The package underscores Broadcom’s mission to become a major player in the world of artificial intelligence computing. The company has been offering its custom-made chips as an alternative to processors sold by Nvidia, which dominates the AI semiconductor industry.

Last week, Tan said that Broadcom had landed a major new customer in this area — later identified by people familiar with the matter as OpenAI — and indicated that 2026 sales of custom AI chips would be considerably higher than previously forecast.

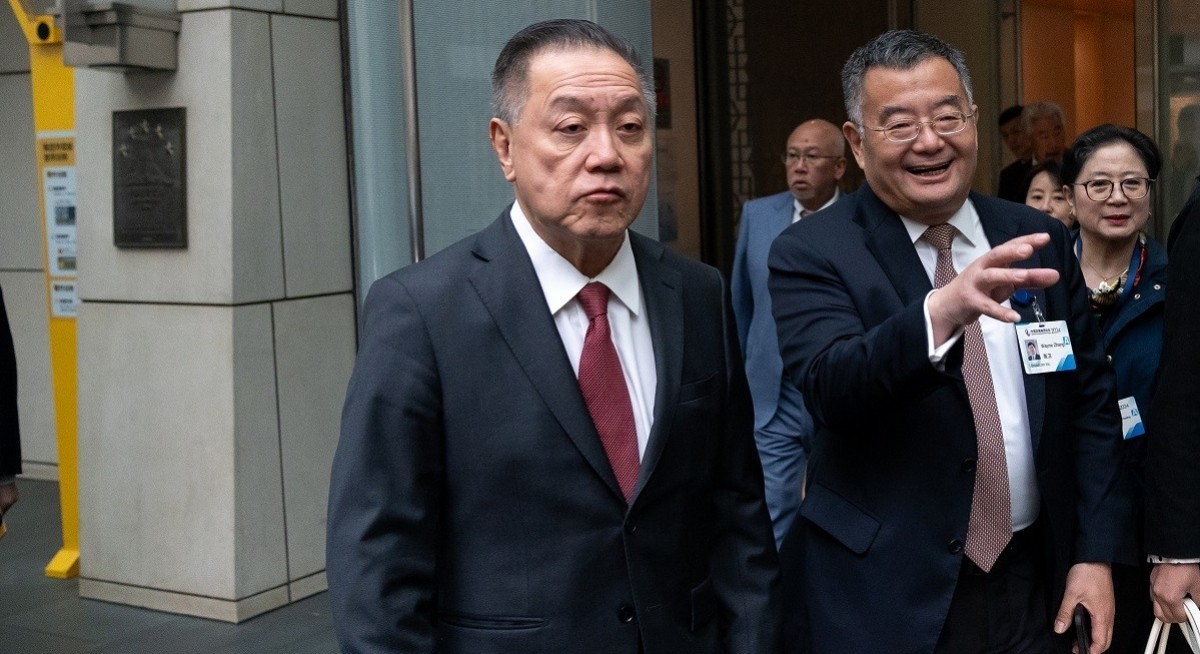

Speaking at a Goldman Sachs conference on Tuesday, Tan declined to detail what he expects for sales from that business next year or in 2027. Analysts polled by Bloomberg expect AI chip sales of almost US$20 billion for 2025 on average.

Tan said last week that he and the board have agreed that he will stay as Broadcom CEO until 2030 “at least”.