(Jan 29): Apple Inc’s stock is taking a hit as investors try to assess how much rapidly rising memory prices are eating into its bottom line. Investors will get a peek when the iPhone maker reports its earnings after the close on Thursday.

Since hitting a high on Dec 2, Apple shares are down more than 10%, by far the worst performance among the Magnificent Seven tech giants and the biggest drag on the S&P 500 Index in terms of points over that stretch. The stock is coming off its eighth consecutive down week, the last time it had a worse stretch was in 1993.

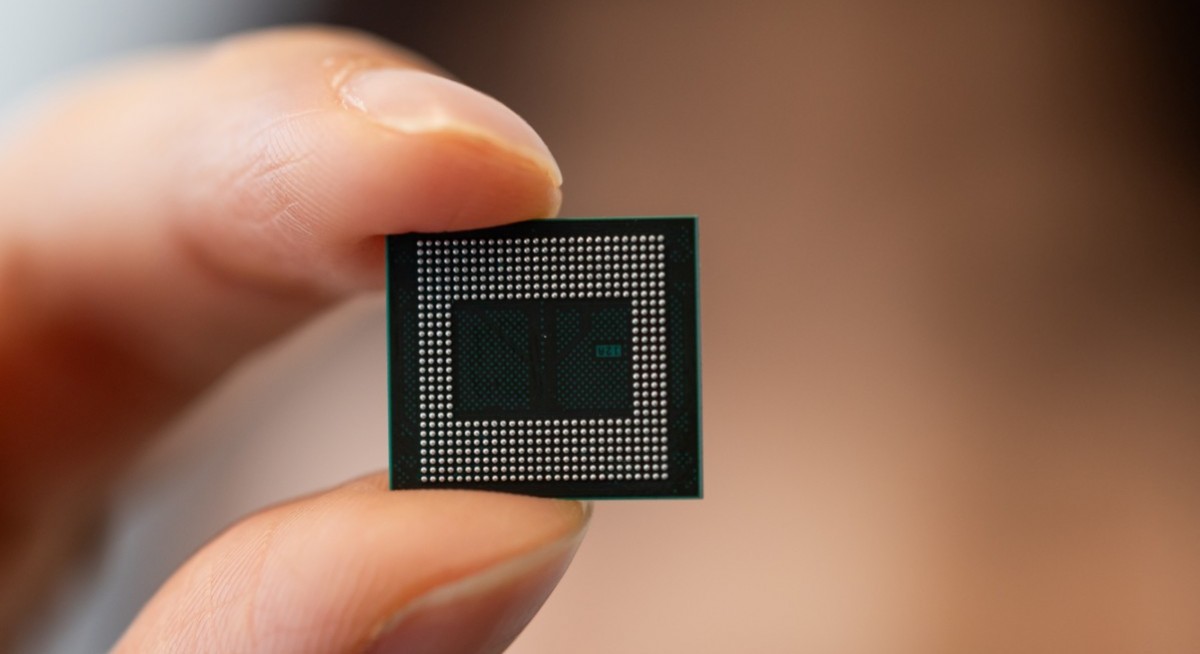

The selloff is being driven at least in part by fears that a spike in costs for memory chips, a critical component of smartphones and tablets, will pressure Apple’s margins and earnings. The issue has overshadowed encouraging news on its artificial intelligence (AI) plans, and it’s expected to get more pronounced in the second half of 2026, when supply contracts expire. Memory prices are projected to remain elevated for the foreseeable future amid brisk demand.

“We’ve seen Apple face pressure from memory prices before, but never at this unprecedented rate,” said Shaon Baqui, senior tech research analyst at Janus Henderson, which owns a sizable stake in the shares. “The market is clearly uncertain and concerned that we’ll see more bad news on the memory front.”

Since the end of September, an index of spot prices for dynamic random-access memory, or DRAM, chips is up almost 400%, reflecting the soaring demand as more AI data centres get built. On Tuesday, Apple supplier Qorvo Inc gave an outlook that was much weaker than expected and cited “some of the memory pricing and availability constraints that are impacting customers’ build plans” in its conference call.

See also: US stocks trim gains after S&P 500 hits 7,000-point mark

Apple’s size means it has a lot of sway with suppliers and some ability to pass higher costs onto consumers, especially as demand for pricier high-end models continues to hold up. But the steep price for memory leaves it with few good options. Memory represents between 10% and 20% of the cost of building a smartphone, according to technology research firm IDC, which called the rise in memory prices a “crisis” for hardware companies.

“Apple can mitigate some of this, but there are only so many levers it can pull,” Baqui said. “Pulling the pricing lever comes with potential demand destruction. Getting clarity on the margin impact will be critical.”

For now, Wall Street is taking a wait-and-see approach. Consensus estimates for Apple’s 2026 net income have barely budged over the past month, as have expectations for revenue and gross margins, according to data compiled by Bloomberg. Should those assumptions slide due to the cost of memory, it would mean the stock is even pricier than it appears despite trading at a premium to major indices and its own history.

See also: AT&T revenue beats estimates in 4Q, buoyed by broadband strength

The memory issue is arising as investors have mixed sentiment towards the tech giant. The company’s previous earnings report featured a bullish forecast, although it was marred by a surprise sales decline in China. However, Wall Street is turning positive on its AI position following a multi-year deal for Alphabet Inc’s Google to power Apple’s AI technology, including Siri. The news was seen as validating Apple’s strategy of not spending aggressively to build out AI the way other megacaps have.

“I love what Apple is doing from a spending perspective,” said David Wagner, portfolio manager at Aptus Capital Advisors, which holds Apple stock in a variety of portfolios. “Everyone was focused on its positioning within AI, but this suggests it isn’t falling behind.”

Apple shares are trading for around 30 times estimated earnings, above their 10-year average of 22 times and higher than the Nasdaq 100 Index’s and Magnificent Seven’s multiples.

Apple’s revenue is expected to rise 8.7% in its 2026 fiscal year, which runs through September. While that would represent the fastest pace since 2021, the figure is expected to slow in each of the next three fiscal years. Revenues for the overall tech sector are projected to climb about 19% in 2026, according to Bloomberg Intelligence, with the tech hardware and equipment sub-sector rising 11%.

Still, even with the company’s high stock market valuation and relatively muted growth, many investors continue to view the stock as a relative safe haven in tech. Its healthy balance sheet, durable earnings and strong cash flow make it a stable position in a portfolio.

“Clearly there’s an elevated multiple, but Apple looks like a very resilient business relative to the other Mag 7,” Janus Henderson’s Baqui said. “It has a massive user base and recurring revenue from services, all of which provides a ballast to free cash flow. I don’t know that we can call for an inflection in growth anytime soon, but it still looks like a warm blanket in times of volatility.”

Tech Chart of the Day

To stay ahead of Singapore and the region’s corporate and economic trends, click here for Latest Section

The world’s largest tech firms show no signs of easing up on AI spending, a record wave that’s propelling hardware providers like Samsung Electronics Co and SK Hynix Inc. That’s even as doubts persist about the staying power of AI demand to justify all that capital.

Uploaded by Felyx Teoh