Lim & Tan ‘buy’ 6.6 cents

Fully integrated vertical value chain

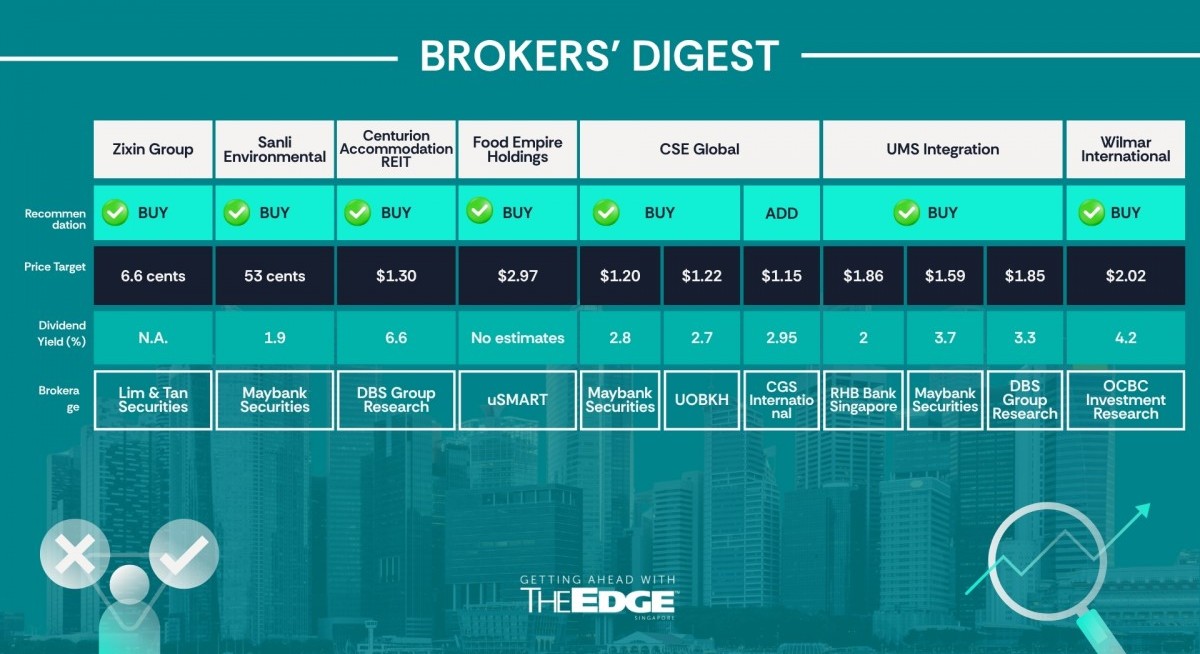

Lim & Tan Securities analyst Nicholas Yon has initiated a “buy” call on Zixin Group with a target price of 6.6 cents. The target price is pegged to 10 times FY2026 P/E ratio, which is significantly below peer averages.

In his Nov 11 report, Yon mentioned that Zixin is a highly profitable and undervalued S-Chip consumer staple stock whose next step of expansion in Hainan can potentially see its profit more than double over the next few years as it seeks to replicate its successful model in an area five times its current size with the help of China’s government as a co-investor.

See also: PhillipCapital, UOB Kay Hian raise respective target prices for BRC Asia following 1QFY2026 earnings

“As one of the few listed companies with a fully integrated vertical value chain in the sweet potato sector, Zixin enjoys a moat that is difficult for competitors to replicate,” says Yon.

In his report, Yon also highlighted that Zixin is the only listed sweet potato supply chain operator in China with a truly vertically integrated ecosystem that spans seedling research, cultivation, food production and waste recycling. This closed-loop model delivers higher efficiency, stronger margins, and greater product consistency, while supporting national priorities on food security and sustainability.

Yon believes that Zixin will extend its scalable and integrated model into Lingao County in Hainan as part of its next growth phase, following its success in Liancheng County.

See also: Citi ups target prices on all three banks; prefers Singapore banks over SGX for EQDP play

“The proposed sweet potato cultivable farmland in Lingao County is approximately five times bigger than the current size in Liancheng County and has a climate that can cultivate sweet potatoes twice a year. This will help Zixin strengthen upstream supply, expand processing capacity, and enhance regional distribution,” Yon adds. With the Chinese government supporting Zixin, he expects profits to more than double when Hainan goes operational.

According to Yon, Zixin’s current valuation remains undemanding relative to its fundamentals. Zixin trades at about 5.4 times FY2026 P/E and 0.5 times the P/B, compared with sector averages of 18.3 times and 2.6 times, respectively.

Backed by a war chest of RMB108 million ($19.7 million) in net cash and improving profitability, Zixin presents a compelling opportunity for re-rating as its growth story unfolds.

Meanwhile, founder and CEO Liang Chengwang, together with key shareholders, has significantly increased his stake through five-year share options, which could bring his stake to 21.9%.

Despite the dilution, Yon views this positively, as it demonstrates strong confidence in Zixin’s future and aligns management’s interests more closely with those of shareholders. The proceeds will be used to replicate Lian Cheng’s success in Hainan, which is expected to more than double Zixin’s current revenue and profits. — Teo Zheng Long

Sanli Environmental

Price target:

For more stories about where money flows, click here for Capital Section

Maybank Securities ‘buy’ 53 cents

Order book to hit $1 billion?

Maybank raises target price for Sanli Environmental after winning a Public Utilities Board (PUB) project worth $205 million.

Jarick Seet of Maybank Securities has maintained his “buy” call on water and waste project developer Sanli Environmental and raised the target price from 50 cents to 53 cents following the latest contract win from PUB.

In his note dated Nov 11, Seet mentioned that PUB contracts are “bread and butter” for Sanli. He does not expect the execution and margins for the project to be an issue, adding that the contract is attractive, especially towards Sanli’s net margins.

Sanli’s new $205 million contract is for the development of Changi NEWater Factory 3, which is to be delivered over two years. With this latest contract win, Sanli’s order book has reached a new record of $838.7 million.

The analyst believes that with a record order book significantly higher than the previous record of around $300 million, as well as tenders yet to be announced, such as the upcoming $142 million Tuas Water reclamation plant bid, Sanli’s order book could potentially reach the $1 billion mark by the end of 2025.

“We believe that the record orderbook implies record revenues and profits, assuming no issues with execution. We believe Sanli is on the verge of a multi-year growth spurt in FY2026 to FY2028,” says Seet.

In the longer term, Seet believes Sanli is well-positioned for sustained growth, driven by PUB water-related projects and anticipated Long Island tenders as part of Singapore’s climate change mitigation efforts.

“Successfully securing a portion of these projects could establish a multi-year growth trajectory for Sanli. We believe securing these orders would elevate Sanli’s orderbook to fresh highs. This may eventually generate record revenues and profitability, barring any hiccups in execution,” Seet adds.

With the latest contract win, Seet has lifted his FY2026 and FY2027 patmi estimates by 5.2% and 10.1%, respectively, resulting in a 6% higher target price of 53 cents based on 16 times FY2027 P/E ratio. — Teo Zheng Long

Centurion Accommodation REIT

Price target:

DBS Group Research ‘buy’ $1.30

Bedrock of essential housing

DBS Group Research has initiated coverage of Centurion Accommodation REIT (CA-REIT), dubbing it a “bedrock of essential housing”, with a “buy” call and a target price of $1.30.

In their Nov 6 note, Geraldine Wong and Derek Tan of DBS point out that the REIT operates an “essential lodging portfolio” in strategic locations, with robust demand-supply dynamics due to the tightening of dorm regulations and high student-to-bed ratios in the UK and Australia.

The REIT offers “unmatched growth” with an estimated 15% CAGR in distributable income from FY2025 to FY2027, driven by a 35% growth in beds.

The upside is expected to come from stronger-than-expected rental reversions in its portfolio of workers’ dorms, where an estimated 5% increase is expected to translate into a 5% lift in distribution per unit (DPU).

Wong and Tan note that the REIT, with a portfolio of 15 assets worth $2.1 billion, offers direct exposure to Singapore’s resilient purpose-built worker accommodation (PBWA) sector, which is described as “structurally tight”.

“High historical occupancy of more than 97% and short one-year leases offer defensive income visibility with the ability to capture organic growth,” state the analysts.

The projected 15% CAGR in distributable income over the next two years is expected to be driven by an expansion in capacity, which includes new acquisitions, specifically Epiisod at Macquarie Park.

With a gearing of just 31%, which provides a debt headroom of $561 million based on a 45% limit, there is plenty of flexibility to drive medium-term growth through acquisitions from the sponsor’s pipeline or the redevelopment of existing assets, according to them.

In addition, the DBS analysts note that CAREIT will be the only S-REIT to fully lock in current dovish interest rates, with debt costs expected to be about 50 basis points lower at 3.5% from underwriting the initial public offering.

“Reversions could surprise on the upside, which we view as the real delta for distribution per unit,” state Wong and Tan. Their $1.30 target price has factored in FY2026 DPU of 6.9 cents and 7.63 cents for FY2027. — The Edge Singapore

Food Empire Holdings

Price target:

uSMART ‘buy’ $2.97

Strong regional footing and growth momentum

uSMART, a brokerage platform licensed by the Monetary Authority of Singapore (MAS), has initiated a “buy” call on Food Empire with a target price of $2.97.

The report by the brokerage’s Eng Thiam Choon notes that the F&B group, which generates over 70% of revenue from instant beverages such as coffee and tea, is looking to capture the growing consumer instant beverage sector in Southeast Asia. So far, the group has seen initial success in Vietnam through their brand, CafePHO. It has also seen continued revenue growth across its other key regions, including Russia, the Commonwealth of Independent States (CIS) and South Asia.

Revenue in FY2024 ended Dec 31, 2024, grew 11.9% y-o-y to US$476 million ($621.6 million) while revenue in 1HFY2025 rose by 21.7% y-o-y to US$274.1 million.

After adjusting for a one-time non-cash fair value loss on its redeemable exchange notes (REN), Food Empire’s 1HFY2025 came in at US$31 million, from US$23.2 million in 1HFY2024. Including the one-time fair value loss, the first six months of this year saw a net loss of US$1.1 million.

To this end, Eng believes the group will continue to grow, driven by improvements in its consumer brand recognition as it invests more in advertising and marketing.

In his view, key catalysts for growth include Food Empire’s healthy balance sheet, which boasts a strong net cash position, allowing for expansion plans, future investments and partnerships.

“Recently, the group signed a partnership with Capital A Bhd to co-develop new lines of product and increase sales channels to include in-flight sales in the Southeast Asia region,” Eng writes in his report dated Nov 5.

Conversely, risks include cost pressures on raw materials, as the group will have to depend heavily on the prices of coffee beans and tea to create its products. Macroeconomic volatility affecting exchange rates will also impact profits, as the group reports earnings in US dollars and generates revenue across multiple regions. “The most detrimental threat, though unlikely, is a long-term shift in consumer preference away from instant beverages,” says Eng.

In addition to his “buy” call, Eng recommends investors have a medium- to long-term allocation to Food Empire due to its strong position in the regional instant F&B market, with growth driven by advertising and localised content. — Felicia Tan

CSE Global

Price targets:

Maybank Securities ‘buy’ $1.20

UOB Kay Hian buy $1.22

CGS International add’ $1.155

‘Fame-changing partnership’ with Amazon

Analysts from Maybank Securities, UOB Kay Hian, and CGS International have raised their target prices on CSE Global following the company’s announcement of its “game-changing partnership” with Amazon. Maybank has a new target price of $1.20, up from $0.84 previously, while UOB Kay Hian has a target price of $1.22, up from $0.85 before. CGSI now values this stock at $1.15, up from $0.86.

CSE Global, on Nov 11, said it was proposing to issue 62.97 million new warrants to Amazon’s subsidiary. Each warrant represents the right to acquire one share at the exercise price of 76.71 cents. Assuming that the warrants are fully converted, Amazon will hold an 8% stake in the company.

“This partnership is a major win for CSE, and could boost its data centre-related revenue from around 10% to potentially 30% annually,” say UOB Kay Hian analysts John Cheong and Heidi Mo in their Nov 12 report.

Maybank’s Jarick Seet believes the move is “significant” given that this is the first Singapore-listed company that Amazon has taken a stake in, and validates CSE as one of the US tech company’s key system integrators for their data centres.

In his Nov 11 report, Seet notes that a US$300 million ($390.6 million) per year run-rate from Amazon is significantly higher than its existing US$40 million per year. This refers to the warrants being subject to vesting based on payments of up to US$1.5 billion over five years till Nov 9, 2030.

To Cheong and Mo, the sums are “significantly higher” than the year-to-date order win of around US$50 million with Amazon.

While Seet also notes that the US$1.5 billion in potential orders could potentially double CSE Global’s order book from a single client, the analyst expects a gradual ramp-up in capacity. This is likely to start at US$200 million to US$250 million per year and accelerate in 2027 following its expansion phases.

Based on his estimates, CSE Global’s data centre contribution is projected to increase from 5% in FY2025 to over 30% by FY2027.

Cheong and Mo also believe the company’s electrification business stands to benefit from the growing demand for data centres as the use of AI increases, especially in the US.

“In August 2025, CSE won a $59 million data centre extension order from its existing US hyperscaler client. In addition, CSE is in the qualification phase with more hyperscaler clients,” they note.

“To recap, CSE’s first data centre order win was only around $20 million in 2023, while the second order was $49 million in 2024, followed by $59 million in 2025. We believe the size of the contract wins will continue to increase due to more adoption of AI,” they add.

Looking ahead, Seet remains “bullish” on CSE’s outlook and sees potential for a multi-year growth story.

“The company expects to more than triple capacity by 2027/2028, and we believe it will secure another data centre client by 1QFY2026. Its 50% dividend payout guidance will provide shareholder stability alongside upside from the positive outlook,” he writes.

Seet has also raised his FY2026 and FY2027 patmi estimates by 9.5% and 17.6% to $43 million and $50 million, respectively. His new target price is based on a higher FY2026 P/E of 20 times.

Cheong and Mo’s new target price represents an FY2026 P/E of 21 times as well as +1 standard deviation (s.d.) to the mean, up from their previous P/E of 15 times. “[The higher target price] reflects the higher earnings potential from the new partnership and huge order indications from Amazon.”

With CSE currently trading at only 15 times its FY2026 P/E, Cheong and Mo believe valuations remain “undemanding” given the company’s exposure to the high-growth data centre space. They have kept their earnings forecasts for now. — Felicia Tan

UMS Integration

Price targets:

RHB Bank Singapore Yeo ‘buy’ $1.86

Maybank Securities ‘buy’ $1.59

DBS Group Research ‘buy’ $1.85

Long-term beneficiary of semiconductor growth

Numerous analysts are maintaining their “buy” call on UMS Integration following the recent business update for 3QFY2025 ended Sept 30. The company reported earnings of $10.5 million for the 3QFY2025, up 1% y-o-y. For the 9MFY2025 period, earnings grew 4% y-o-y to $30.5 million.

UMS Integration’s revenue for 3QFY2025 and 9MFY2025 came in 9% y-o-y lower and 5% y-o-y higher at $59.3 million and $184.3 million, respectively.

In his Nov 11 report, Alfie Yeo of RHB Bank Singapore remains positive on UMS Integration as he sees it as a “long-term beneficiary of the semiconductor sector’s growth”.

“Growth over the short to medium term should be driven by an increase in semiconductor equipment spending, ramp-up in new customer orders, and margin expansion,” Yeo adds.

UMS Integration is now trading at a PEG of less than 1, which is deemed “compelling” at 19 times its FY2026 P/E ratio, against a CAGR of 20% for earnings growth from FY2024 to FY2027, and below the peer average of 21 times.

Therefore, Yeo maintains his “buy” call on UMS Integration with a new target price of $1.86, which represents a 22% upside.

Meanwhile, Jarick Seet of Maybank Securities is maintaining his “buy” call on UMS Integration, with an unchanged target price of $1.59, as he rolls forward his valuation based on a 20 times FY2026 P/E.

In his Nov 11 report, Seet notes that UMS Integration’s 4QFY2025 should improve due to the ramp-up of the new customer as more parts are being qualified.

“Going forward, their old key customers have guided for lower orders in 1HFY2026 and higher orders in 2HFY2026. As a result, we cut our FY2025 and FY2026 numbers by 15.5% and 10%,” Seet adds.

The analyst notes that UMS Integration’s management has indicated the capex cycle is almost over and more dividends could potentially be awarded to shareholders.

Finally, DBS Group Research analyst Ling Lee Keng believes that UMS Integration’s outlook remains upbeat, supported by multiple growth drivers, including a major production ramp-up, stable performance from key existing customers, strong industry tailwinds and its positioning as a second-order AI beneficiary, gaining from its exposure to leading semiconductor customers.

Ling is maintaining her “buy” call on UMS Integration with a higher target price of $1.85 as she rolls forward her 25 times P/E ratio valuation peg to FY2026 earnings, a level above +2 standard deviations and close to the early 2024 peak.

She also believes that UMS Integration is a direct beneficiary of MAS’s equity market development programme (EQDP). Meanwhile, its secondary listing on Bursa Malaysia and inclusion in the SGX iEdge Next 50 Index are expected to elevate market visibility and investor interest.— Teo Zheng Long

Boustead Singapore

Price target:

OCBC Investment Research ‘buy’ $2.02

Value unlocking; higher order book

Boustead Singapore has turned in a mixed report card for its 1HFY2026 ended Sept 30, with its geospatial technology division chalking record revenue while its healthcare segment reported lower revenue.

Overall, earnings dropped by 2.9% y-o-y to $34.9 million, on the back of a 0.4% dip in revenue to $294 million. The company plans to maintain its interim dividend at 1.5 cents per share.

Despite this mixed showing, Ada Lim of OCBC Investment Research has maintained her “buy” call and has even raised her fair value estimate for this counter from $2 to $2.02.

Since the start of the current FY2026, Boustead has secured some $193 million worth of new engineering contracts and major variations, including a recently announced design-and-build contract to reconfigure an existing semiconductor material manufacturing plant.

This brings its current engineering backlog to $396 million, of which $122 million and $274 million are booked under its energy engineering and real estate solutions divisions, respectively.

Lim observes that while the overall quantum has grown from the $349 million reported at the FY2025 results, Boustead’s backlog for the energy engineering division has dipped slightly from $126 million h-o-h, which, to the management, is a reflection of the moderation of business activities in the global energy sector due to US tariff uncertainty.

“We continue to like that the company has been exploring value-unlocking initiatives, such as the proposed listing of UI Boustead REIT to recycle capital and its ongoing discipline to manage costs.

“Though there remains a significant amount of macroeconomic uncertainty which may weigh on business and investment sentiment in the near-term, we continue to look favourably upon Boustead’s long-term growth profile given that it is levered to multiple secular trends,” she adds.

All things considered, Lim has finetuned her forecasts, and her fair value estimate is now $2.02 instead of $2. — The Edge Singapore