Keppel has exposure to digital infrastructure such as data centres, power and subsea cables. “Keppel is on a positive trajectory, with lower gearing, improving ROE, return of capital via share buybacks and, rising dividends. This is underpinned by further simplification of its business to its core asset management/ infrastructure businesses, disposal of $14.4 billion of non-core assets and 8% p.a. Cagr in profit from continuing operations over the next three years on 7% growth in funds under management (FUM) and 50% uplift in power generation capacity,” Song and Khi write in their report.

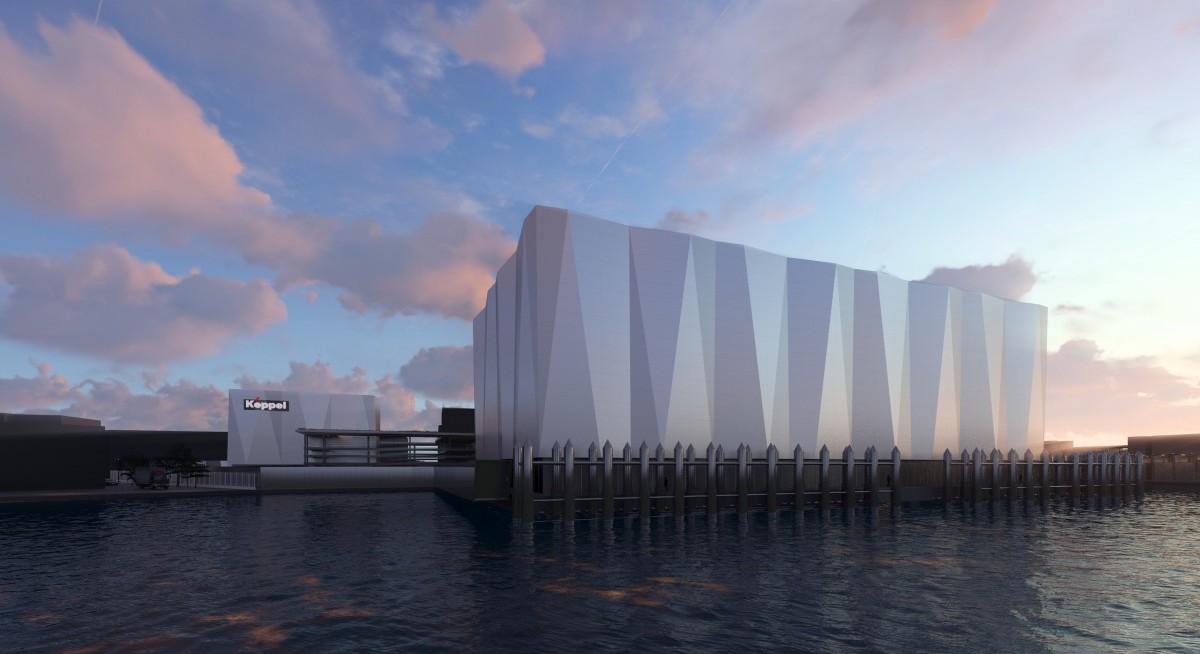

According to the duo, Keppel’s vertically integrated digital infrastructure platform comprising data centres, power and subsea cables could benefit from a 25% Cagr in global data centre capacity from now to 2028.

“Keppel should command a scarcity premium as Singapore’s only listed play on this theme. Its ability to import green energy directly enables new Singapore data centre builds,” the JP Morgan report says.

Since Keppel is also an operator of digital infrastructure, it should be able to deliver a 20% IRR for its funds, Song and Khi reckon. This positions KEP to achieve its $200bn FUM target by 2030 (from $91 billion as of end-June).

See also: RHB keeps ‘buy’ on HRnetGroup, citing its ability in ‘adding more value to customers’

On capital management, the JP Morgan report points to a potential $500 million a year in share buybacks coupled with rising dividends. Song and Khi are forecasting dividends per share of 34 cents, 38 cents and 44 cents in FY2025, 2026 and 2027. The duo are also expecting gearing to fall to 0.51x by FY2027 from 0.84x in 2024.

The 2026 $12.50 target is based on a sum-of-the-parts valuation of 16x EV/Ebitda for asset management, 10x for infrastructure, 7x for connectivity and with a similar 15% holding company discount similar to CapitaLand Investment.

“With improving ROE, we anticipate Keppel’s FY2026 EV/Ebitda of 15.6x to move towards regional real estate investment manager (REIMs) in the high teens. Our price target implies an FY 2026 EV/Ebitda of 19.5x,” the JP Morgan report says.

On Oct 10, Keppel is at $9.22, up 34% this year.