In their Aug 5 report, Ong and Lim note several positives, including Wee Hur’s $700 million order book, which should increase its construction revenue for FY2026 by 73%.

Wee Hur’s order book could even go up to $1 billion with an estimated $300 million worth of new orders to be won in 2HFY2025 to FY2026, the analysts write.

The opening of Wee Hur’s 10,500-bed PBWA Pioneer Lodge in Singapore by the end of 2025 will lift its PBWA bed inventory by 40% to 26,000. With this, the analysts believe Wee Hur’s PBWA revenue will grow by 14% and 55% y-o-y in FY2025 and FY2026, respectively.

Given the shortage of beds in Singapore, analysts expect the lease on the company’s Tuas View Dormitory to be extended by three + three years. Should that happen, Wee Hur’s PBWA revenue will increase by 55% in FY2026, they estimate.

See also: Analysts mostly bullish on EQDP's impact on SGX; Morningstar views tailwind as ‘temporary’

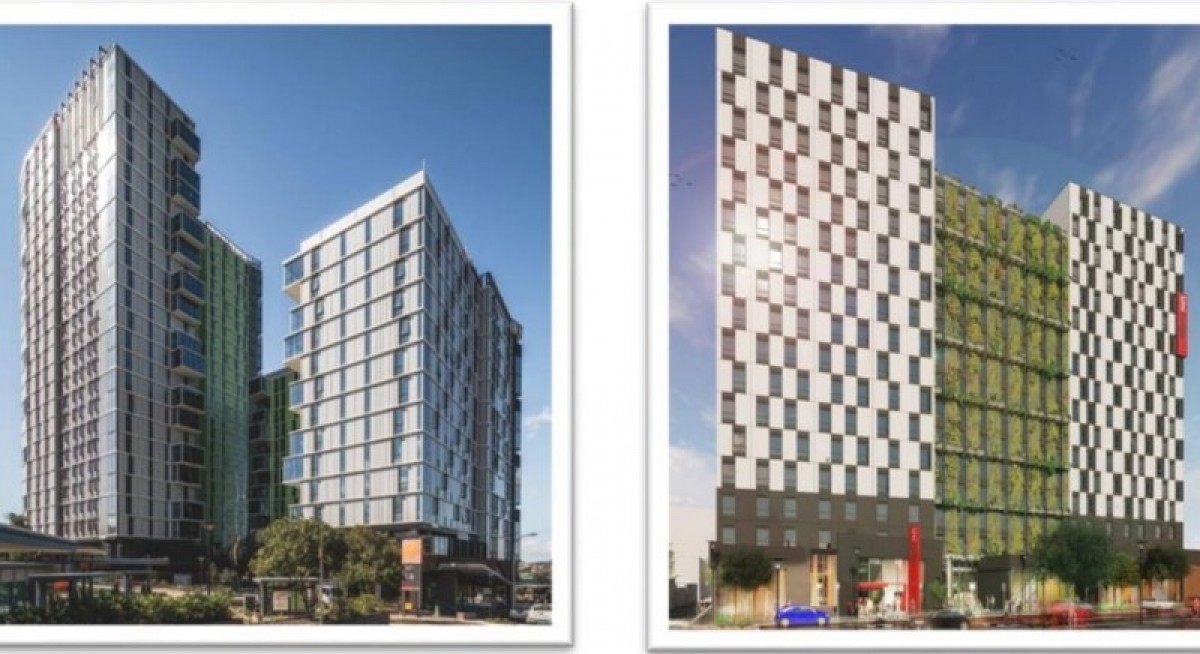

The analysts also like Wee Hur’s track record of venturing into asset-light new growth engines. Before selling its seven PBSA assets for A$1.6 billion ($1.4 billion) to Greystar in December 2024, Wee Hur was the fifth-largest PBSA owner in Australia. At the time of the sale, Wee Hur had an indirect stake of 50.1% in the fund holding the PBSA assets. The remaining 49.9% were held by GIC through Reco Weather. Following the disposal of the 37.1% indirect stake, Wee Hur will have a 13% stake in the segment.

“The ability to attract credible investors into its new businesses is a plus,” say the analysts.

Wee Hur is also in the process of developing a PBSA property at Grenfell Street in Adelaide, Australia, which the analysts believe will be injected into a new fund.

See also: RHB's Yeo raises Frencken's target price to $2.03 with demand picking up from customer restocking

Ong and Lim, who have given Wee Hur a target price of 91 cents, believe Wee Hur’s current share price has not factored in the lease extension of its Tuas PBWA property. If the lease isn’t extended, the analysts’ target price would be at 73 cents instead.

As at 9.39am, shares in Wee Hur are trading 2 cents higher or 2.88% up at 71.5 cents.