CNMC in 1HFY2025 produced 11,811 ounces of gold, up 26% y-o-y, and its average selling price was US$3,197 per oz, up 41.1% y-o-y.

The company plans to pay a dividend of 1.5 Singapore cents per share, equivalent to a payout ratio of nearly 29%. For 1HFY2024, it paid just 0.4 cent.

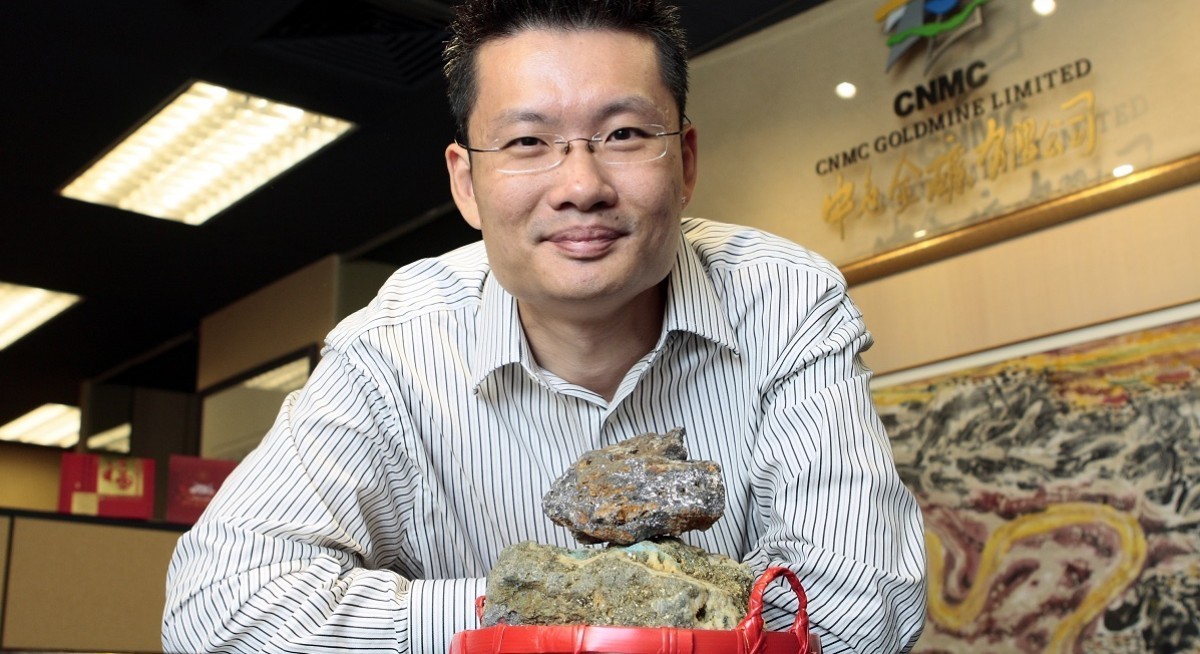

CNMC CEO Chris Lim says the 1HFY2025 results "far exceeded" expectations.

"We intend to build on this momentum and are going all out to produce and sell even more precious and base metals,” he adds.

See also: Chuan Hup's earnings jump more than three times to US$2.1 million

CNMC shares closed at 55 cents on Aug 13, up 2.8% for the day and up 120% year to date.