This value unlocking, they note, accounts for 60% of Wee Hur’s share price of 58 cents as at closing on July 21.

Wong and Tan write in an unrated report: “The disposal allows Wee Hur to focus and grow its workers’ dormitory business, while expanding other business segments. We value the dormitory business using a conservative four times price-to-earnings ratio (P/E) multiple and the construction business at eight times P/E.”

Construction remains a major revenue driver, with Wee Hur having been awarded major contracts by the Housing Development Board (HDB) in Singapore.

Wee Hur was recently awarded two build-to-order (BTO) projects for $440 million, expected to be completed by 2029, adding to its existing order book of $263 million as of December 2024.

See also: Citi keeps ‘buy’ on CLI at $3.40 TP on ‘proactive’ M&A exploration and growing FUM

“With three of its ongoing five projects expected to be completed in 2025, Wee Hur is anticipating a busy year for the construction arm in 2025 and 2026 while also looking to replenish its order book value,” write Wong and Tan.

The pair now classify the group as an “investment holding company” with diversified operations in construction, property development, workers’ accommodation and PBSAs.

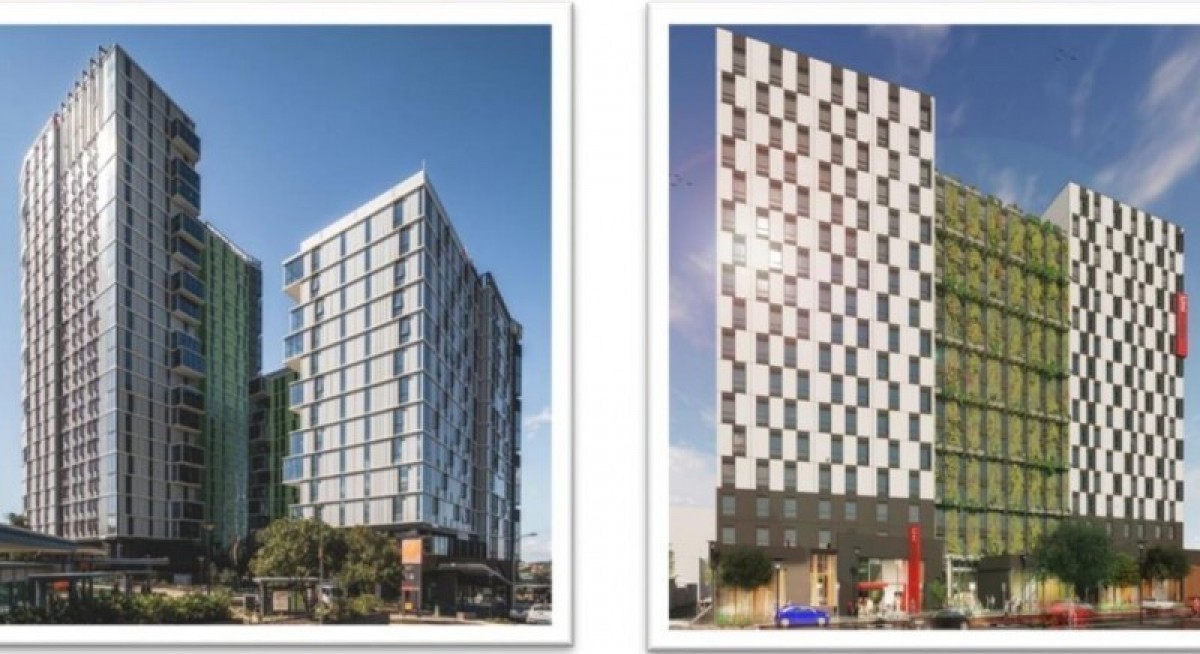

The group operates a massive portfolio of 6,071 student housing beds under its ‘Y-Suites’ brand across five key locations in Australia and over 25,000 beds in two large scale workers’ dormitories in Singapore. Another 683-bed PBSA project is being constructed in Adelaide with completion targeted for 2HFY2027.

“The group also earns revenue from fund management services and PBSA operations such as sales, marketing and student dormitory management,” write Wong and Tan.

Wee Hur ventured into the workers’ dorm business by opening its maiden purpose-built dorm (PBD) in Tuas View in 2014. With a capacity of 16,800 beds at that time, it was the first and largest PBD in Singapore offering a range of amenities, including multipurpose recreational rooms, gymnasiums, canteens and retail shops.

Wong and Tan write: “Since then, the property has enjoyed strong occupancy rates and competitive rental increases, achieving 93% occupancy, 43% increase in revenues and contributing 42% to total group revenue in FY2024.”

On the back of strong demand, Wee Hur is building another large scale 10,500-bed dorm in Pioneer Lodge, expected to be fully operational by end-2025. This will increase the total number of operational beds under Wee Hur by 70% and position this business segment as a major growth driver.

The analysts note that the group is “poised for growth” from 2026 onwards with Pioneer Lodge.

Already, Wee Hur has been able to charge rental rates slightly higher than average while maintaining over 90% occupancy for its dorm at Tuas View, enabling revenue from the worker’s dorm segment to increase to $85 million in the FY2024.

With its new Pioneer Lodge, the group hopes to maintain high levels of occupancy and competitive rental rates close to $500 per bed. The new property will increase the number of beds under Wee Hur by 70% to 26,244 by the end of 2025.

For more stories about where money flows, click here for Capital Section

Thus, Wong and Tan believe the accommodation segment is set to be a “major revenue driver” for the group, which they estimate could be by up to around 70% based on full-year contribution beginning in the FY2026.

Presently, the group’s FY2024 revenue is split between its workers’ dormitory segment at about 42%, construction at about 31%, property development at about 23%, fund management at about 3% and lastly, PBSA operations about 1%.

With this, the DBS analysts have a valuation of about 80 cents a share for the stock. Their fair value is pegged to a 10% discount of their sum-of-the-parts (SOTP) valuation of 89 cents a share.

Yeat-to-date, Wee Hur’s share price has gained almost 77%, and it is trading at a P/NAV of 0.9 times.