Since then, having won a growing list of contracts, Addvalue has returned to profitability, with earnings of US$302,000 in FY2024 and US$2 million ($2.5 million) in FY2025. The company’s financial year ends on March 31. In an October 2025 interview, CEO Tan Khai Pang said the company would have met the criteria to exit the watch list and would have applied to do so if it had not been removed.

Addvalue derives its revenue from four main segments: space connectivity (SPC), advanced digital radio (ADR), satcom connectivity (STC) and strategic design (SDS). Its ADR-related business accounts for 57% of its half-year revenue, while SPC accounts for 37%.

The exposure comes at a time when space is no longer a niche dominated solely by governments and defence agencies. Once deemed a forbidden frontier, space has now become one of the most sought-after growth areas, driven in part by companies like Elon Musk’s SpaceX, Jeff Bezos’ Blue Origin and Richard Branson’s Virgin Galactic. These companies have lowered launch costs and democratised access to space, opening up new opportunities across communications, data and infrastructure.

As a marker of that potential, SpaceX is reportedly seeking a valuation of $1 trillion ahead of its IPO. Beyond that, Musk has grand plans, including launching around one million satellites into orbit to form solar-powered data centres that will power artificial intelligence (AI).

See also: An ‘Irrational’ Year of the Fire Horse and ‘DBS at $80’

Key to this vision is Starlink, SpaceX’s satellite broadband network, which already operates thousands of low Earth orbit (LEO) satellites providing global internet coverage. To be sure, every Starlink satellite launched represents a potential customer for infrastructure providers like Addvalue.

The opportunity has become irresistible. On Feb 2, the Singapore government announced the formation of the National Space Agency of Singapore to capture a share of the space economy, which is projected to reach US$1.8 trillion by 2035, up from US$630 billion in 2023.

“What was once the exclusive domain of the superpowers and aerospace giants has now become a more accessible frontier for nations and businesses worldwide,” said Dr Tan See Leng, Minister for Manpower and Minister-in-charge of the Energy and Science & Technology in the Ministry of Trade and Industry (MTI).

See also: Our 2026 picks: AvePoint — AI play with a focus on data governance, management

Addvalue has already generated its own momentum. In 2024, it won contracts worth US$18.5 million, and in 2025, another US$25.8 million. As of Jan 29, it won another US$3.5 million. On Feb 2, Addvalue also announced the signing of a memorandum of understanding (MOU) with SpeQtral to develop an integrated quantum key distribution (QKD) satellite solution, potentially opening the door to more business opportunities.

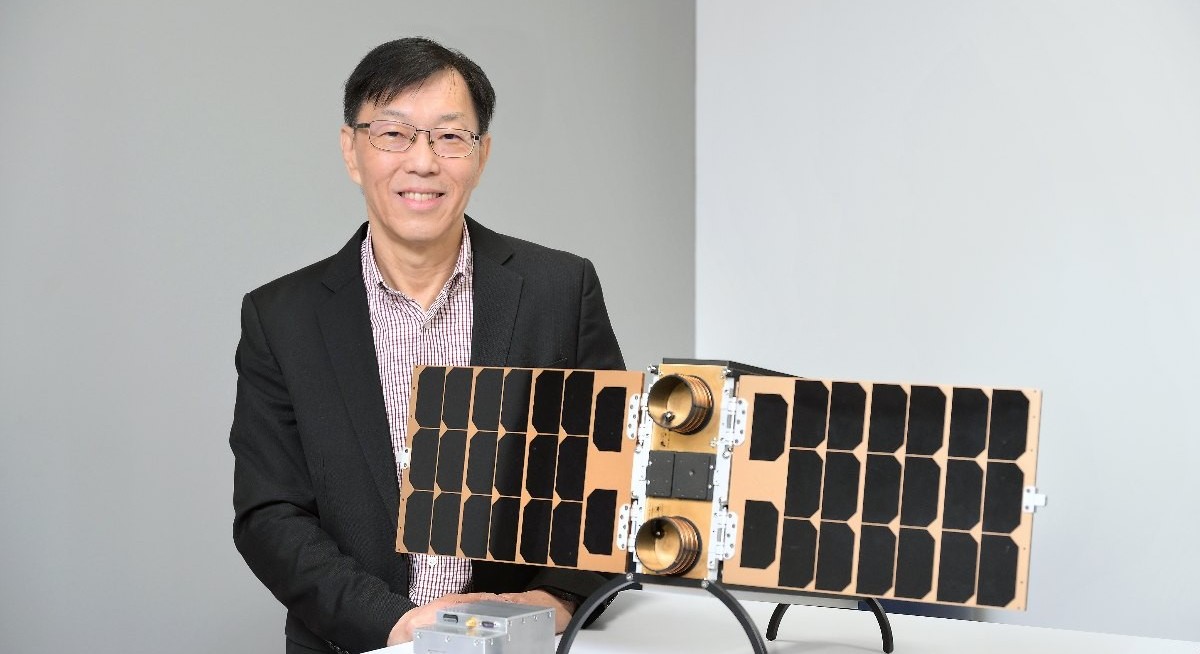

At the heart of Addvalue’s offering is its inter-satellite data relay system (IDRS), the world’s first on-demand, real-time connection service for LEO satellites. Tan told The Edge Singapore last October that the more satellites the company has in orbit, the more revenue it generates. He added that the company is also building a business based on estimates from several reports, including one by Goldman Sachs, that the satellite market is expected to grow by US$108 billion by 2035, implying there is much more room to grow.