"We believe the RFS status is an important milestone that enhances Keppel and Singapore’s positioning as a regional digital hub, supports growing AI/cloud workloads," state CGS International analysts Lim Siew Khee and Meghana Kande in their Oct 2 note, where they have kept their "add" call and target price of $10.23.

As a recap, the Bifrost consortium comprises Meta, PT Telekomunikasi Indonesia International, Keppel Telecommunications & Transportation, and Amazon.

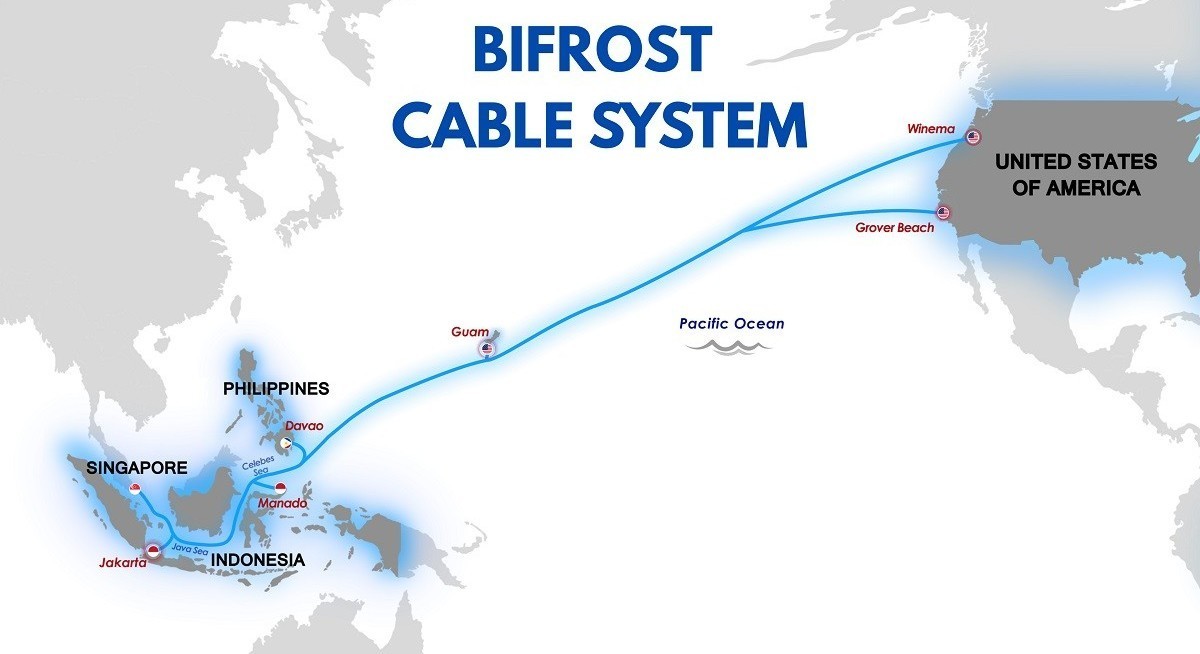

This is the first subsea cable system directly linking Singapore to the West Coast of North America via Indonesia through the Java Sea, Celebes Sea and Guam.

The cable spans over 20,000 km and is equipped with 260 Tbps design capacity and sub-165ms latency, which is 10 ms faster than incumbent routes.

See also: uSMART initiates coverage on Yeo Hiap Seng with ‘hold’ call and 64.3 cent TP

Alcatel Submarine Networks was the main construction company for this cable system, which has an initial cost of some US$760 million.

Via a joint build agreement, Keppel and its private fund co-investors own five out of 12 fibre pairs in Bifrost.

Of these, two fibre pairs have been committed to customers through Indefeasible Rights of Use over 25 years, while the remaining three fibre pairs are being negotiated with potential clients, according to Keppel.

See also: OCBC's Lim raises her fair value for Boustead Singapore to $2.45

Lim and Kande figure that the contribution from Bifrost is likely to help make up for the earnings to be lost in what Keppel groups under its "connectivity" segment following the divestment of subsidiary M1's mobile business.

Keppel expects the investment in Bifrost to generate an IRR of more than 30% and also collect operational and maintenance fees for the five fibre pairs of more than $200 million per fibre pair over 25 years.

The analysts have factored in $21 million of gains for the sale of the first two pairs to be recognised in 4QFY2025, with $5 million of O&M fees in the coming FY2026.

Keppel had earlier sold the first fibre pair in 2021 for US$100 million to Converge ICT Solutions and Lim and Kande, who say that Keppel is actively marketing the remaining fibre pairs, to book all-in-gains of $85 million from selling the third and fourth fibre pairs in the coming FY2026.

Keppel shares gained 0.33% as at 4.28 pm to trade at $9.17. Year to date, it is up 33.48%.