CEO until 2030 “at least.”

In the third quarter ended Aug 3, sales rose 22% to almost US$16 billion. Profit, excluding some items, was US$1.69 a share. Analysts had estimated revenue of about US$15.8 billion and earnings of US$1.67 a share.

Sales of AI semiconductors were US$5.2 billion, compared with an estimate of US$5.11 billion. The company expects revenue from that category to reach US$6.2 billion in the fourth quarter. Analysts projected US$5.82 billion.

Broadcom’s Tan has been upgrading the company’s networking equipment to better transfer information between the pricey graphics chips at the heart of AI data centers. As his latest comments suggest, Broadcom is also making progress finding customers who want custom-designed chips for AI tasks.

Tan has used years of acquisitions to turn Broadcom into a sprawling software and hardware giant. In addition to the AI work, the Palo Alto, California-based company makes connectivity components for Apple Inc’s iPhone and sells virtualization software for running networks.