Singapore Fintech Festival 2025

What happened to blockchain?

Bitcoin, Ethereum and platforms like Binance gained legitimacy during the Trump presidency. According to the Financial Times, the Trump family’s companies made around US$1 billion ($1.3 billion) from crypto since Trump’s inauguration in January. Reuters reports that the Trump family raked in US$800 million from crypto in 1H2025.

The Monetary Authority of Singapore (MAS) has worked with distributed ledger technology through pilots since 2017, starting with Project Ubin. MAS views asset tokenisation as a promising development, with the potential to enhance liquidity and improve efficiencies in financial markets globally. The central bank is focused on supporting innovative use cases with clear institutional value, while at the same time strengthening its regulatory framework to address the novel risks arising from crypto-asset services. This ensures that innovation can develop within well-defined risk parameters.

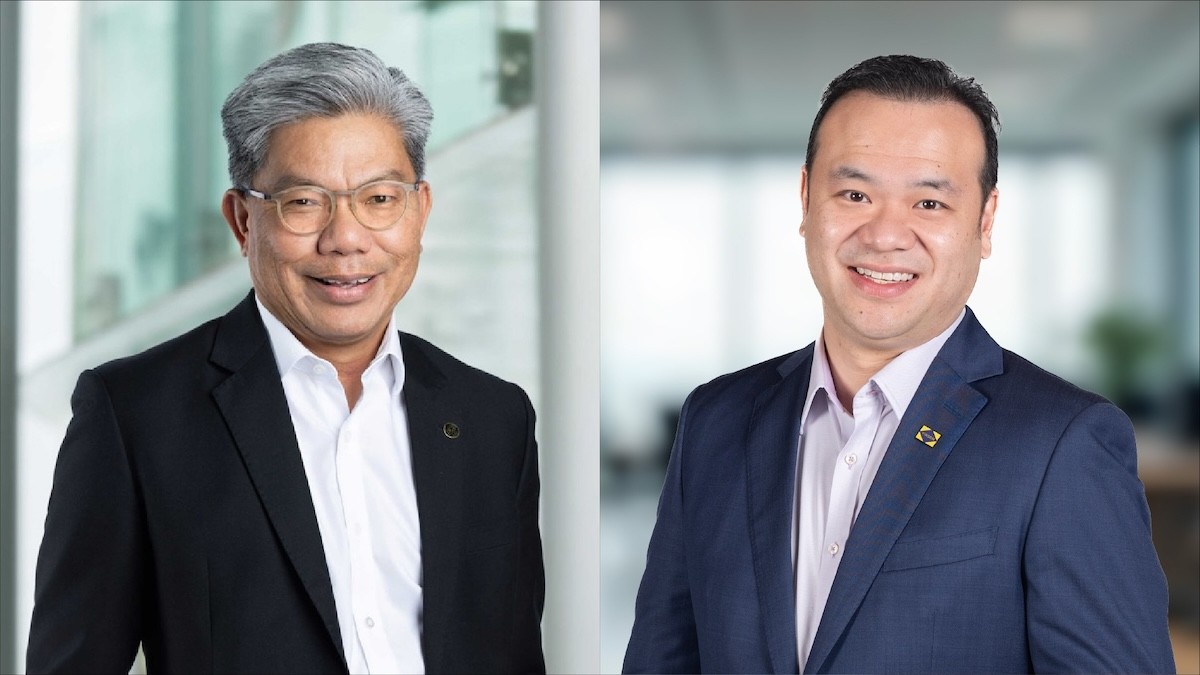

“With the passing of the Genius Act by the US Senate in July this year, we expect global interest and adoption of stablecoins and digital assets to increase. MAS is pushing forward its regulatory framework to clearly distinguish well-regulated stablecoins from other crypto assets. We are working on legislative amendments to formalise the framework and will issue a public consultation later this year,” says Leong Sing Chiong, MAS’s deputy managing director, markets and development.

“Digital asset tokens present both opportunities and risks that require careful navigation. Some tokens support real economic activity and can enhance transaction efficiency and financial inclusion, while others — such as cryptocurrencies — are highly speculative and can pose significant consumer risks without proper safeguards,” he adds.

Related stories:

Tags: singapore fintech festival 2025 - blockchain

For more insights on corporate trends

Create an account to access our premium content.

Subscription entitlements:

Less than $9 per month

3 Simultaneous logins across all devices

Unlimited access to latest and premium articles

Bonus unlimited access to online articles and virtual newspaper on The Edge Malaysia (single login)

.jpg)